The original post below written in 2019 has been superseded by a newer post written in 2024 here: https://frugalprofessor.com/bank-of-america-customized-cash-rewards-card-and-premium-rewards-review/

****************************

Original Post below

****************************

For reference, here’s a link to all the articles I’ve written on the BoA credit card strategy.

- https://frugalprofessor.com/another-boa-efficiency-post/

- https://frugalprofessor.com/an-audit-of-boa-credit-card-reward-efficiency-2019-q3/

- https://frugalprofessor.com/one-month-review-of-updated-boa-cash-rewards-card/

- https://frugalprofessor.com/best-credit-card-rewards-strategy-2018-edition/

(Lack of) Disclosure:

I don’t make a penny on any credit card recommendation. What I recommend is what I currently have (or have had) in my own wallet.

There are Two Basic Credit Card Strategies:

- Choose your credit card based on the best available sign-up bonus at the time.

- If you decide to go down this path, here is a great resource: https://www.doctorofcredit.com/best-current-credit-card-sign-bonuses/

- I have a colleague who implements this strategy and has around 25 active cards. This seems ludicrous & unwieldy to me.

- Alternatively, sign up and use the best cards on an ongoing basis.

I don’t have much to say about Door #1 above. Doctor of Credit is going to be the best resource there.

However, if you take Door #2 above (by getting & using the best cards), then I have two recommendations:

Door #2A (getting & using the best cards) with < $100k (or even $50k) of investments

Fidelity offers a great no-nonsense, no-fee 2% cash back card (https://www.fidelity.com/cash-management/visa-signature-card). I’ve had permutations of this card for almost 15 years now (starting with a 529 MasterCard version of the card way back in the day). The card requires you to have a brokerage account with Fidelity to receive your cash back rewards. There are no fees associated with the brokerage account and zero minimum balances. For years the sole purpose of my Fidelity brokerage account (before I started using it as a high-yield savings account) was to receive the rewards before I pulled the money to an external checking account. Once you’ve accrued $25 or so of rewards (I forget the exact number), you can set it up to automatically dump into the brokerage account.

If you want to supplement the above with a nice zero-fee card (aside from the cost of the normal Costco membership), the Costco Citi Visa is a pretty nice one (https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-credit-card). 4% cash back on gas. 3% cash back on travel & dining. 2% cash back at Costco. 1% cash back everywhere else. The annoying thing about this card is that cash back is paid back annually in the form of a check, which is much less convenient than the above Fidelity card. For this reason alone, the Fidelity card is better than the Costco card for Costco purchases. For obvious reasons, the Fidelity card is better than the Costco card for any non-gas, non-travel, and non-restaurant transaction (i.e. those transactions earning only 1%).

The above is what I recommend to my students who are just starting out. It’s a great system, and pretty similar to one that I utilized for a decade or so.

Door #2B (getting & using the best cards) with > $100k (or even $50k) of investments

This is where the gravy train of credit card rewards can be really lucrative. But unfortunately you have to jump through a few non-trivial hoops.

**** Edit: To be abundantly clear, the rest of the article can be pretty well exploited with only $50k of investments. Doing so simply reduces the bonus multiplier from 75% (with $100k of investments) to 50% (with $50k of investments). As reader MA points out in the comments, this is still not a bad strategy at all. ****

Hoop #1: Get $100k to Merrill Edge to qualify for “Platinum Honors” status

The whole point of the madness that ensues is to quality for a 75% bump in credit card rewards (link). Without this, BoA’s cards would be pretty impotent. With this, BoA’s cards are the best in the country.

In order to quality for the preferred rewards, you need to do the following:

- Open up a checking account. I keep $0 in mine on an ongoing basis and avoid maintenance fees through my Platinum Honors status. The sole purpose of this account is to meet the requirements of the preferred rewards program and to dump the CC rewards there (which are then immediately swept elsewhere).

- Enroll in the preferred rewards program.

- Transfer $100k of investments to Merrill Edge.

- Wait 3 months to qualify.

The $100k transfer may initially seem like a nuisance, but it isn’t too bad. Transferring $100k from our joint brokerage account at Vanguard to our newly opened joint brokerage account at Merrill Edge was as simple as any transfer I’d ever experienced at any brokerage. It takes about 3 minutes to initiate the transfer online. Zero paperwork. Zero mailings. Zero faxes. Zero phone calls. Just a simple online request.

The downside to holding VTSAX at Merrill Edge is that you cannot costlessly sell it. There is a $20/transaction commission for doing so, which puts a damper on tax-loss-harvesting strategies. To combat this, you may want to consider converting VTSAX to VTI at Vanguard before transferring to Merrill Edge. With platinum honors status, you get free ETF and stock trades, so VTI becomes free to trade.

Once the $100k is at Merrill Edge, you have to wait up to 3 months for the “Platinum Honors” status to kick in since it is computed on a three month rolling average. Annoying, but necessary.

Once you hit this “Platinum Honors” status, you qualify for a 75% bonus on all credit card rewards.

By the way, the act of transferring $100k from Vanguard to Merrill Edge will qualify you for a transfer bonus of $250: https://www.merrilledge.com/cmaoffer

These bonuses will periodically increase during promotional time periods. Check these links to see if now is one of those times:

If you wanted to transfer IRAs instead of brokerage accounts, you could do so. If you go down this path, your spouse’s IRA will not count towards your preferred rewards status (and vice versa). Only jointly owned accounts count towards both spouses preferred rewards statuses. Since my wife and I have a joint brokerage at Merrill Edge, $100k in assets there will suffice for both of us (i.e. no need to store 2*$100k there).

Hoop #2: Get two different types of BoA credit cards

Credit Card #1: BoA Premium Rewards (link)

- Travel & Dining: 2% base rewards * 1.75 = 3.5% cash back with platinum “preferred rewards” status.

- Everything else: 1.5% base rewards * 1.75 = 2.625% cash back with platinum “preferred rewards” status.

Disadvantage: $95 annual fee, though the card provides $100 statement credit on travel incidentals. What airline incidentals get reimbursed? Check out this link at Doctor of Credit.

I’ve purchased both $100 AA egift cards and $100 United Travel credits, both of which qualify for the $100 travel credit reimbursement. Since I fly United, it makes more sense for me to do that. If you fly with neither, perhaps you can buy a AA egift card and sell it online. I’ve done so in the past, but it’s more of a hassle than using the gift card directly.

You are able to do this once per calendar year.

I hit the $100 benefit this year through the purchase of a $100 American Airlines E-Gift Card.

Here is the after-commission sale of the $100 gift card on Raise.com for $86.

Here is the after-commission sale of the $100 gift card on Raise.com for $86.

Advantage: In addition to the $100/year in airline incidentals, there is a Global Entry / TSA precheck credit every few years (which we’ve taken advantage of through my wife’s Global Entry membership). Other benefits, such as no foreign transaction fee, are described here (link).

Current sign up bonus: $500 (not amplified by 75% bonus).

Credit Card #2: Get some BoA Cash Rewards cards (BoA link, list of Affinity cards (i.e. identical card, but affiliated with university; useful for acquiring multiple cards to defeat $2.5k/quarter juicy rewards cap))

