June 2023 update:

A reader sent me the following email today. I haven’t validated the claim personally, but I have no reason not to trust it. Assuming it’s true, any claim to 5.25% BoA cash back in my original post below should be ignored.

I bought a Walmart gift card from Raise on the 31st, and the merchant description was ‘POI Funding Transactions’. That’s unfortunately on Bank of America’s exception list for online transactions so no bonus was awarded for online shopping.

This merchant category code change is recent because my previous purchase on the 19th was ‘Miscellaneous General Merchandise’ and thus qualified for the online bonus.So unless Raise‘s discount is large enough, you are going to have to start ordering a gift card from walmart.com and wait for it to be delivered via USPS to get the 5.25% discount.

Original Post

I think that gift cards are of the devil. They are easy to lose. When I receive them as gifts, I typically sell them for a loss on Raise.com. Maybe that makes me a horrible person, but I’ll take $18 in cash over $25 to a retailer I don’t visit.

I realize there’s a bit of irony when I admit that I use gift cards almost exclusively in my real life. Why?

- Costco gift cards open up the door to 5.25% BoA cash back at Costco (+ 2% executive) thanks to BoA cash rewards.

- (Gift cards earn me an extra 1.75% thanks to utilizing BoA’s 5.25% online category at Costco.com)

At retailers like Walmart and CVS, it can become even more lucrative:

- Walmart gift cards purchased at Raise.com gives 2.5% cash back (as of today) + 1% if you use ebates/rakuten + 5.25% BoA ≈ 8.75% cash back.

- The (digital) Walmart gift card can be loaded immediately onto the walmart app so you don’t need to print anything off.

- (Gift cards earn me an extra 3.5% thanks to Raise.com + ebates/rakuten)

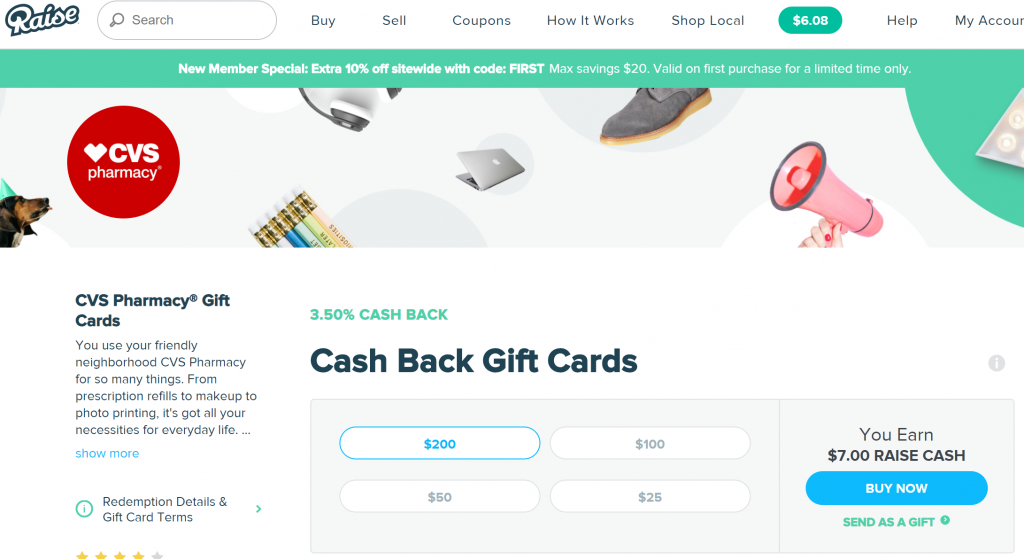

- CVS gift cards purchased at Raise.com gives 3.5% cash back (as of today) + 1% if you use ebates/rakuten + 5.25% BoA ≈ 9.75% cash back.

