Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Beau Miles spends a night in his gum tree (link).

- I love Beau; always providing a refreshing perspective on our place in the universe. He is a remarkable storyteller and filmmaker.

- His YouTube channel is probably tied for my favorite channel alongside Mediocre Amateur (link).

- If I could only watch content from those two channels for the rest of my life, I’d die a well-entertained man.

- Wholesome Humans of New York stories.

- PBS Frontline episode featuring Atul Gawande which basically summarizes his “Being Mortal” book (link).

- The book (link) and the video are highly recommended for those planning on dying some day (or knowing someone who will die).

- Atul Gawande is an impressive individual. He’s spearheading the joint venture between Amazon, Berskhire, and JPMorgan Chase that was commissioned a year or two back to fix healthcare (link).

- Fabulous Jason Zweig WSJ article on Warren Buffett and the $300k haircut (link).

- I’m not as 1% smart as Buffett, but it appears that he and I have similar thoughts on the forgone compounding as a result of today’s spending: FV = PV*(1+R)^N.

Before he was even a teenager, wrote Ms. Schroeder, his biographer, “Warren began to think about time in a different way. Compounding married the present to the future. If a dollar today was going to be worth 10 some years from now, then in his mind the two were the same.”

By the time he was in his late 20s, the way Mr. Buffett thought about compounding was like a reflex. When he paid $31,500 for his house in Omaha, he called it “Buffett’s Folly,” because “in his mind $31,500 was a million dollars after compounding” into the future, Ms. Schroeder wrote.

His friends and family regularly heard the young Mr. Buffett mutter things like “Do I really want to spend $300,000 for this haircut?” or “I’m not sure I want to blow $500,000 that way” when pondering whether to spend a few bucks. To him, a few dollars spent that day were hundreds of thousands of dollars forgone in the future because they couldn’t compound.

- I’m not as 1% smart as Buffett, but it appears that he and I have similar thoughts on the forgone compounding as a result of today’s spending: FV = PV*(1+R)^N.

- Speaking of Buffett, here’s a few more links:

- MyMoneyBlog on happiness (link).

- Fascinating NYT podcast on the mechanics of the NBA bubble (link).

- Poignant interview with former NBA player Chris Webber on the Buck’s decision to walk out on their scheduled NBA playoff game (link).

Life

- Mrs FP started selling her body for money this month. More precisely, she started selling plasma and gets paid $75/visit to do so, with each visit taking slightly over an hour.

- A few years ago we formally quit sports for the kids; it was just too unmanageable to juggle many kids in sports during the same season. Somehow, our boys (FC3 & FC5) convinced us to reverse course on this decision. FC5 is playing coach-pitch baseball, which is basically glorified t-ball. FC3 is playing flag football. Stepping away from kid sports for years caused me to forget how ludicrous our child-sports-obsessed culture is.

- This is FC3’s first year playing flag football. The same is true for most of his teammates. His first game they played a team of future NFL hall-of-famers. Mercifully FC3’s team scored a miracle touchdown as the final seconds ticked off of the clock. The refs certainly helped by showing mercy to FC3’s team (allowing them to start their drive at mid-field rather than their own end zone and arbitrarily giving them more than 4 downs). The final score was something like 77-7.

- FC3 is 10 years old and I feel slightly guilty for making him wear his sister’s pink hand-me-down cleats, but he luckily hasn’t complained about it once.

- I had to dress up in a suit for the first time in years for a work photo-shoot. It was suffocating; a poignant reminder of why I’m pursuing this alternative lifestyle — to never have to dress like a schmuck again.

- An MBA buddy of mine texted me to share that just crossed $2M in investments by 40. He and I were contrarians during the MBA program, not drinking the general careerism-at-all costs kool-aid (with the closely related cycle of insatiable consumerism). Instead we spent our time discussing investment/tax optimization, lifestyle design, and early retirement. He’s a testament to the the strategy of buying lowly (and brutally tax efficient) index funds and holding them for life.

- Bill Gates quoting Warren Buffet (same article as linked above):

- Of all the things I’ve learned from Warren, the most important thing might be what friendship is all about. As Warren himself put it a few years ago when we spoke with some college students, “You will move in the direction of the people that you associate with. So it’s important to associate with people that are better than yourself. The friends you have will form you as you go through life. Make some good friends, keep them for the rest of your life, but have them be people that you admire as well as like.”

- Bill Gates quoting Warren Buffet (same article as linked above):

- As of today, there have been 225 positive Covid test results on campus since 8/12/20. I remain unsure how this will end…..

- UNC and Notre Dame were hit particularly hard and consequently transitioned from in-person to online teaching. A quick google search tells me that more universities have also followed suit (Temple, etc).

- Apparently the University of Illinois is the most innovative in the country in dealing with the virus, implementing mandatory twice-a-week testing for all students/faculty. Here’s a great article about what they are doing (link).

- The conclusion of the article is that if U Illinois can’t get school to work despite the innovative and costly screening regimens, then universities nationwide are doomed.