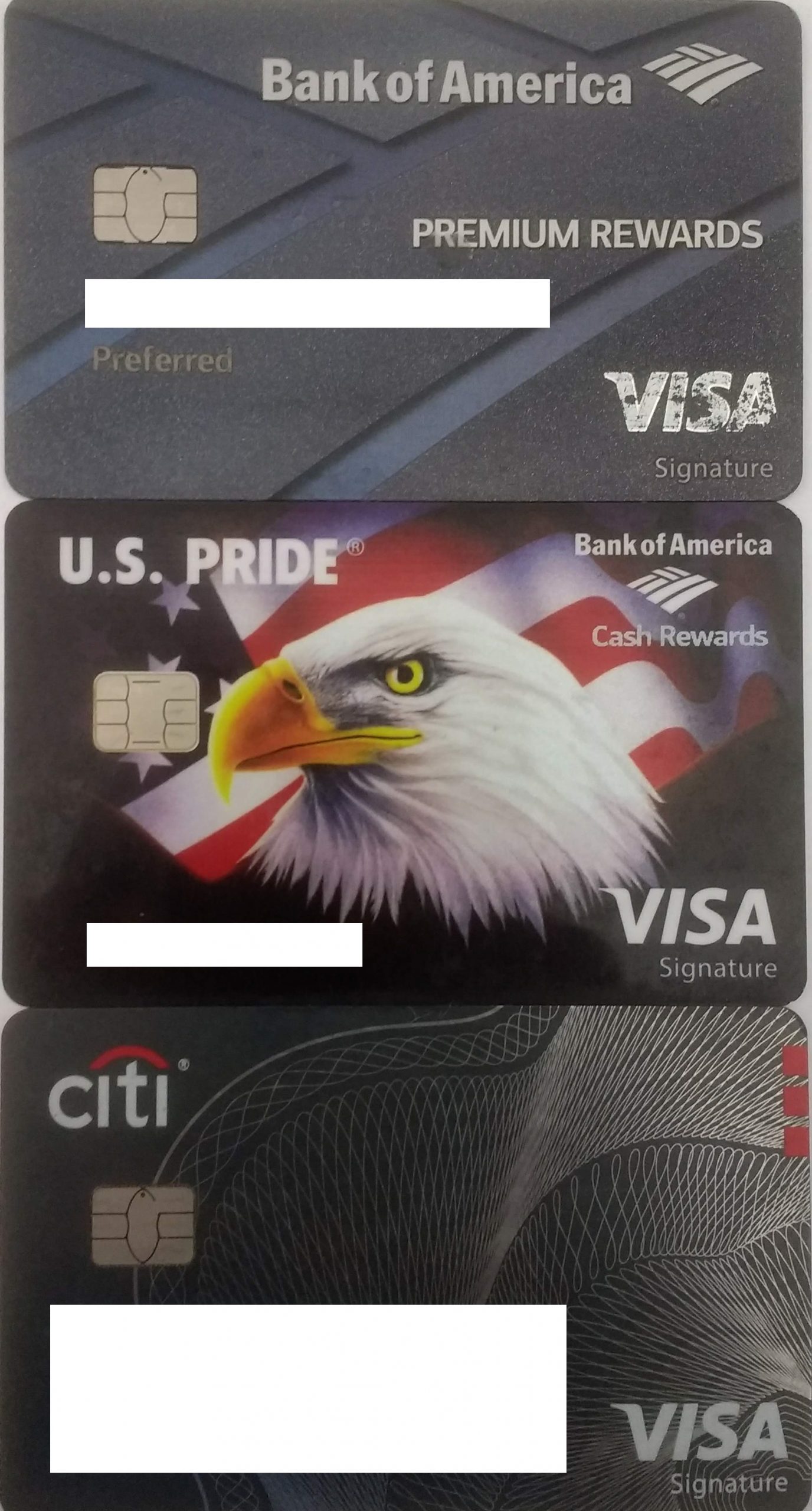

The BoA Cash Rewards card comes in a bunch of different forms, all of which are absolutely identical in function. When I initially signed up for the base “Cash Rewards” card shown in red above, it was a Visa. For some reason it is now a Mastercard. If you prefer Visa (as I do b/c of Costco), then simply pick out a different card.

- Your choice of: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 3% base rewards * 1.75 = 5.25% cash back with platinum “preferred rewards” status.

- Groceries/Wholesale

- 2% base rewards * 1.75 = 3.5% cash back with platinum “preferred rewards” status.

- All else:

- 1% base rewards * 1.75 = 1.75% cash back with platinum “preferred rewards” status. Note that this portion of the card is inferior to the above Premium Rewards card so it makes no sense to spend in this region.

Advantages: No annual fee.

Disadvantages: $2.5k/quarter spending cap on these good rewards. After hitting the cap, the credit card bonus on all subsequent purchases within the quarter reverts to 1%*1.75=1.75%.

Current sign up bonus: $200 (not amplified by 75% bonus) is the promotional rate, though this bonus is normally $150.

Hoop #3: Defeat the $2.5k/quarter BoA cash rewards cap by getting multiple Cash Rewards cards

Each BoA Cash Rewards card has a $2.5k/quarter spending cap on the 3%*1.75=5.25% and 2%*1.75%=3.5% categories. If you are single, you are able to get multiple BoA cash rewards cards so long as they have a different picture on front. If you are married, you can repeat this activity for your spouse as well. There is essentially no reason (other than the $500 sign-up bonus) to get a second BoA Premium Rewards card. However, there are huge incentives to getting multiple BoA Cash Rewards cards.

I own 1 red card + 1 tigers card + 1 breast cancer card.

My wife owns 1 red card + 1 eagle card.

We are both authorized users on each other’s cards.

The net effect of the above is $2.5k * 5 = $12.5k/quarter in spending eligible for 5.25% cash back, in up to 5 different categories at one time.

Hoop #4: Buy Costco Cash Cards Online for 5.25% cash back there

We shop a lot at Costco. I may have an unhealthy obsession with the place. While the base 3.5% cash back from the Cash Rewards card at Costco are indeed better than any card on the planet I can think of, I have an obsession with optimization. So, on a monthly basis I purchase a $1k Costco Cash card online and have it delivered via snail mail (usually takes at least a week). Why would I do this nonsense? Because the most lucrative Cash Rewards category is the generous “Online” category. Costco.com counts as online, resulting in 5.25% cash back in-store via the “backdoor” Costco Cash Card.

To put the “hassle” into perspective, the online transaction takes about 2 minutes and the activation of the card takes about 1 minute. I reason that a $17.50 (=$1k*(5.25%-3.5%)) tax-free return for 3 minutes of labor is not a bad trade-off.

For months, I would also use the Costco Cash Card for my gas purchases. In recent months, however, I’ve dedicated one of my cards as a “gas” card and started using that instead. Why? To limit the hassle of reordering the Costco Cash card and to better utilize credit card float. Further, when paying for gas via the Costco Cash Card I lost the ability to easily track my gas spend. The dedicated “Gas” card remedies this.

If you misplace the Costco Cash card, they can reissue it at the help counter at Costco.

And a few random observations I’ve made over the past many months.

Random Observation #1: The Online Category is the best

It’s been my experience that booking a hotel through Expedia counts towards either Online or Travel, which begs the question why anyone would select Travel as their category if most Travel also counts as Online….I’m still looking into this. Need something from Home Depot? Buy it online and pick it up in store. In-store Walmart counts as “online” for me so long as I use the Walmart app to pay. Ebay, Amazon, etc are all obviously Online as well.

If you want to learn more, Doctor of Credit has two great threads on the topic: Thread 1 & Thread 2.

Random Observation #2: You Can Change Categories on the BoA Cash Rewards Category relatively freely

So long as you haven’t already changed the category in your BoA Cash Rewards card in a given month, you may do so at any time during the month. Let’s say that you have a card designated as your “gas” card but are about to spend $200 on medication at the end of the month at a pharmacy. On the 31st of the month you could change your card to “pharmacy”, make the $200 pharmacy purchase, then revert the card back to a “gas” card the very next day on the 1st. If you do this, be aware that you’ll be unable to make subsequent changes until the 1st of the following month. It’s a pretty interesting strategy.

The below screenshot shows how easy it is to choose a new category. It also shows the historical spend on the card across all categories. Unsurprisingly, I only used our “online” card for online purchases.

Random Observation #3: Having many of the BoA Cash Rewards card is great

Between my wife and I we have 5 Cash Rewards cards. 2 are permanently designated as “online.” 1 is permanently designated as “gas.” The remaining two card can be whatever we want.

Random Observation #4: BoA’s website is frustrating

The bill pay portion of the site is almost bad enough to not be worth thousands of dollars of tax-free money per year. Luckily the Finance Buff has a great guide on how to navigate it: https://thefinancebuff.com/autopay-bank-america-credit-card.html. The good news is that once autopay is set up (much easier said than done), you’ll never have to log onto that god-forsaken site again.

In the process of signing up for autopay, I screwed up a few times (it’s really easy to do) leading to some late payments. Luckily BoA forgave my mistakes. Their website really is horrific.

Random Observation #5: If you want to change the statement dates of your credit card (to align with your paycheck, for example), you have to call them

Most other banks will allow you to do this online. It’s annoying that BoA requires a phone call.

Random Observation #6: There are no 1099s

Like credit card miles, there are no 1099s generated by the cash back (same as any other bank’s credit card reward system).

Random Observation #7: It adds up

Over the past 12 months, I’ve redeemed $3,687.04 in rewards (admittedly, some of those were deferred). The little stuff adds up. And unlike miles or hotel points, I’m able to vacation how I want (by sleeping on the ground for weeks for near-free) and pocket the difference. I’m not compelled to stay in swanky hotels to use points.

Random Observation #8: My avg cash back across all purchases is higher than any other strategy I’m aware of

Average Cash Back % = 5.25%*(Fraction of Spending on Gas + Costco + Online + Travel + in-store Walmart/Sams) + 3.5%*(Fraction of Spending at Other Grocery) + 2.625%*(Fraction of Spending on All Other Categories).

Given the large amount of spending we have in the 5.25% categories, when I plug in my numbers above I get a number around 4.5%(ish) as the weighted average cash back across all spending.

Here’s an entire blog post dedicated towards the calculation of the above: https://frugalprofessor.com/another-boa-efficiency-post/

Random Observation #9: The one-time bonuses aren’t too shabby either

$250 Merrill Edge transfer bonus

$500 BoA Premium Rewards Card (Spouse 1)

$200 BoA Cash Rewards Card #1 (Spouse 1)

$200 BoA Cash Rewards Card #2 (Spouse 1)

$200 BoA Cash Rewards Card #3 (Spouse 1)

$200 BoA Cash Rewards Card #4 (Spouse 2)

$200 BoA Cash Rewards Card #5 (Spouse 2)

$1,750 total rewards.