- (Gift cards earn me an extra 4.5% thanks to Raise.com + ebates/rakuten)

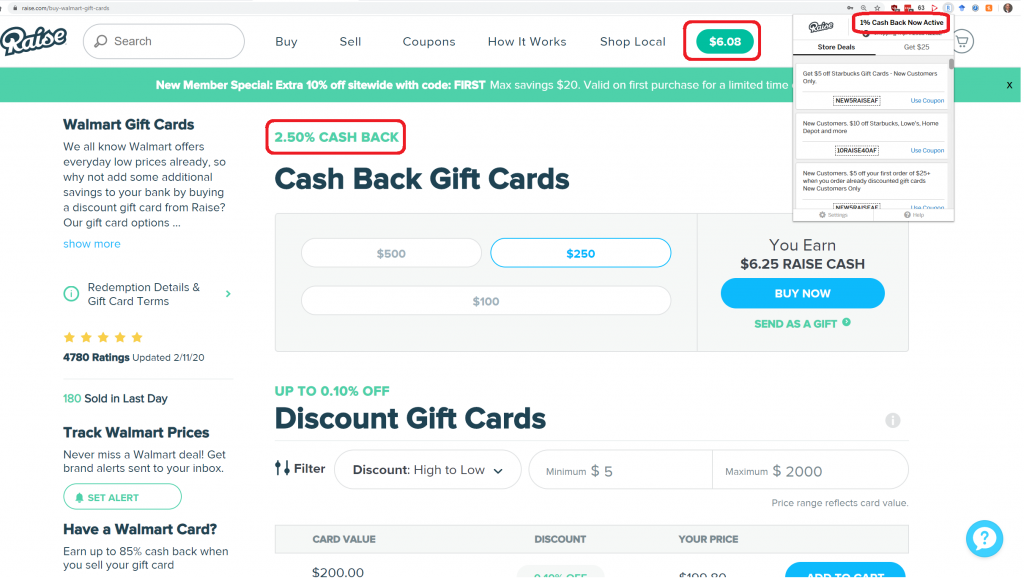

In recent months, Raise.com has basically killed the secondary gift card market (for select retailers) by selling the full face value of gift cards to consumers in exchange for “Raise cash” back. What in the world is “Raise cash”? As of today, I have $6.08 in Raise credits to be used towards future purchases. I accrued those through a former purchase. If I wanted to buy a $250 gift card to Walmart, it’d cost me $250-$6.08 = $243.92 this time, but I’d earn a $6.25 credit for my next purchase. Kind of weird, but that’s how they do it (presumably to keep you coming back to use the service).

Walmart gift card. 2.5% discount highlighted in top left. $6.08 balance shown on top. 1% Ebates/Rakuten cash back shown in top right. 5.25% BoA discount not shown.

Similar gig with CVS. Not all retailers do this “cash back” thing with Raise.

Similar gig with CVS. Not all retailers do this “cash back” thing with Raise.

Conclusion

7.25% off of every Costco purchase + 8.75% off of every Walmart purchase + 9.75% off of every CVS purchase adds up, particularly when we’re talking tens of thousands of dollars of spend for our family of 7 (groceries, meds, etc.).

Gift cards can be a pain to deal with, but much less so with apps/digital wallets. For high spend retailers (Costco, CVS, Walmart in my case), it seems like the extra effort is worth it.

Notes:

5.25% BoA cash back described here: https://frugalprofessor.com/best-credit-card-rewards-strategy-2019-edition/

Rakuten + Raise + a cash back credit card for purchasing is how we also save money on airfare (back when we used to purchase plane tickets!). It’s an easy hack for big savings on expensive one-time purchases.

Thanks for the recommendation! I BoA + rakuten/ebates for flights before, but not Raise as well. I’ll look into it next decade when we’re allowed to fly again….

Your avatar is adorable.

Raise/Rakuten/BoA combo is amazing for Walmart. Thank you for sharing!

My favorite offer currently is 10% cashback on Walgreens (I get amazon GC) and grocery stores with the cash app. Max discount is $7.5. I get a new offer every week.

