It is pretty widely known that the HSA is the best savings account in the U.S. because contributions, growth, AND withdrawals are tax-free.

- Contributions are tax free from the following types of taxation:

- Federal

- State (unless you live in CA or NJ)

- Payroll

- Usually 6.2% Social Security + 1.45% Medicare

- Investment growth (dividends + capital gains) is tax-free.

- Withdrawals are also tax free so long as they are used on qualified medical expenses.

- You can read what constitutes a “qualified medical expense” straight form the horse’s mouth at the IRS’s website here: https://www.irs.gov/publications/p502.

- Suffice it to say that the list is pretty comprehensive. It includes most anything you can think of (eyeglasses, teeth, healthcare, etc).

- A few important things to note:

- Future insurance premiums are generally not a “qualified medical expense” for the HSA.

- If you eventually switch out of a HDHP plan, you can still use your old HSA to fund “qualified medical expenses” on any insurance plan (link).

- If you incur medical expenses today, you can pay out of pocket today and reimburse yourself down the road. There is no “expiration date” which prevents you from reimbursing yourself from historical “qualified medical expenses” so long as you save the receipts properly.

- You can read what constitutes a “qualified medical expense” straight form the horse’s mouth at the IRS’s website here: https://www.irs.gov/publications/p502.

So what’s going on with the delayed HSA reimbursement strategy?

Despite my best intentions to spend $0/year on healthcare, my family generally spends about $6k/year on healthcare. Consequently, I have a choice to make every year:

- Raid the HSA piggy bank, or

- Keep the HSA piggy bank in tact by paying out of pocket instead

- This strategy obviously requires sufficient cash flow or liquidity to cover medical expenses from either income or non-HSA accounts.

Option #2 above is what we do. The consequence of paying out of pocket is that our HSA balances grow but our cash flow is hindered, thereby reducing (dollar-for-dollar) the amount of money available for us to invest in taxable brokerage accounts.

The source of the profits from adopting the not-raiding-the-HSA-piggy-bank strategy is that the after-tax returns from investments in a HSA are higher than the after-tax returns from investments in a taxable brokerage account. The source of tax-savings is two-fold:

- Inside the HSA (and all tax-sheltered accounts), there is no dividend tax drag every time a dividend is received. The consequence of the dividend tax drag is a drag on investments equal to one’s marginal tax rate on dividends (15% federal + 7% state in my case) * the dividend yield of your investments (usually about 2%). For my situation the product of these two numbers, 22%*2%=0.44%, is the effective drag on returns due to the taxation of dividends annually.

- The other tax advantage of HSA’s is that there are no capital gains taxes.

I created an excel model to quantify the benefits to the “delayed-HSA-reimbursement” strategy that I utilize. The model is downloadable here (link) and the key assumptions and results are below.

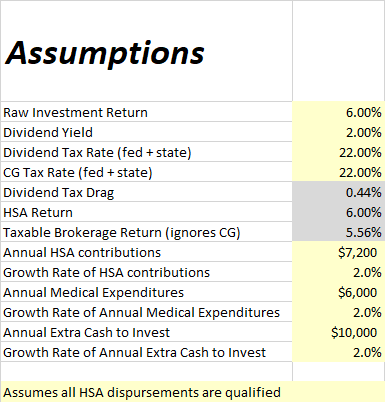

Key assumptions are shown above. I don’t think that there is anything terribly controversial going on. Yellow cells are inputs. Grey cells are calculations. Feel free to play around with the model inputs to whatever you think is more reasonable. The only source of taxation in the taxable brokerage account is the dividend tax drag and an eventual capital gain realization at a terminal date (I don’t model any intermediate capital gains taxation that would results from rebalancing, for example). If your investing horizon is 15Y, you can appropriately take that value from the chart since each time period is independently modeled as be the terminal time horizon. If you believe you will be in the 0% LTCG tax bracket in the future, you can change that input parameter in the sheet (cell C8). This will obviously diminish the benefit of the delayed-HSA-reimbursement strategy.