Random Observation #10: Despite the underlying complexity of owing 5 BoA Cash Rewards Cards + 1 Premium Rewards Card, the wallet is pretty simple

Since “online” and “travel” categories are used with online purchases, there is no need to lug those cards around in the wallet. I simply carry the Premium Rewards Card + the Cash Rewards Card (the “gas” one) in my wallet. If I make an online/travel purchase, the info is saved in Lastpass so there is no need for the physical card. The only reason I hold the Costco Citi card is to get into Costco. Now that Costco offers digital cards, I’ll be left with the mathematical problem of whether the few megabites of data (times $0.02/mb) to access the digital card is worth not having to lug around the otherwise unused card. My intuition is that the digital card won’t be worth the hassle. Unpictured below is the Costco Cash card because my wife is the one that does most of the shopping.

On the topic of simplicity, all billing cycles are perfectly aligned and autopay on the 1st of the month. The underlying complexity does not making paying the bills any more difficult.

Random Observation #11: BoA Doesn’t alert you when you’ve blown through your $2.5k/quarter spending cap

This is annoying, but solvable with a pivot table in Excel with output from Personal Capital. Below is our quarter-to-date spending on each of the 5 BoA Cash Rewards Cards. Quarters follow the calendar (Jan + Feb + Mar, etc) and are independent of billing cycles.

Random Observation #12: Given the above strategy, the BoA Premium Reward Card is somewhat impotent

Given how generous the 5.25% categories of the Cash Rewards categories are, the premium rewards card is somewhat impotent. The 3.5% travel & dining categories are dominated by the Cash Rewards card. The only reason I retain this card is to get 2.625% on all other expenditures, which admittedly are large (property taxes, doctors offices, utilities, insurance, etc).

Random Observation #13: BoA gives additional random bonuses away if you click to activate

I think this is largely a gimmick, but I think I’ve used it once or twice. Unfortunately, it’s not automatic and requires a few mouse clicks. The only one that is remotely appealing to me in the below list is the 5% Airbnb discount. Curiously, my offerings are more generous than my wife’s.

Random Observation #14: The platinum honors bonus is now awarded at time of purchase rather than at time of redemption

Last year you used to be able to defer the redemption of the cash back until you hit the platinum honors status. This strategy is no longer viable, as the credit card bonus multiplier (1.25, 1.5, or 1.75) is now applied at the time of purchase.

Conclusion

More free money is better than less free money.

The above setup is as good as any I’ve seen in the past decade and a half of my adult life since I started paying attention to credit card rewards. I can’t really think of how it could realistically be improved upon, though admittedly I may pick up a 6th Cash Rewards Card because why not? If I go down this path perhaps we’ll get a BoA Premium Rewards for my wife, harvest the $500 bonus + $100 global entry bonus + $100 airline incidental – $95 annual fee then “product convert” it to a Cash Rewards card. Doing so would produce a net sign-up bonus of ~$405 higher (500+100+100-95-200) than going the straight Cash Rewards route.

If you have $100k of investments laying around (even if it’s in IRAs), you might want to consider following suit.

The setup costs are non-trivial (i.e. transferring the $100k and getting autopay worked out properly), but once you’ve got it figured out it is smooth sailing.

Edit 2023

I made a YouTube video demonstrating the system. It’s basically a video summary of the above:

I wonder if I could transfer my SEP IRA at Vanguard over to Merrill Edge?

Looks possible? https://www.merrilledge.com/small-business/sep-ira

I feel like the Chase Trifecta is a much more hassle-free way to get similar types of rewards. The Sapphire Reserve gives you essentially 4.5% back on dining and travel. Pair that with the Freedom for rotating ~7.5% categories and the Freedom Unlimited for ~2.25% back on everything else. All the above for a total annual fee of $150, which the Reserve sign up bonus alone will cover for 5 years. Not to mention all the other Reserve benefits like Global Entry credit and airport lounge access among others.

Then if you really want to optimize, you can use the Costco card for gas and American Express blue cash everyday for groceries.

I’ve written about this here: https://www.moneyandmegabytes.com/?p=440. I think it’s a more accessible plan than the above, but I’m also biased by what’s in my own wallet :).

Thanks Joey. I concede that the $100k transfer is too large of a hassle for most people.

Your strategy looks pretty good, though the annual fee turns me off (albeit $150 after travel credits). And the rotating categories also seem stingy-ish. That said, for someone with <$100k, it's probably a good strategy?

Dude – this is some seriously impressive optimizing. Well done.

I like the Citi Double cash/AMEX Blue Preferred/Chase Sapphire Reserve/Citi Ink Cash/Prime Visa combination.

Please correct me if I’m mistaken but think the above combo beats your system for groceries, streaming, internet service, cell phone service, restaurants. (Counting ultimate rewards points at 1.5 cents). But because those categories are a big part of my spending I estimated that my combo has a similar overall return for me (3% vs 3.2% for your system) after subtracting out annual fees.

Thanks.

I’m not terribly familiar with your system, but I did some quick doubling.

Double cash (a card I had for years before product converting to Citi Costco Visa) is inferior to premium rewards because 2% < 2.625%. AMEX Blue Preferred is better than the BoA Cash Rewards because 6% grocery > 5.25% (assuming Costco / Walmart grocery, for example. But it’s inferior because of the $95 annual fee vs the $0 annual fee. Chase Sapphire Reserve seems to be most powerful when combined with the Chase Freedom as Joey mentions above, but I dislike the $150 annual fee. Chase Ink Cash is indeed better for cell phones, internet, and cable TV because 5% > 2.625% but my monthly spend on those categories is on the order of $35/month. Prime Visa is worse than Cash Rewards because 5% < 5.25%. What I like most about my system is dealing with a single bank (albeit across 2 accounts for my wife and me), pretty generous spending caps ($2.5k/card/quarter), the fact that these generous spending caps can be defeated by getting multiple cards, and that the net annual fee for all 5 cards is ~$0.

How do you spend so little on phone and internet. Amazing! 🙂

Two small responses:

1. I think people should be annual-fee neutral. Just make sure to subtract it from the cash back before calculating the %. The AMEX is effectively a 4.5% cash back card on $6000 of groceries after subtracting the fee.

2. Chase rewards have a 1.5 multiplier with the CSR when spent on travel (which I am spending anyway), so for example I would argue that 5% return on Internet is really 7.5%

For my current spending habits, your card system returns .2% more than mine. I’m sure I could squeeze more out of your system by adjusting my spending or if I had a local cosco.

The 1.5x multiplier you get with the CSR is pretty powerful. With the Freedom Unlimited, that makes non-category spending 2.25%, which is still less than FP’s 2.6% but not by too much! $150 annual fee is not too bad, and you can calculate return after accounting for the annual fee as you mention. If you have 100k to move around and some free time then maybe BoA is slightly better than Chase, but it’s close!

Almost free cell phones described here: https://frugalprofessor.com/phones/

Internet: By haggling with Spectrum to get $30/month 450mbps (down) / 20mpbs (up) internet. I’ve been a long time customer of theirs at a $15/month plan 2mbps (down) / 1mbps (up) for almost a decade. I cancelled to go with a local fiber company for $45/month. A month after cancelling I called and they offered that $30/month plan for 3 years. When the promotion ends, I’ll cancel again for a month then repeat.

I agree with being annual fee neutral.

The CSR + Freedom seems pretty sweet. Perhaps I’ll investigate more.

I read your “2018” strategy earlier this year and gave it a try, turns out you don’t have to be a “Platinum Honors” to take advantage of that BofA program:

I’ve been in the “Platinum” tier (> $50k) for a while even though my 3 month average balance is below $35k…I don’t know why I haven’t been “demoted” yet.

I have 2 Cash Rewards (Online and Gas) and 1 Premium Rewards (Travel, Dining and Everything) and have been redeeming between $30-$45 per cycle per card (of course, I put everything on the cards).

I also have the Costco Credit Card.

This is what I get with the “Platinum” tier (x1.5):

– Gas and Online: 4.5% (greater than Costco’s Gas cash back).

– Dining and Travel: 3% (same as Costco but more redeeming options).

– Wholesale (Costco Food Court included) and Groceries: 3% (greater than Costco’s cash back).

– Everything else: 2.25%.

I’m sorry I wasn’t more transparent in the blog post. $20k with BoA/ME gets you a 25% bonus, $50k gets you a 50% bonus, and $100k gets you the max 75% bonus. You’re indeed right that the 50% bonus gets you most of the way there.

It’s curious that you haven’t been demoted, but that’s awesome. After today’s market turmoil perhaps I’ll be demoted soon! In that case, I’d transfer more from Vanguard to ME.

It sounds like you’ve got a good system going (almost identical to mine). Hopefully I didn’t lead you astray.