How do you get the 10% on Walgreens? Is it the BankAmeriDeals through BoA’s portal?

Is there a purchase limit to the Amazon GC at Walgreens? Do you have to go in person or can it be done digitally?

In my experience, Walmart’s online prices are significantly higher than in-store. A box of diapers that’s $19.53 before tax at a nearby store is listed at $23.32 online. Because of this, I don’t shop Walmart online.

I hadn’t been buying Walmart gift cards from Raise because I didn’t want the trouble of dealing with a digital gift card in store.

Thanks to this post, I now know I can load digital gift cards in Walmart’s app. Thanks!

Happy to help! And if I didn’t make it explicitly clear in the post, your understanding is exactly correct. You can use the gift cards through the Walmart pay app in store.

What category at BofA do the Raise.com gift cards get applied? On-line Shopping?

Yup.

Great post, FP! I will look into using Raise more often.

*******************

Here’s my set up:

1. Straight Cash Back $0 AF Cards

5.25% BOA Cash Rewards x3 (Online, Drug Store, Gas) – eligible for 4th card in December

10% Discover Q categories thru Q1 2021 – hope to combine my 2 Discovers in 2021 and do this trick again

5% US Bank Cash + on Utilities, Gym Membership – hope to get 2nd Cash+ card for streaming and cell phone

2% Citi Double Cash for any non-category spend over $15K not covered by Hyatt card below.

2. Keeper $AF Cards

Primarily hotel cards, where the free night certificate value > $AF by $100-$160. Only makes sense if you can use the hotel night.

Chase World of Hyatt probably the most valuable straight hotel card, because you get 2nd free night at $15K spend. Free nights are worth 15,000 points. Points are worth 1.7 cents. So it’s an extra point per dollar on spend, meaning I earn 2x or 3.4% on the first $15K spend for non-category items, and 3x or 5.1% on restaurants, gyms, flights and transit. Plus it comes with some travel insurance like lost luggage if I use it to book a flight. I chose Chase Hyatt over BOA Premium for my non-category spend because 3.4% > 2.625% and the free night means I profit $160 from just having the card whereas BOA Premium I just profit $5 if I use the airline incidental credit.

Another outstanding card for travelers is Amex Hilton Aspire if you can use the $250 resort credit. While it costs $450 a year, I get $850 a year in benefits from having the card. Keeper.

3. SUBs for Big Purchases

I owe about $8K per year in real estate taxes. So I like to open new cards with nice SUBs in December. It costs me 2.5% to pay my taxes with cards, but my SUBs dwarf that fee. Usually earn 20% or more. Now most of these are “points” and not cash back.

Some of these SUB cards have nice rewards. Amex Gold appears to be a loss leader for Amex. I earn 4x at restaurants and grocery stores. Amex points are worth at least 1.7 cents, so that’s nearly 7%. The card costs $250 a year, but I get that down to close to $30. I use the $10 food credit each month at the Shake Shack near my house, and I use the $100 airline incidental credit.

4. Retention Bonuses

For my $AF cards, I also check each year after the $AF hits for any retention offers. Sometimes it works.

5. Checking Account Bonuses

I also try to open a couple of checking accounts per year for the bonuses. Make $500-700 a year doing that.

**************

So my set up is not 100% cash back. It’s a mix of cash back and points.

How do know when you’ll be qualified for next B of A cash reward card? You mentioned December as though it’s a sure thing. I’m trying to apply for 1-2 more but not sure what route to take … thanks

Here’s my timeline:

* Nov 2017: Premium Rewards + 1st Cash Rewards (same day)

* Feb 2019: 2nd Cash Rewards

* June 2020: 3rd Cash Rewards

Here’s Mrs FP’s timeline:

* Jan 2018: 1st Cash Rewards

* Feb 2019: 2nd Cash Rewards

Not sure what is typical or not. My credit score is in the neighborhood of 840 +/- 15. Mrs FP’s is about 10 lower. Not sure if that helped.