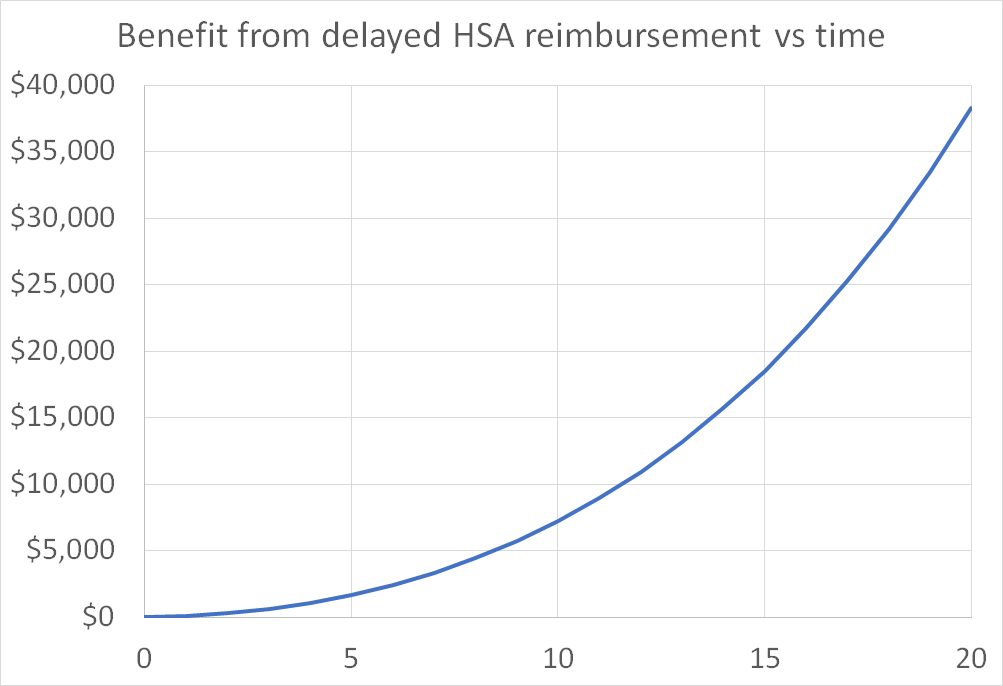

Assuming $6k/year (in today’s dollars) of annual medical expenses, the above chart shows the after-tax benefit of not raiding the HSA piggy bank over time. The x-axis is years. Given the exponential growth of this chart, the strategy is most advantageous for those with long investing horizons (same as any investing strategy with compounded investing growth).