Have you figured out any secrets to the “online” category? I’ve been really impressed with the category and have yet to be disappointed with it. I’m still never sure whether southwest.com, delta.com, hotels.com, etc would count or not. There was a good thread at flyertalk on the topic: https://www.flyertalk.com/forum/credit-card-programs/1945621-bank-america-cash-rewards-3-category-qualifying-options.html. Comment #69 looked interesting (using Paypal to pay for Southwest flight apparently worked?).

Have you heard about Plastiq? I’ve been using them whenever they run a promotion (their fee is 2.5% but they sometimes run promotions and lower the fee, lowest I’ve seen is 1%).

I’m a BoA Platinum and I get 1.5% on everything with my Cash Rewards Mastercard…there was an issue with BoA Visas not working but seems to have been resolved now, I’d still check Plastiq’s website.

Anyways, I was checking my rewards last night and noticed that the two Plastiq payments I made during December were categorized as “online” giving me 4.5% instead of 1.5%! I believe this has to do with Plastiq now adding the recipient’s name to the description and BoA still hasn’t catch up.

Pretty slick! I saw some discussion on doctor of credit’s site about Plastiq + 5.25% BoA cash rewards. At the time, the consensus was less favorable than what you’re indicating.

So, best case scenario Plastiq would produce 5.25% online benefit – 1% promotional fee = 4.25% net of fees under the best case scenario? For non-promotional periods, it’d yield 5.25%-2.5%=2.75%?

You are correct. They waive the fee on the first $500 or so if you sign up using a referral link.

I’ve used Plastiq to make regular payments for an auto loan, payoff another car, mortgage payments (regular and principal only) and property taxes.

I usually wait for promotions but will schedule a couple of payments since I’d still get 2% back with their regular fee (4.5% – 2.5%).

Do regular in-store Target and Walmart count as wholesale clubs? If not, any way to get discounts without buying online?

In-store Walmart counts as grocery (3.5%). In-store Target usually has not counted as grocery for me. Both could presumably be 5.25% “online” if you purchased gift cards from Walmart’s and Target’s websites as I do with Costco.

I’d like to bring up the Target RedCard here. They have a credit card, but also have a debit card option (that you link to your checking account). Both get 5% off Target purchases, free shipping from online orders, and an extra 30 days to make returns. I have avoided the credit card for lack of sign-up bonus, but the debit card does not involve a “hard credit pull.”

Good feedback. Thanks!

Does your authorized user for the cash reward card also have a $2.5k quarterly cap, or do authorized user purchases count towards the account holder’s $2.5k cap?

All purchases go towards the same cap (so you can’t defeat the cap by simply adding more authorized users). I went over the cap by $20 once and my rewards reverted from 5.25% (or 3.5% in the case of groceries) to 1.75% for those last $20 of purchases in the quarter.

Thank you! I am about to adopt this strategy. I plan to transfer a Vanguard IRA ($100k+) to Merrill Edge. I would prefer to keep my funds invested in non-ETF Vanguard index funds. I typically set my Vanguard dividends to automatically reinvest. Do you know if Merrill will charge any sort of transaction fee to reinvest December dividends? I won’t be able to reach Platinum Honors status until January.

I have 106k of VTSAX at ME right now. There are luckily no charges for reinvestment of dividends. If you needed to sell, there would be a non-trivial redemption fee ($20?), but this is easily avoided by transferring back to Vanguard if you need the liquidity.

It’s a bummer you can’t immediately qualify for Platinum Honors status, but once you do you’re golden for 5.25% cash back on most of your life. Seems to me like a pretty decent payoff.

Can you use the American Airlines egift card to buy tickets? Thanks.

It’s my understanding that you can. It’s just like any other gift card. That said, I’ve always sold them online so I can’t personally verify.

Also, how does one do a “product conversion?” One BAC representative told me that I’d have to close my old account.

I’ve never done one with BoA before, but I’ve done one with several other credit card issuers.

This thread seems relevant to your exact situation: https://ficoforums.myfico.com/t5/Credit-Cards/BoA-does-not-allow-Product-Changes-Downgrades-from-Premium/m-p/5512643#M1624407

It appears that you just need to call back a couple of times. Maybe BoA is slowly changing their policy on this?

Yes, you can. I used them to pay for an international flight last year.

I have a question and a comment about the ability to change the 3% category once a month for the Cash Rewards card.

Question: Does the 3% reward bonus get applied to whatever category is selected *at the moment of purchase* — allowing one to get rewards in up to 2 categories within a given calendar month? Or does the category selected at the end of the month apply to that whole month (so there is still some value to switching, in that you know what your expenses have been)? For example, if I spend $500 in Category A, switch mid-month to Category B where I spend another $250, assuming the $2500/quarter limit has not been reached, do I get 3% applied to 500+250=750, or just to 250?

Judging by the BofA rewards page, it seems that the rewards get calculated within a few days of each purchase, so the first answer above seems correct, unless BofA does retroactive adjustments. (This question may have been implicitly answered by an example you gave about pharmacy purchases at the end of the month, but I wasn’t sure.)

Comment: Assuming the 3% gets applied to to whatever category is selected at the moment of purchase, one could effectively get 2 categories every month by using a 2-month cycle:

Month 1: Category A until the 15th, then switch to B

Month 2: Category B until the 15th, then switch to A

I just signed up for a second Cash Rewards card and fear that I will be “wasting” a lot of the $2500/quarter by not spending enough on travel or dining alone (of course, the low spending is otherwise a good thing). The first card should be max-able if I can convince my wife to use gift cards for all grocery purchases like you do at Costco.

The change is effective immediately and doesn’t retroactively negate any pre-change rewards accrued. Rewards are always accrued at the time of purchase, so it’s impossible for them to renege.

Your category switching example looks Kosher to me.

This quarter, we’ve maxed out 2×2500 “online” category cards so we converted our “restaurants” card to “online” mid-december. No big deal at all.

The optimal strategy is to have a sufficient number of cards across both spouses to not hit the cap. It introduces a bit of complexity but has a pretty good payoff. I think it’s worth it.

Hi Professor,

When you changed the category, is the bonus based on the date of transaction or the date the charge posted?

Thanks for the great post!

This is a good question. I’m not 100% sure, but whenever I need to change categories I do it before the actual transaction (just in case it’s the transaction date not post date).

If anyone else has feedback, I’d be curious to hear.

Promotional period is back https://www.merrilledge.com/offers/900offer .

Thanks for the heads up! Perhaps I’ll call them about a retention bonus.

Here’s a way to get 3.5% cashback for the things that will only generate 1% cashback. Use the BofA cards at grocery stores to buy $500 Visa/Mastercard Debit/Gift Cards when they offer a promotion to take off the activation fees. That way, you get the 3.5% cashback and you don’t pay the extra $5.95 fee. I generally use the Visa Gift Card in situations where the POS terminals will give me 1% (i.e. parking garages, medical bills and co-pays, utility bills to be paid online, but don’t count as “online purchase”, etc). Just don’t lose the Visa/Mastercard debit card!

That is an interesting suggestion. To be more clear, the worst-case with my current system is 2.625% with the boa preferred rewards card or 1.75% with the cash rewards card.

Relative to my system, I’d be (3.5%-2.625%) better off for doctor’s offices, etc. I spend a lot of money at doctors, so perhaps this is worth looking into.

Is there an easy way of finding out “when they offer a promotion to take off the activation fees”? Do you have a grocery store of choice? If purchased at Walmart via the Walmart app, this would yield 5.25% (I learned this trick from another reader on the thread).

In California, the Albertsons/Safeway/Vons group of stores have a weekly “just4you” savings program on their app where they offer a discount to offset the activation fee every few weeks. I believe Kroger and Kroger owned-chains have similar app coupons occasionally as well, but not as often.

Thanks!

I’ve only been using one BoA Cash Rewards and did not really think you could have multiple! I use my 5.25% for dining but had been wishing I could get another for online shopping. Also had been considering adding the Premium Rewards card to my wallet to upgrade over the Double Cash and the now useless to me Uber card; simple question: can I apply for both at the same time or should I space them out?

Between my wife and I, we have 4 Cash Rewards + 1 Premium Rewards. We seldom use the Premium Rewards any more.

If I were you, I’d apply for a 2nd BoA Cash Rewards, and once approved, apply for premium rewards. The worst they can do is turn you down for PR. Best case, you get both cards on the same day. Admittedly, the Doctor of Credit forum would probably have better into than my random intution.

Also, how much do you pay to pay your taxes with credit cards?

1.87% swipe fee for federal, which I don’t do b/c I withhold via W2 wages. For my property taxes, I pay 2.35%, so there’s a tiny spread.

does paying taxes online at the irs website count as an online transaction ?

It’s my understanding the answer is unfortunately no. However, with the premium rewards card you can get 2.625%, which is higher than the 1.87% swipe fee.

Merrill checks your balances with Merrill/BoA about every 6 months or so and gives you another 3 months to put the money back (they’ll send you a warning). Perusing online it looks like once you qualify, you can keep status for up to 1 year, after your balance falls below the threshold amount.