One oddity is that my fourth BoA CC was not met with increased credit; it was simply reallocated from other cards. Weird, but fine enough because I’m not going to put over $2.5k/quarter on any cash rewards card.

A few years in the making… I finally was able to implement your BOA credit card + Platinum Honors strategy.

I’m curious to how you handle dealing with gift cards after you receive them. Do you keep them at home and only pull them out when you know you are going to store? Do you keep them in your wallet at all times? Do you keep them in your car in case you stop by a store on a whim?

I worry about keeping them in my wallet, losing my wallet, and then being SOL. Thanks in advance. BTW they better not nix Platinum Honors now after all this work I went through haha!!

Congrats on joining the BoA cult!

Walmart GC’s purchased through Raise.com go right to my WM account online. No theft risk.

Costco cards go to my wallet. If stolen/lost, I’d report immediately to Costco for a replacement. Minimal risk.

CVS GC’s purchased through Raise.com are printed and stored until needed.

It adds up.

Apologies for replying to an older thread, but can you explain “Costco gift cards open up the door to 5.25% BoA cash back at Costco (+ 2% executive) thanks to BoA cash rewards” The +2% is confusing me as my understanding is that Costco cash cards are excluded from the 2% exec, correct? Separately, wouldn’t you about the same by skipping the Costco cash card and just buying with BofA 3.5% (2%*1.75) normal warehouse reward plus 2% exec = 5.5% (minus the $60 exec fee if you are comparing to a strategy without)?

Executive 2% sits on top of any payment method, including cash.

5.25% cash rewards + 2% executive = 7.25%.

Raise has a new app called Slide that offers 4% on quite a few sites including CVS. Slide allows you to purchase a eGift Card for the exact amount of the purchase at checkout. Attaching the BoA Cash Rewards to Slide counts as an online purchase so you get the 5.25%. It gets even better because you can use a portal like TopCashBack to get to Slide which currently adds 4% (10% on your first purchase). Finally, if you PreFund your Slide account with you’ll get another 1%.

Currently stores like Amazon, Walmart and Costco aren’t available through Slide, but if you shop at one of the many stores that are, you can get:

14.25% = 1% PreFund Slide + 5.25% with BoA Cash Rewards + 4% by clicking through TopCashBack to get to Slide + 4% by clicking through Slide to get through CVS for example

Thanks for sharing!

I’d heard about the app on Doctor of Credit. However, I’d also heard that it doesn’t work at Walmart, which is a bummer. 95% of our retail spend is at Costco, and 5% of our retail spend is at Walmart. Bummer; otherwise I’d utilize it. Currently we use gift cards purchased at Raise to save an extra ~3-4% (when combined w/ Rakuten referral bonus).

Getting 14.25% cash back on CVS prescriptions is a good deal though. We spend thousands a year on prescriptions, but we recently transitioned to Costco’s pharmacy. There, I’m getting 7.25% (5.25% BoA + 2% executive). So I’m leaving 7% on the table relative to CVS, but the experience at Costco is much better for us.

@FrugalProfessor

Have you looked into a Citi setup? They stack quite nicely. Then you can take advantage of Robinhood 3%

Can you please elaborate?

Which part?

Which Citi setup is stackable?

I now see your point about freeing up investments from Merrill to redeploy to Robinhood to capture the 3% bonus. For some reason, I was thinking that there was a Citi/Robinhood strategy I was unaware of.

Citi Premier is the $95 card you need to transfer points to partners. It gets 3x at gas, groceries (not Walmart or Costco), restaurants, hotels, and airlines (uncapped). You can pair it with the following no annual fee cards:

1) Double Cash card — 2 points/$ everywhere

2) Rewards+ — 10 points per purchase minimum, get back 10% of redeemed points per year (up to 10k on 100k redeemed)

3) Custom Cash — 5x up to $500/month at your highest spending category (restaurants, gas, groceries, home improvement, streaming, and a few more). Ideally, you’d have multiple of these.