- Mrs FP’s bike crapped out so I took it to campus for a $30 repair. On the bike ride home, I was passed by a 60 year old man on a tricked out Walmart scooter! I’ve never been more humiliated in my life!!! I’d like to think that the only reason he passed me was because I’m slower on my wife’s bike than my own….

Are you kidding me!?!?!?! Look at that smirk on his face in the mirror! Not loving being passed by the man, I drafted him for a couple of miles before his battery slowed him down and he (very kindly) allowed me to pass him.

Are you kidding me!?!?!?! Look at that smirk on his face in the mirror! Not loving being passed by the man, I drafted him for a couple of miles before his battery slowed him down and he (very kindly) allowed me to pass him.

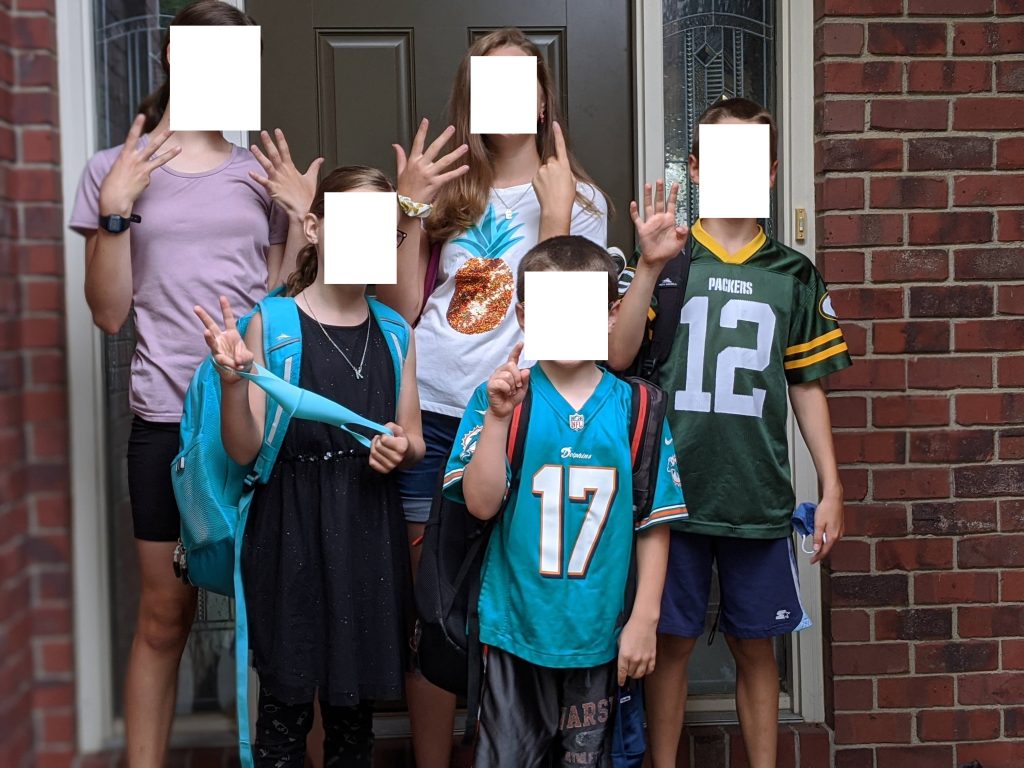

The FC clan on their first day of school: 8th grade, 6th grade, 4th grade, 3rd grade, 1st grade. It seems to be going reasonably well so far….fingers crossed it continues.

The FC clan on their first day of school: 8th grade, 6th grade, 4th grade, 3rd grade, 1st grade. It seems to be going reasonably well so far….fingers crossed it continues.

FC3 with the pink cleats on the right. His team practiced social distancing to perfection while playing defense, never coming within 6 feet of the ball carrier en route to their 77-7 loss. Dr Fauci would have been proud of his team!!!

FC3 with the pink cleats on the right. His team practiced social distancing to perfection while playing defense, never coming within 6 feet of the ball carrier en route to their 77-7 loss. Dr Fauci would have been proud of his team!!!

FC5 is the happiest kid on the planet with his first organized sports experience.

Socially distanced birthday party. Playing JackBox games, which are always a huge hit (link). Each player interacts with the game on their own device. They used the TV pre-dusk and projector post-dusk. We’ve really enjoyed the 120″ spandex projector screen, which we use a few times a year (link). Setup of the screen takes only a minute because the mounting hooks are permanently attached to the garage.

Made me Smile

- The most Michael-Scott-esque video I’ve seen in my life (link).

This Month’s Finances

- The good:

- Still employed…

- The stock market has been on a tear, adding $266k to our portfolio since April 1 (after dropping $197k from Jan 1 to April 1). This is not all good news, of course, given that I’m continuing to purchase highly-priced stocks with every paycheck.

- With returns on a 30Y treasury at 1.43% today (link), which is less than expected inflation (particularly on an after-tax basis after accounting for capital gains + dividend taxes), historical asset pricing conventions regarding equities vs fixed income seem to be in question.