With regard to stock/ETF/mutual fund sale fees, most brokerage (as of 2020) have eliminated fees on stock/ETF. For this reason, I’d prefer to keep my Merrill holdings in ETFs. There are no charges for reinvestment of dividends/cap gains for any type of holding I’m aware of.

If you’re talking about the $100k status, it’s been my experience that they update the status/balance on a monthly basis (calculated on a 90 day rolling basis).

With respect to comissions, ME used to have an advantage here with free trades. Now the advantage is gone since everyone does it. It’s my understanding that VTSAX is still costly to liquidiate there. Consequently, VTI would be preferable to hold there.

A quick Google search landed me on TPG’s website showing Bank of America has a 2/3/4 rule. Can only be approved for 2 cards within a 30 day period, 3 cards within a 12 month period, and 4 cards in a 24 month period. Should have did that before posting!

Also I feel I’ll use the Premium Rewards card quite a bit; I’ll be able to put my rent on it given my complex charges 2.5% for CC (effectively cost neutral with 2.62% return but a little something is always better than nothing), I’ll buy plane tickets with it because even if it’s paltry and utilization likely rare, I’d rather have some form of trip cancellation/delay insurance – one claim would likely see the benefit of 5.25% vs 3.5% disappear, I have a bunch of work related incidentals (many of which are reimbursable), and then of course insurance (auto+renter’s), internet, etc. Not a huge boost from 2% from Citi Double Cash but the no FTF, Global entry, and the fact I’ll be living in an American Airlines hub soon (and will be making full use of the $100 eGC) make it a worthwhile upgrade.

I’ve been approved for both and looking forward to a dining-online shopping (will fit gas and groceries via gift cards) -premium rewards combo! Thanks!

Like you, I’m glad to have the premium rewards card in my wallet. It doesn’t provide the 5.25%, but it’s still not a bad card, particularly if you can utilize the $100 AA egift card. I don’t live by a hub so I have to sell the card online. No big deal.

Glad you were approved for both cards!

You know I say there is no sign up bonus, but then I’m proven wrong.

https://www.doctorofcredit.com/apply-for-a-new-target-redcard-debit-credit-and-get-25-off-25-shopping-trip-1-19-2-2/

Hi everyone

wanted to add my recent discovery, paying at the pump using Exxonmobil app is an online transaction

Thanks for the feedback!

Does Simon mail visa/mastercard gift card counts as an online transactions?

These seem relevant. I can’t vouch for them personally.

https://www.doctorofcredit.com/which-online-retailers-earn-3x-with-bank-of-america-cash-rewards/#comment-716762

https://www.doctorofcredit.com/bank-of-america-cash-rewards-card-now-lets-you-choose-your-3-category/#comment-688697

I’ve never heard of Simon mail. What are the fees associated with the cards?

500 visa gift card: 4.45 fees posted as online transactions. So you can have 4.4% cashback everywhere.

Thanks for sending. 4.36% cash back on life (docs, dentists, etc) is pretty slick. Too bad the max amount is $500.

Have you verified this personally yet?

Is this the relevant link? https://simon.giftcardmall.com/pages/home (Visa® Simon Giftcards®)

Yes, you can order as many as you like. Also it is 4.40% and not 4.36 (I know that’s small still) (effective reward 22.03 for 500).

Thanks for sharing. How many multiples of $500 have you purchased? I could see myself doing this for a few thousand each quarter. Are you protected in the event of a loss? With my Costco Cash strategy, Customer Service has told me I can go to them any time I lose it for them to reissue.

Is the below math Kosher?

Benefit = 5.25%*($500 + $4.45) – $4.45 = $22.03

Cost = $500 + $4.45 = $504.45

Effective reward = Benefit / Cost = $22.03 / $504.45 = 4.37%

22.03/ 500 As I only get 500 gift card. I am waiting for my card to arrive and read the fine print, people apparently to many many thousands there.

Thanks for correcting my math.

I hope you have a good experience with the gift card. Please let me know how it goes. It’d be pretty nice to funnel spending through that channel.

I’m interested in the Bofa Premium Rewards Card at the Platinum Honors level. I’m trying to simplify things and having one card with at least 2.625% cash back all the time sounds really good.

I’m also interested in Travel Protections offered by this card. I have not been able to find any detail on the Coverage Limit on Common Carrier Travel Accident Insurance. This is important for me since I plan to do a bit of travel after the current situation improves.

Can someone who has this card post their coverage limit for the Common Carrier Travel Accident benefit?

Where would I find this benefit?

This is all I can find: https://www.bankofamerica.com/credit-cards/premium-benefits/

Thanks you, I’m aware of the info on Bofa website. Can you check the Benefits Guide that came with your card?

Most banks (Chase, Wells, Citi) put out the Benefits Guide on their sites so the benefits are available for everyone to review. An example from Wells Fargo: https://www08.wellsfargomedia.com/assets/pdf/personal/credit-cards/guide-to-benefits/cashwise-signature.pdf

Bofa for some reason does not put the detailed information on their web site.

I think that your focus is on Rewards and your posts are really great. I’m trying to combine (and maximize) the Travel & Shopping Protections along with optimizing the Rewards. Having a generous protection offers peace of mind. As an example, in the case of the Wells Fargo card above (disclaimer I do not own this specific card, just quoting this as an example), granted that the cash back is less, but the travel protections seem to be very generous.

Another example is that Costco Visa offers one of the Best (if not THE best!) Extended warranty benefits. So I use it for new electronic or other purchases where additional warranty makes sense. I can accept a few dollars less in cashback rewards for a 2500$ TV or a 1500$ laptop,if the card offers 2 additional years of warranty.

I can’t find the terms of the card in my email inbox. I would have tossed the paperwork that came with the card.

I’m aware of the extended warranty on the Costco card. I recently bought a TV from Costco and had to decide whether the 2% cash back + extended warranty was better than 5.25% using the BoA card. I opted for the BoA card, but I’ll obviously regret it if my TV craps out in 3.01 years (or whenever the default Costco warranty expires).

@frugalprofessor – Appreciate your prompt reply. I’ve followed your posts for a while, have not posted until recently. I’ve been trying to find out the coverage limit on Bofa card for a while.

Would you be able to call up and find the Coverage Limit on Common Carrier Travel Accident Insurance?

You mentioned yr wife also has 2 of her own cards, but does she also require to have her own $100K in BofA? Or is your $100K in BoA a Joint account thus she also gets her own Platinum status? Thanks.

We only have $100,000 in a joint brokerage account and it counts for both of us. We picked up a fifth cash rewards card since I wrote this blog post. Pretty slick system.

I really enjoy your posts/blog and have moved to a BoA system. A question regarding Raise, after you list your GC, how long did it take the listing to go from pending to actually listed? After being listed, how long did it take for someone to purchase it?

Keep blogging!

Thanks for stopping by.

If selling the AA gift card on Raise, it must sit there for about 4-6 weeks before it sells as an anti-fraud precaution. It’s annoying, but apparently it’s their policy for retailers they consider to be high fraud risk. With other retailers, it lists and sells almost instantaneously. I forget what card I sold there most recently (perhaps Barnes and Noble?) but it had listed, sold, and the cash was transferred out in the same day.

Thanks for the info. In the info they send you, they say most list within 24 hours and say a few can take several days. It’d be nice if they were a little bit more upfront about the length of time for some GC’s to list.

Regardless, the BOA system is very nice. Given that the hoops to jump through are rather steep and it isn’t really heavily promoted, hopefully the Preferred Rewards system is here to stay.

I’m glad you like it. I think BoA isn’t promoted on other blogs because they don’t have good affiliate programs. Since my recommendations are independent of the presence of affiliate programs, I’m happy to recommend what I like and use.

My biggest concern with my strategy going forward is BoA taking away the lucrative “online” category from their Cash Rewards card. I use that category almost exclusively, so it’d be a big blow if it were taken away.

Online is my category of choice for the Cash Rewards card as well. I can see why you have multiple of that card. There are not too many cards with that reward category, one wonders if they will do away with that one. CC companies are constantly changing their T&C’s.

The Discover It after the first year gives 5% (up to $1500 per quarter of spending, I believe) in the reward categories for that quarter. If you could max every quarter out you’d net up to $300 cash back after the first year. It is 1% cash back after the first year for non bonus category spend.

Thanks for sharing!

In the first year of a Discover It card, the effective rate is 10%. Q2 includes wholesale clubs. Costco takes Discover online. It’s $1500 per quarter. If you got the card before June 30, you could do $1500 this Q2 and $1500 in Q2 2021 before your anniversary date. Q3 is usually restaurants. Q1 is drug stores. Q4 is Amazon,etc. Anyway, possible to max out at $750 cash back on $7500 spend. You can have 2 Discover It cards….

Thanks for the heads up. What is the rewards after the introductory period?

Just 1%. Right now, I am in the first year of my second Discover It card. My first one is very old. If I had a player 2 and neither of us had any Discover It cards, I could have 5 years in a row (4 cards * 5 quarters = 20 quarters) of 10% back on the quarterly categories.

Sorry, 5% in the quarterly categories, and 1% on everything else and after the $1500 limit per quarter in the category.