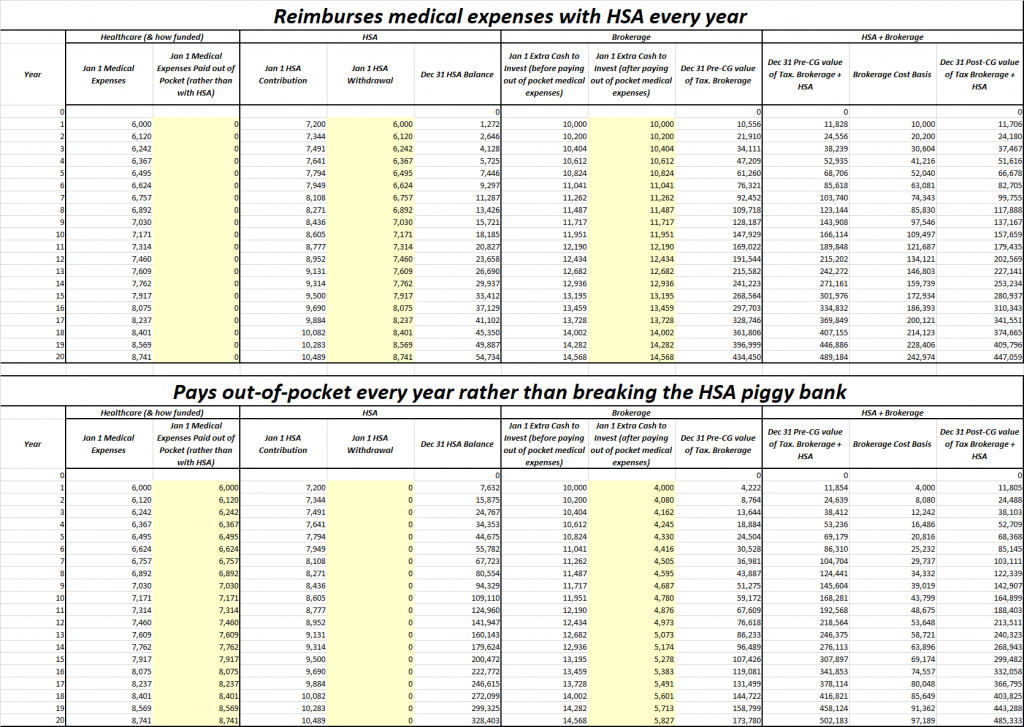

Here’s the formal analysis. Yellow columns in this table show the key differences. The top table raids the HSA piggy bank and pays $0 out of pocket. The bottom table does the opposite (pays out of pocket and leaves the HSA in tact).

The most important parameter in the analysis is (obviously, in hindsight) how much you spend per year on healthcare. The more you spend, the more you benefit from not raiding the HSA piggy bank (assuming, of course, that you have the liquidity/cash flow do to so).

The most important parameter in the analysis is (obviously, in hindsight) how much you spend per year on healthcare. The more you spend, the more you benefit from not raiding the HSA piggy bank (assuming, of course, that you have the liquidity/cash flow do to so).

Potential Risks / Concerns with this Strategy

The main downside to the not-breaking-the-HSA-piggy-bank strategy is that you have to diligently save receipts to satisfy the IRS at some future date in which you reimburse yourself. According to today’s IRS rules, there is no expiration on these receipts. However, this is subject to change (as with any tax law). If the IRS changes the law some day, this would obviously limit the profitability of the deferred reimbursement strategy.

Further, a $500k HSA withdrawal from a HSA in 20Y is likely to result in more scrutiny from the IRS than a series of modest withdrawals. Provided you have your documentation (detailed receipts) in place, this shouldn’t be an issue if you have your ducks in a row. But I don’t anticipate it will be a pleasant experience to go through in the year 2040+.

Another potential concern with this strategy is that one “over-saves” in an HSA. If someone has too much in an HSA (in the sense that their future medical expenses aren’t sufficient to draw the HSA balance to $0), then HSA withdrawals for non-medical expenses would be subject to taxation just like a Traditional 401k in retirement. Given the modest contribution limits to HSA accounts and rate of inflation of medical expenses (including long-term care expenses, which are eligible for HSA reimbursement), I think that it is almost comical to think one can over-save for future medical expenses at $7k/year of contributions (in today’s dollars).

A final problem with the HSA-hoarding strategy is that, unlike an IRA, an inhereted HSA is subject to full taxation if it is passed to a non-spouse heir. Mike Piper has a good blog post on the topic (link). In the post, he explains that qualified medical expenses can be withdrawn tax-free for up to 1 year after the passing of the account owner (and spouse). This implies that it is important to leave a pile of receipts to your heirs to process the tax-free distribution, since anything not distributed would be fully subject to income tax. This is much worse than the treatment of taxable brokerage accounts (and real estate) which has the step-up of cost basis at death.