- Given that I hopefully have around a half century of life ahead of me, I’m unambiguously continuing to bet on equities outperforming fixed-income securities over this 5-decade investing horizon. For someone with a shorter investing horizon, perhaps you could rationalize a negative after-tax expected return on fixed income, but locking in a negative after-tax real return for 30Y is a hard pill to swallow when we’re talking about large sums of money.

- I’m sure equity markets will collapse in the future, as they always do, but it still seems like an incredibly simple decision to bet on equities today. Paraphrasing Warren Buffet in his CNBC interview before this year’s Berkshire meeting, a 30Y treasury with a yield of 1.43% today translates to a P/E ratio of 70 (=1/0.0143) on treasuries.

- From that perspective, stocks remain a bargain on a relative P/E basis.

- The bad/abnormal:

- $11,480 to replace two 20-year-old HVAC units. Ouch. Without this expense, we were converging on our arbitrary $45k non-healthcare spending goal this year. I suppose 2021 will have to be the elusive “year of frugality” for our family…..

- $4,320.30 for 2nd half of 2019 property taxes.

- $725 in copays/prescriptions/dentists. We recently hit our deductible, but given the extremely delayed nature of medical billing we’ll likely be paying large bills for the next few months. Given that we’ve hit our deductible, we’re front-loading discretionary medical visits like crazy over the remainder of the year. Going to doctors becomes financially palatable when there is a 80% discount applied!

- $500 deposit for Mrs FP to take kids on Disney cruise in a post-Covid world some day with her mother and sister (I’ll stay home with the dog and my job). The decision for me to stay home from the cruise may have been somewhat influenced with my disdain for all things frivolous and the non-zero chance that I would have complained the whole time, thereby ruining the experience for everyone.

- 11.75% cash back on Disney gift cards (and thus, the vacation) with the following strategy:

- 5% off at BJ’s (link).

- 5.25% BoA CC rewards (online category)

- 1.5% ebates at BJ’s

- Minus $10 online-only BJ’s membership.

- Not a trivial savings on a many-thousand dollar vacation.

- I’ve recently resigned to the fact that the Disney Company is as real of a source of taxation as the Federal, State, and County governments, predictably extracting wealth from me on a regular basis. The last time I was hit with a multi-thousand dollar Disney tax bill was in 2015 (one year before the blog started). Mercifully the “Disney tax” only seems to be imposed about twice a decade, though our newly acquired Disney plus membership is imposed on an annual basis.

- 11.75% cash back on Disney gift cards (and thus, the vacation) with the following strategy:

- $183 in restaurant expenses, the highest we’ve ever spent in this category.

- This includes several $6 smoothies purchased by my children with their own money with their friends after-school. I’ve tried to instill in my kids the Buffett compound interest mentality, but some are more eager to listen than others.

- $67 for the vet to give us 12 ibuprofen for unfrugal dog’s slightly sprained ankle. I suppose I should be happy it wasn’t a many thousand dollar knee surgery…..

Full version is downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads as well as the inability to buy partial shares. With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link).

- I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

I read both Buffet articles yesterday before I read your post about them today.

I’m taking this as an indication that I’m officially turning into you…

Which means I’ll be rich! (Eventually, lol)

We are indeed the same person!

So long as you are spending less than you are earning and investing the difference prudently, you’ll be a multi-millionare. The only question is timing. The bigger you can grow that gap between income and expenses, the quicker you’ll get there.

Congrats again on achieving that milestone, BTW!

That’s an impressive rebate on the Disney trip! For our visit to Disney World in 2019, I purchased gift cards using my Target RedCard for a 5% discount, but I should be stacking a cashback credit card with the BJ’s discount for any future trips. (My in-laws retired to Florida, which makes additional Disney taxation far more likely for us than it would otherwise be.) I’d love to do one of the “Adventures by Disney” trips once we’re traveling again, but the Disney premium there appears to exceed that of the cruises.

Best of luck in avoiding the cost of future Disney Taxes, though it indeed seems you’re doomed given the location of the in-laws.

I’d never heard of “Adventures by Disney” before. I’ll do my best to ensure Mrs FP never finds out about it.

My workplace retirement accounts are also with Fidelity. Have you explored BrokerageLink? It’d be nice to invest in FZROX instead of FSKAX.

I’d never heard of BrokerageLink before. I googled it and it looks good. The Finance Buff has a post on it: https://thefinancebuff.com/best-investment-options-with-fidelity-brokeragelink.html.

Presumably this is an option my employer would have to facilitate? I can’t just sign up for this on my own, right?

Correct, you would see it on the page where you select investment options.

Great update. Thanks for sharing the Beau Miles link. I loved his mother-in-laws question of “can you convince him out of anything?” Classic.

I showed that video to Mrs FP this morning and loved it the second (or third) time through. If you haven’t seen his other videos yet, I’d recommend it. The “mile an hour” video is really good as well. I’m a big fan of kayaking, and he has a great documentary about kayaking in south africa that was pretty incredible.