Thanks for the info!

I loved the phrase “If I had a player 2….” It makes me think of a dating profile you might write: “Seeking loving relationship with a loving player 2 to enjoy long walks on the beach, raising children with, and maximizing credit card rewards with.”

Least I can do. Learning from you/this blog! Already discovered the BOA trick beforehand, but so much good stuff here. Thanks for all your hard work.

My HOA dues posted as Travel/Dining on the premium rewards. No idea why. I used it to hit the sign up bonus, but it turns out the 3.5% multiplier is higher than the 3% fee…..

Really weird! We visited a community rec center / pool in Aurora CO once and that counted as Travel. Our local YMCA, on the other hand, does not.

If you had the cash reward card, you’d presumably be able to get 5.25% back on that next time.

fyi, you can tell when u go over the boa limit, i included a screen shot.

https://i.imgur.com/GVWtYpN.png

I have also learned sams club online with curbside pickup counts as online shopping, a local grocery store with pickup does the same, and so does certain walmart stores.

Thanks for sharing! However, to confirm, BoA doesn’t provide a running tally for you, right? That’s been my experience so I just manage it with a pivot table. Easy enough.

FYI, you can use Walmart gift cards at Sam’s. Why is this relevant? Raise.com allows you to buy Walmart gift cards (digitally and instantly) for 2.35% off with a 1% ebates/rakuten bonus on top of that. All in, you’re close to 8.75% all-in (5.25% BoA + 1% ebates + 2.35% raise). Not too shabby. https://www.raise.com/buy-walmart-gift-cards

To be clear, this opens up the door for 8.75% in-person at Sam’s (or online).

No, there is no running tally. BOA CS confirmed this is the only place it will show up. We don’t generally hit the limits, as we have 4 cards. the walmart gift card comments are interesting i will give it a go, as i use ebates as well.

I hope the AA egift card trick for the Premium Card still works, i just purchased it to sell on raise.

appreciate the info, i have been doing this for about 2 years now, amazing offer. we still use the Amex Preferred (6% at 95 for grocery) we have gotten the annual fee waived as well.

Best of luck! Hope it works for you like it did for me. I just purchased $500 of disney egift cards using that trick.

Regarding the $100 american airlines gc on raise, this is certainly a bad year to be selling. But even if you get $60 or so, the card will only net you $35 AF, which seems very doable.

i guess the rates change daily on raise? walmart flipped to .50 today, from 2.3, lost a bit there.

I’ve noticed that as well recently. It used to be consistently 2.5% every day. Now it’s 2.35% most days and occasionally 0.5%. Check back in a day or two and it should be back up to 2.35%. Presumably, this has something to do with quotas or something.

I’m excited to get started with this strategy. Trying to understand order of operations. Do you open the bank account first? If yes, how do you avoid fees if you have to wait 3 months to get platinum honors status? Or do you open the Merrill Edge account first, wait 3 months to get platinum honors, then open the bank account?

I moved brokers because of a broker bonus, the platinum honors was icing, i had their cards for years, but never noticed what this program was about, thought it was some annual fee thing.

you need a checking account 1 dollar balance. whatever credit cards, then 100k in the brokerage. i transferred the brokerage in, then asked to expedite the honors status, that took less then 2 weeks. and the rest is history

BOAMAN – how did you expedite status? Did you just call after you had the $100K in? And are you saying they gave you the status in 2 weeks vs. 3 months?

When i transferred the money in on the merriledge side. while i was getting the bonus, and talking to the advisor, i asked if they could credit the platinum honors status for the credit cards before 3 months, he said yes. within 2 weeks the credit card side was showing platinum honors, and the rewards were reflecting as such. make sure you get your brokerage bonus as well. you need a checking account as well. i had mine prior to this.

i now have 4 BOA credit cards for this program.

I tried to accomplish something similar but was unable to do so, so I guess YMMV.

Here’s my recommended order of operations:

1.) Get the $100k to ME

2.) Open up BoA checking account. You could do this concurrently to Step 1 above. They ***should*** give you a month or two grace period on account fees if you’re in the process of doing platinum honors at ME.

3.) Apply for CC. I don’t really see a large downside to applying early, so why not do it concurrently. If you’re going to do the multiple cash rewards card strategy, then perhaps apply for one nor two now to start the clock (whatever that may be) for you to apply to your third and fourth cards. You might want to hold off on actually spending on those cards until the platinum honors kicks in. I guess the downside to this approach is that to get the $200 bonus, you’d need to hit a minimum spend requirement over a certain time period (easily googleable). Without platinum honors, perhaps you’d be forced into a situation where you’re not getting the full 75% platinum honors bonus. Keep in mind, however, that you’ll qualify for a 50% bonus at $50k of assets. Since it’s computed on a rolling average, you’ll hit a 3-month-average of assets of $66.6k after two months with an initial $100k deposit.

It’s all kind of annoying, but once you overcome this initial hassle, you’re off to the races with pretty much unlimited 5.25% cash back.

Is there a waiting period between applying for new cards or max number of cards one can apply for? I did the ME transfer early this year, and have applied for and received 3 of their cards so far. Is there a maximum number of cards over a 1 year/2 year period?

I’m not aware of any strict max waiting period, like at other banks. Surely there’s got to be some sort of max hidden in their approval algorithm, though.

If we have 2 cards (me and my husband) with the same card numbers, each of the card can has $2500/quarter cap for up to $5000/quarter? Not sure how that work?

That counts as 1 card, so $2.5k/quarter. To get to twice that, you’d have to open a new card.

FYI – It’s been reported that BofA is considering reducing the reward structure of their credit cards to bring them more inline with competition.Top tier may go down to 3%.

I don’t know what the odds are or when this would happen but I don’t see why I would continue investing with Merrill to get credit card rewards that top out at 3% when there are other options out there without tying up capital with subpar service. It is just anecdotal at this point, but I just wanted to share.

Thanks for sharing! I found out about this last month and now have a giant disclaimer at the top of this post warning people about this possibility.

(Sorry for the delayed response to your comment. For some reason it was initially sent to Spam).

do you guys have a link? that would be devestating to see, i just spent 7500 over 3 of them in the last 3 months.

I’m in the same boat. I have 5 cards and spent $12.5k over the past 3 months. $2.5k of that was helping a friend buy a camera with the discount.

Here’s the speculation: https://www.doctorofcredit.com/survey-bank-of-america-might-eliminate-75-platinum-honors-bonus-2-62-5-25-etc/

It’s not official yet. But I think the writing’s on the wall??? Not sure when the hammer will drop.

I got my folks on it as well. Bummer if cancelled.

Looks like the program has been around since at least 2014???? https://www.magnifymoney.com/blog/consumer-watchdog/bank-of-america-preferred-rewards/

yea it would, the system works for me, really don’t want to get another set, as my parents are on the same program. did even last 2 years?

My wife got denied applying for her 3rd bofa credit card even with platinum honors status. If the following is true

https://www.doctorofcredit.com/httpswww-doctorofcredit-combank-america-312-rule-credit-card-approvals-contribute-data-points/

It will take years to build up this system.

Thanks for sharing. For simplicity, I copied the apparent rule from DoC’s website:

Currently, I have:

BoA premium rewards x 1

BoA cash rewards x 3

Mrs FP has:

BoA cash rewards x 2

It took a while to get there, but we never got denied. It seems below is how you’d get there pretty quick:

Spouse1:

CR Card 1: Jan 1, 2021

CR Card 2: Jan 1, 2021

CR Card 3: Mar 2, 2021 (2.01 months after previous)

Spouse2:

CR Card 4: Jan 1, 2021

CR Card 5: Jan 1, 2021

PR Card: Mar 2, 2021 (2.01 months after previous)

The above satisfies:

* no more than 2 cards over rolling 2 months window

* no more than 3 cards per rolling 12 months.

* no more than 4 cards per rolling 24 months.

From first application to last application, that’s 6 cards across two spouses over 2.01 months.

Am I missing something obvious here?

Platinum Honor’s doesn’t mean anything. the 2/3/4 rule is all that matters. i called fought, nothing. waited the time and now i have 4. it is what it is.

Thanks for sharing! Do you concur with the viability of my example immediately above your comment? 6 cards (across 2 spouses) in 4.02 months?

There seems to be a new 1.5% card that is unlimited on all purchases, with a $200 signup bonus and no annual fee: Bank of America® Unlimited Cash Rewards

Couldn’t this take the place of the Premium Rewards card to get 2.6% on “life” expenses that fall outside of the Customized Cash Rewards categories, without an annual fee to worry about negating?

I agree, but there are downsides:

* No 3.5% on travel/dining

* No FTF waiver

For now, I’ll stick with the PR card.

What is FTF?, you can get separate dining travel cards as well.

Sorry. Foreign transaction fee.

Yes I just converted. You loose the 100 dollar air credit, and the global precheck etc, if thats important to you.