Id say it’s pretty easy to get 1.5 cents/point from Citi Thank You Points and they have not infrequent transfer bonuses (currently 30% to Virgin Red — Delta partner)

You’d have to do the math, you can justify the BoA setup too, but if you move assets to Robinhood from Merrill, this isn’t a bad choice, as you’d be getting 2x everywhere with likely 5x at many places and 3x at others.

The US Bank Altitude Rewards is a great choice if you can use mobile wallet everywhere too (no partners needed).

Thanks for the recommendation on the Citi setup.

I have a colleague that went the US Bank Altitude Rewards card route and is quite happy with it.

I’ll give it some thought, but I’m addicted to 5.25% cash back on most purchase (including the $20k/year we spend at Costco).

If you are receiving 5.25% cash back on most/all of your spend with no annual fee, it’s hard to argue with. This is a recommendation if you move away from Merrill for the Robinhood 3% offer

Well, as to be expected, math can solve this. If you pay $60/year for 2 years for Robinhood Gold (required amount) that’s $120 + loss on Costco Cash at $20K/year (you can continue to receive 3% vs 5.25%) so 2.25% * $20K * 2 years = $900. That’s $1020. If you get more than this from Robinhood, you are better off with Robinhood (not including taxes).

I forgot, so if you transfer over a Roth IRA with > $34,000 the math suggests you are better off (I selected Roth to avoid the IRA tax issue down the line). You are stuck with Robinhood for 5 years, but I don’t see how it’s different than leaving the money with Merrill unless you are taking advantage of this… https://www.wsj.com/articles/buy-borrow-die-how-rich-americans-live-off-their-paper-wealth-11625909583

The math gets better if you decide to just use the US Bank Altitude card at Costco as you are only giving up 0.75% with a $75 net fee.

Thanks for the response. Here’s our situation:

* The Merrill $ is a joint taxable brokerage account, so it’s exempt from the Robinhood bonus. Consequently, the decision isn’t BoA CC vs Robinhood.

* That said, we have a combined $180k in Vanguard Roth IRAs that could get us $5.4k of robinhood bonuses. The upsides are obvious, but the downsides is the 5-year lockup and dealing with a company that a viscerally loathe.

I’ll have to give it more thought, but I’m leaning towards “no” right now because I loathe robinhood more than I like a bit of free money.

That said, if my workplace retirement plans could be rolled over to IRAs and get >$30k of free money, that would be quite the tempting offer. I’m still gainfully employed, so there is unfortunately no opportunity to take advantage of this with the big money accounts.

Not sure you’d want to lose ERISA from a 401k to convert to IRA even if you could. I’m not sure the loathing for a holding company that likely would be holding Vanguard index ETFs anyway.

I loathe what they represent — the confetti, encouraging naive investors to trade options, encouraging speculation in individual stocks. One option trader was a college student who killed himself when he saw a $730k loss in his RH account, which ended up being a technical glitch. https://abc7news.com/robinhood-settles-lawsuit-alex-kearns-stocks-settlement/10851075/. He’d be alive if not for his involvement in Robinhood.

But I understand that one can hold a passive couple-basis point Vanguard ETF portfolio there.

Yes, and they give you $1000 margin free with your Gold subscription along with 5% (currently) for un-invested funds, so that almost offsets the $60/annual fee.

Thanks for the dialog. It’s certainly an interesting option. I’m flushing $5.4k away if we don’t take advantage of the offer. I guess I’ll give it some thought.

I just saw Chase (JP Morgan) is offering $700 when you put $250k into an investment account (with no 5 year requirement) though the math for Robinhood is the best I’ve ever seen for moving money to a different investment broker.

An intriguing offer for sure; especially with the uncapped limit.

Merrill is offering $750 for $200k: https://www.merrilledge.com/offers/me750

They’ve offered $900-$1000 in the past too.

The BoA Premium Rewards Elite card is interesting if you book flights with BoA travel portal a lot and can utilize all the credits.

If I flew more, this would be a tempting card….