Conclusion

To be honest, the magnitude of the HSA deferral advantage wasn’t near as big as I thought it’d be. If you want to simplify your life and reduce the hassle from dealing with the IRS decades from now, I don’t think it’s unreasonable to simply reimburse yourself now. Particularly if your medical expenses are modest. Even if you did this, I’d still pay with credit card to get the points/cash back and reimburse yourself from the HSA.

However, if you’re an optimization weirdo and have the liquidity/cash flow, I think it’s prudent to follow the not-raiding-the-HSA-golden-goose strategy. The above analysis concludes (obviously) that it is most advantageous for households with high annual healthcare expenses and those with long investing horizons.

This, alongside other “tax arbitrage” strategies, are likely to make us many hundreds of thousands of dollars wealthier in the future. I refer to the financial gains from tax strategies as generated from “tax alpha” in the sense that results in higher investing gains without incurring any additional investment risk.

Reader Poll

Where do you stand on the delayed-vs-immediate HSA reimbursement debate? Is there anything obvious missing from the analysis?

We have one child who has a miracle medication that costs $900 out of pocket each month until we hit our deductible. We pay out of pocket and save the receipts in case we need the cash in an emergency sometime down the road.

Sorry to hear about the $900/month expense but it seems that it’s better than the alternative. I feel the same way about the $500/month recurring asthma/adhd medication.

I agree entirely that the combination of HSA + receipts would serve as a great emergency fund down the road.

Great post, as usual. In my case, I’m filing single and self-employed (with a somewhat variable, below-actual-middle-class-not-what-Bogleheads-call-middle-class gross income) and therefore paying higher premiums for an HSA plan vs a traditional plan.

Those higher premiums have the potential to offset any benefit to the HSA, so each tax year I have to run the numbers and decide what ACÁ plan I’m going with.

I also have minimal medical expenses each year, so I’m reimbursing as I go to keep things simple.

Like you, every year I do the math to ensure the HSA plan at work continues to make sense. I dedicate several hours per year on this decision (which has huge financial ramifications if I choose poorly).

I’m glad the reimbursing-as-you-go approach is working for you. Given your low expenditures, it seems like a logical choice.

I always contribute the max to my 401-k so for me, I see the HSA as an extra contribution, worst-case. I pay medical expense with after tax money so I can get the extra tax advantaged growth in my HSA, even though it’s not that much. Since I have sufficient extra cash from after tax income to pay for medical expenses, I think it’s a no-brainer.

Glad the strategy is working out for you as well!

I have a HDHP plan but no access to an HSA. Instead, the plan is coupled with an HRA, or Health Reimbursement Account. I automatically get reimbursed for healthcare expenses until the HRA is depleted. It’s not portable and it’s a use it or lose it situation. Basically my deductible == the initial balance of the HRA and my six kids work hard to deplete it every benefit year.

I’ve had an HSA in the past but keeping receipts around for 40 years for the tax benefit, didn’t really seem worth it to me.

That’s really interesting. I’d say that your deductible (which, in my mind, is the portion of the medical expenses that I’m responsible for) “turns on” the moment your HSA is depleted and “turns off” the moment you get some coinsurance benefit (assuming it works that way).

If you need help depleting your HRA, I’m sure my kids would be happy to oblige!

This was really helpful and something I’ve wondered about for a while. While I’m digging out of debt I’ve been raiding my HSA, and I figured I would start paying out of pocket once we’re out from under our student loans but hadn’t fully decided yet. Thanks to a very effective but exorbitantly priced medication we’ll be hitting our out of pocket max every year for the foreseeable future, so it’s a lot out of pocket every year. I’ll definitely take another look at this article when we have to make that decision.

Two questions though- is there any effect on the tax benefits with the payroll tax cut (particularly if they are made permanent like Trump was suggesting he wanted to do)? And also, any concerns that socialized medicine could take away your opportunity to use up your HSA in the future? (I guess that doesn’t matter as much if you save your receipts?)

Good to hear from you Benjamin!