Frugal Professor, I recently started with two Bofa Cash Rewards cards – one for me and one for the spouse. I do not see any way on the Bofa web site to track my 2500$ quarterly spend limit towards the 3% and 2% rewards categories.

The Bofa website is clunky and confusing. Can you provide the steps to track the 2500$ quarterly spend

I hate to Bank of America website as well. Unfortunately there isn’t a way of tracking easily the $2,500 per quarter spend. I just download transactions to a spreadsheet periodically.

no way to track. but you can tell when your over.

I recall reading somewhere that Bank of America considers “property management” to fall under travel, but I can’t find the reference now and am wondering if anyone has heard anything similar. This would be quite nice for me because I rent from a property management company and the cash back on my rent, from either the Customized Cash card or the Premium Rewards card, would offset the credit-card convenience charge from the property manager’s payment portal and therefore pay me to pay my rent.

Doctor of credit is probably going to be your best bet there. Lots of users reporting their experiences with different categories.

A lot of rent codes as ‘Real Estate Agents and Managers (Rentals)’ which BofA considers as Travel, as you can see at https://www.bankofamerica.com/credit-cards/products/cash-back-credit-card/cash-back-category-choices/.

Thanks for sharing!

Raise.com no longer is accepting American Airlines gift cards as of 4/19/22. https://www.raise.com/donotbuy

Bummer. Thanks for sharing!

You can currently sell $100 AAGC on CardCash for $80 (didn’t check Raise). The ability to sell on these sites comes and goes, so sometimes you have to wait til it comes back. (BoA has always credited for $100 AAGC.)

Thanks! This is helpful!

I read the BH forum but don’t have an account, so I’m actually replying to your post https://www.bogleheads.org/forum/viewtopic.php?p=6935648#p6935648 here.

The timing is based off of the anniversary month which you can find where it says

“Preferred Rewards member since: Month Year”

You said yours is April. I’ll describe this all for anniversary month April, and anyone else can adjust it for their anniversary month accordingly.

Your “3 month grace period” is Apr-Jun, and the only time in the year that your tier can drop is at the end of June.

(Changes may happen a few days into the next month.)

3 month averages are average daily closing balances over 3 consecutive calendar months (e.g. Aug-Oct, never e.g. mid-Aug – mid-Nov).

At any month-end it is possible to increase tier.

The question is, when you reach a tier, how long does it last.

For anniversary month April:

If you reach a $100k 3 month average on any one of the 3 calendar month periods

Jan-Mar 2023

Feb-Apr 2023

Mar-May 2023

Apr-Jun 2023

then you are guaranteed to stay at that tier until end of June 2024, regardless of what your balance does later (assuming you don’t close checking etc).

But a $100k 3 month average for

Dec 2022 – Feb 2023 is only good enough to last until June 2023.

If you did drop tier at end of June 2023, then a $100k 3 month average on any one of the 3 calendar month periods

May-Jul 2023

…

Dec 2023 – Feb 2024

will get you back to the top tier starting the month after that 3 calendar month period until end of June 2024

(while Jan-Mar 2024 is good til June 2025).

In other words a qualifying 3 month average will qualify you for a tier for 4-15 months after that, depending on the timing, and always and only ending at the end of the “3 month grace period”

I.e. (for anniversary month April and so “3 month grace period” Apr-Jun)

Jan-Mar is good for the following 15 months

Feb-Apr is good for the following 14 months

…

Nov-Jan is good for the following 5 months

Dec-Feb is good for the following 4 months

in all cases until end of June.

Everything is based off of the anniversary month. Once you know how it works, you can disregard any BoA/ME low balance letters, since they don’t tell you anything you didn’t already know.

Thanks for taking the time to explain this so thoroughly!!!! It was way more complicated than I thought!!!!!

Given the bear market, I’ll obviously need to top off my balances with an asset transfer. Thanks to your detailed post, I now have a really good understanding on the mechanics of the timing. I really appreciate it!!!

Fantastic writeup! I too love Costco – we probably spend the most there out of any store per month – and considered your hoops strategy, but in the end it’s just a bit too risky and complex for me.

* Risky in that if you lose one of those $1000 gift cards, or gift cards of any amount, they’re gone forever.

* Complex in that I’d have to open yet more accounts, plus always be reminding my wife of which card to use where.

Now trying to decide on an everyday card, between Fidelity 2%, Apple Card 2%, Chase Freedom 1.5%, and Chase Sapphire Preferred. Nobody seems to have good things to say about Fidelity’s portal. If anyone has any suggestions for other good everyday cards now that USAA’s 2.5% is going away, let me know ..

* If you lose a physical gift card, the front desk will reissue it.

* However, they’ve recently introduced a digital eGift card, so the chance of loss/theft goes down quite a bit.

That said, the system is a bit of a pain. That said, 5.25% cash back on most purchases is a game changer.

Found you through the Bogleheads thread https://www.bogleheads.org/forum/viewtopic.php?p=7160040#p7160040. Love your write up, and love Costco too. We shop there a ton as well, as it is pretty much our weekly or twice weekly grocery store.

Anyhow, I just got my ME account opened, >$100k retirement transferred, have a checking, and am trying to decide b/w starting with the BofA CCR and a PR, or the BofA CCR and UCR. Both basically achieve the same goal with 2.625% cash back, just that the PR has the benefit for travel, which we don’t do too much at present time. What are your thoughts on the UCR vs. PR card?

We’re up to 6 CCR cards between the two of us, so $15k/quarter of 5.25% space. The vast majority flows through Costco (food, clothing, gas, pharmacy, etc). It took a while to get up to 6 CCR, but I’m glad we’re there.

As far as UCR vs PR, it’s a good question.

I like the PR quite a bit:

* No FTF

* 3.5% on travel + dining (if we don’t use CCR on an expenditure)

* 2.625% on everything else.

The UCR is pretty compelling too. But it does have FTF and doesn’t have the 3.5% category bump.

Historically, buying the $100 of AA e-gift cards and dumping them on Raise.com was pretty slick. Now that this opportunity is apparently closed, I’m going to experiment this year with the $100 United Travel Bank credit, with Doctor of Credit users report works for the $100 credit. Simply put, I don’t fly American, but I do fly United. If you fly either, then the $95/year AF is moot. Plus, the PR card gets you TSA precheck or Global Entry every 4 years, further reducing the effective cost of the card by ~$25/year.

But you can’t go wrong with either. UCR is certainly easier and gets you most of the benefits of PR. But for now, I’m sticking with PR.

There’s also a BoA Premium Rewards Elite card now. For a higher $550 annual fee, it has the same features/cashback as the non-Elite version, but brings the travel incidentals to $300 (i.e. $200 more than non-Elite), adds a $150 “Lifestyle” credit (rideshare, food delivery, streaming services, and fitness), and “Visa Infinite” which includes travel insurance, fancier concierge, Priority Pass for airport lounge access/airport meal discounts, and several other benefits.

For frequent air travelers, the Priority Pass alone might be worth the $105 differential in cost after subtracting the reimbursement benefits [(550-450) -(95-100)]. It’s not uncommon, for example, to be able to get a discount of more than $25 for a meal at an airport restaurant, or > $50 for a traveler and a guest. If you do that twice in a year, you would come out ahead.

If one doesn’t travel by air much, the airports one frequents don’t have any lounges/deals, or they have access to lounges/Priority Pass through some other means, it might not be worth it.

Thanks for the comment. I caught wind of the Elite card a year or so ago when it was unveiled, but I never saw the value proposition for me personally relative to the Premium Rewards card. But if you can use the perks, it seems like a great card to have once you have Platinum Honors status.

You mentioned the ETFs dont cost anything, but MEs site mentions the following:

“Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more about Merrill pricing, visit merrilledge.com/pricing.”

This is roughly 1-3%. Is this something recently added. I am planning to move to your setup as its so much hassle free

Link: https://promotions.bankofamerica.com/preferredrewards/en

Interesting! I must have misspoken. I was under the impression that Merrill had transitioned to free trading alongside the rest of the industry (e.g. Fidelity, Schwab) several years back. I thought ETFs were included in this transition, but I stand corrected…

That said, this Reddit thread contradicts the link you sent: https://www.reddit.com/r/Bogleheads/comments/13wum25/buying_voovti_through_merrill_edge/. Perhaps VTI is one of their $0 commission ETFs?

If not, $0.02 (the average of the range you listed) / $1,000 = 0.002%, or two tenths of a basis point. Not catastrophically high, but still a nuisance.

Personally, I can’t really stand Merrill. I keep the minimum required to get the $100k status. And I don’t transact there. I don’t love that I have to hold assets there to get the elevated CC rewards, but it’s all part of the game I suppose.

Frankly, you only need to maintain the $100k 3-month moving average once per year around your anniversary date (the date you joined preferred rewards, if I’m not mistaken). If your renewal date is Jan 1, for example, you could theoretically transfer $300k on Dec 31, trigger a 3-mo moving average of $100k on Jan 1, then transfer the assets out of ME on Jan 2. But that’s a lot of work with no upside if you simply don’t transact and leave your buy-and-hold assets at ME (or $100k of them).

This is an SEC fee (https://www.investopedia.com/terms/s/secfee.asp). All brokerages are required to charge it, kinda like sales tax. And it’s 0.001-0.003%, not 1-3%!

Good to know. Thanks for sharing!

What are the current BoA partner Customized Cash Rewards cards? Pink ribbon seems still active, but the Tiger and Baseball ones seem to be no longer available. I couldn’t figure out the Eagle to see where it was from?

https://www.reddit.com/r/CreditCards/comments/u09kqq/complete_list_of_boa_cash_rewards_partner_cards/

fyi, I would like it confirmed, raise.com no longer codes as online shopping.

I personally haven’t tried Raise in a bit; I’ve mostly abandoned Raise since it didn’t personally seem worth the hassle to me anymore.

It would be easy to verify yourself, though. Just buy a low-dollar Walmart (or other) GC and see how it codes. You’ll know as soon as the transaction clears.

i spend thousands there, is there another gift card website your now using?

I used to spend a fair amount there (e.g. Walmart / CVS) but I realized it wasn’t worth the hassle once I transitioned our prescription spend to Costco. I’m pretty much out of the GC website game now.

BTW, thanks so much for this site. I was unaware that there were so many variants of the Customized Cash Rewards cards. I added a couple this year and have set things up for my spouse as well. I discovered that my college alumni association has one of the cards! However, the World Wildlife Fund appears to no longer offer one.

You don’t have to be formally affiliated to use affiliate cards. Load up on them.

Great info! Any idea if transactions made via paypal or apple pay to similar stores (say online stores when in the online category) receive the same 5.25% cash back as does using the card directly (CCR). Also does using a virtual card through privacy.com also achieve the same cash back? Thanks

I’ve never used privacy.com, so I can’t help you there.

When I pay via Paypal on online stores, it codes correctly as “online.”

Thanks!

Someone maintains a list of the BoA Customized Cash Rewards card offers out there as a Github Gist:

https://gist.github.com/evantobin/1040d62c8431e0fa7cb66a50fcb9bbc7

Other discussions point to BoA’s 2/3/4 rule: https://www.doctorofcredit.com/httpswww-doctorofcredit-combank-america-312-rule-credit-card-approvals-contribute-data-points/ and their 3/12 or 7/12 rule https://www.doctorofcredit.com/report-bank-of-america-7-12-rule-3-12-rule-for-new-cards/

Thanks!

I stumbled across the github link a month or two ago and added it to the post.

Thanks for the other links. I certainly don’t pretend to know all of the ever-changing rules.

I have enjoyed reading your tips to maximize CC cash backs. I noticed somewhere above you mentioned that you also have a costco visa card which as we know gives 3% back on travel and dining (and 4% on gas). With that in mind, is there still a value for the PR card vs the UCR (which lacks that benefit and has a FTF)? Most sites like yours talk about the PR card but i wonder if that is because the UCR has been around for a shorter period of time and is less known. Would you still get a PR if you were starting off? I may be missing some other value so was wondering. I have a UCR, PR setup but also wondered if i should get a PR card and then request bank of america to change my existing UCR to one of the affiliate cards. Thanks

I think we’re up to 7 CCR cards now, so the 3.5% travel/dining benefit of the PR card is pretty much moot (since we get 5.25% on travel/dining through separate CCR cards).

It does beg the question of why I continue to mess with the PR card if I’m primarily using it for the 2.625% catch-all spending category.

I guess it comes down to the fact that I can utilize the $100 travel credit each year, primarily through United’s Travel Bank. Further, we get the global entry credit every 4 years. Further, there are no FTFs, so it’s nice to bag. I eat out so infrequently that I simply carry the PR card in my wallet so I don’t mind the occasional 3.5% cash back when I dine out.

The wallet is really simple. Basically just the PR card and that’s about it. I carry the Costco Visa card for the sole purpose of getting into Costco, but I could easily transition to the digital version of the card through the app. I also carry a physical Costco cash card but could transition to the digital only version of that.

On the product conversion front, I’m not sure what to tell you. The real power of this setup is multiple CCR cards, as many as you need to cover max total quarterly spend. It takes some time to build up, though.

Hey thanks for the reply. Wow 7 CCRs! Yeah in that case makes sense to use just it. I find it hard to use one CCR for travel as the expense is lumpy and high and one of the airlines we recently booked wouldnt even let me spread the cost over multiple cards. So didnt work.

You mentioned using the costco visa card for getting into costco. You dont need a credit card but just a costco membership card (physical or digital i guess) to get in but i think you mean that since you already have that Citi visa card, you continue to use it as a form of membership identity. It has the close to similar 3% on dining and travel and the waived FTF and so very similar to the PR card. But i see you make good with the travel credit. To me that part is more work to recover the AF and i dont typically fly AA or united or pay airline fees.

Oh and the product conversion is if I got a PR (i presently have a UCR) I would change the existing UCR to a CCR so in effect have two CCRs and one PR. This way i wouldnt have to apply for more than one card this year (given the BOA 2 3 4rule) and i am in the first year of BOA cards and already have two cards. The SUB for the UCR and CCR is the same if i remember.

I acknowledge the problem of lumpy travel spend and the hassle of spreading spending across multiple CCR cards. So far, the hassle has been easily managed. And a sick hobby.

I’ve toyed around with the digital costco card for ID purposes, but it seems so clunky relative to the physical card. But I’m a minimalist and I love the idea of slimming down the wallet by another card. I don’t know that I’ve ever transacted with that card.

If you don’t travel with AA or United, and if you’re already pocketing the Costco Visa for 3% travel/dining, I can see how you would view the PR card as unnecessary relative to the UR card. If I didn’t fly United (or AA), I would have downgraded my PR card to UR already to save the hassle. That said, I think I’ll always maintain global entry, which costs $100 (soon to be $120) every 4 years, so the GE offset equals $25/year (maybe increasing to $30/yr) of the $95 AF. Given that I make full use of the $100 travel credit (via United Travel Bank), it’s a no brainer to keep the card. The hassle factor is almost zero and the upside, albeit small, is still positive.

Thanks! Yes that is the question i am wrestling around, whether it is worth getting a PR in my situation of having the costco visa card. One benefit is the cash back with the PR is sooner (costco/citi deliver it once a year). Not a big deal but a benefit for sure.

Just have to decide whether i should apply for a second CCR or PC my UCR to a CCR and apply for a PR with its higher SUB.

By the way, a nexus application is only $50 and has all the benefits of a GE but it too is going up to $120 in october. This credit card does not cover it though. Strangely very few cards cover nexus even though it has been historically cheaper than either TSA precheck or GE (again that changes this october). The one i know that covers it is the chase sapphire reserve card FYI. Not sure why cards such as the PR dont just group nexus with GE and cover them; or maybe they will going forward!

Have a good memorial day. Thanks for sharing your tips as always.

PC your UCR to CCR + PR with higher SUB probably make sense. I think you’ll enjoy the card, but then you’re stuck figuring out how to use up the $100 travel bonus until you presumably downgrade it to the UCR card in a year (unless you fall in love with the card and decide to keep it).

I don’t love that the Costco card only pays out 1x/year. Kind of dumb.

I’d never heard of nexus before. I certainly don’t travel internationally very often, but when I do it’s really nice to have GE. Coming back from Peru a little less than 2 years ago, GE allowed me to cruise through customs in Atlanta and catch a departing flight that shaved off about 6 hours off of a layover (I had no business catching that connecting flight, but the gate agents let me change flights after running through the airport). Not to mention all the times it has saved me for domestic travel via TSA precheck. I don’t foresee myself letting that lapse. Pretty cheap insurance with a big payoff occasionally.

Another option would be to get one or two CCR cards for my spouse (like u have) though i would first need to open a BOA checking account for them (or add them to my existing one) to get the preferred status. If adding spouse to my existing account or a separate account linked to our ME account (which is how i meet the requirement for PH status), would they immediately get platinum honors given that my account already meets the criteria? Or is it another 3 months wait.

Nexus: lesser known but listed in the trusted traveler program site. Its basically GE plus the ability to use the dedicated lanes when driving too and from canada. Its offered to both countries so the interviews are held at border cities only. If you are near one then great otherwise probably not worth the effort. But yes the TSA precheck makes a difference at airports. I dont fly international much either but seems to be a benefit there too.

I apologize, but I’m not terribly well versed in the nuances of platinum honors (to the extent you’re asking about). Two years back I had a reader do a guest post who seemed to know more about the platinum honors shenanigans than me: https://frugalprofessor.com/slide-app-review/. I think he covered some of those details you’re after in that guest post (check out the “Jeff’s Platinum Honors Footnote” section of the post).

How it works for us is that we share a BoA checking account with zero balance and we share a joint brokerage with $100k of index funds. Pretty simple setup. I like that my spouse has 3 CCR cards to supplement my 4. It seems more lucrative to do that option because you’ll have more flexibility than adding a single more card to your setup (though they aren’t mutually exclusive, of course).