I think you’re doing the right thing – raid the HSA until you are out of student loan debt. After you’re out of debt AND you’re maxing out all other tax-advantaged accounts (IRA, 401k, 529), I think that the HSA deferral strategy makes a lot of sense. Until you’re maxing out all accounts, I don’t think it makes much sense. I should have made that point more clear in the initial article.

With respect to the payroll tax cuts, I’m not quite sure how that will work out. From the little I’ve read, I thought Trump is proposing delaying (not cancelling) the withholding of payroll taxes. But I could be wrong there. With regard to socialized medicine, I suppose this is a concern but there’s two things that help me sleep better: 1.) even with socialized medicine, there will surely be out-of-pocket costs, 2.) I’ll have a pile of receipts to fall back on.

Re: “After you’re out of debt AND you’re maxing out all other tax-advantaged accounts (IRA, 401k, 529), I think that the HSA deferral strategy makes a lot of sense. Until you’re maxing out all accounts, I don’t think it makes much sense.”

Great summary!

As 02nz mentioned in another post, Medicare premiums qualify, and those alone may suffice to drain even a well-funded HSA – let alone the amounts one is likely to spend on medical care beyond the premiums

Thanks for stopping by MDM! It’s always a pleasure to hear from you. I’m glad I didn’t say anything warranting a (kindly delivered) MDM correction this post!

We try to pay all of our medical bills through the “payment portal” provided with our United Healthcare Insurance portal. This has a couple benefits. It helps ensure that we don’t duplicate or overpay (providers tend to bill full allowable amounts and then adjust the amount down as the insurance company slowly “processes” the claim). That usually take approx 2 months, so we’ve learned to delay payment (sorry providers).

The other benefit of the payment portal is that it’s a nice consolidated ledger of payments and receipts – linked to the corresponding claim. At end of year download to Excel or PDF all payments for simplified record keeping. Don’t know if that will be sufficient receipt for IRS in 15 yrs, but that’s all the record keeping I’m organized enough to accomplish.

A drawback to the payment portal is that most payments are executed as EFT from checking account. Providers don’t take CC payment from the portal (fees are probably passed to them).

That “payment portal” sounds like a really nice option. We don’t have that through my insurance company. Consequently, I’m bombarded constantly with EOB’s and doctor’s office bills every other day. It’s really hard to manage and I implicitly assume that the insurance company + Dr’s offices are doing their jobs properly. Despite this, my insurance company was apparently off by $1.5k or so last year and cut me a check for overpaying about 18 months after the fact. Futher, I run into billing inconsistencies all of the time with doctors. It is quite annoying.

I’d gladly trade off 2.625% CC rewards for a simplified payment experience.

Do you have an HSA? If so, are you paying from it?

Yes, we use our HSA as another form of 401k/ IRA (retirement savings bucket). I figure med expenses in retirement will certainly outpace our HSA accumulations and if there’s some form of social reform, accommodations will be made for those that have saved. Unfortunately for us, we are not at risk of over saving.

Incidentally, the payment portal is labeled “InstaMed” but the footer says that it’s provided by Rally Health, Inc. and Optum Bank.

Just as you stated for contributions, investment growth (dividends & capital gains) are not exempt from California income tax.

Thanks for clarifying!

Thanks for the analysis, I’ve done the cash-flow-save-receipt method since I’ve had access to an HSA as well but never did a detailed calculation like this, so it’s nice to see. I find it a fun optimization method. There’s a lucky minority who will have minimal healthcare costs in retirement, but for many (most?) it’s not all that likely that even maxed out HSA savings will outpace medical costs in retirement, so the whole showing-IRS-old-receipts thing is probably not going to be an issue. I keep the receipts anyway, of course, and if nothing else it’s a nice extra emergency fund if there’s some ridiculous disaster requiring 100% liquidity.

I have wondered how scrupulous the IRS is in reviewing old receipts… So far I’ve been keeping paper copies and also scanning everything into Evernote for posterity, as I’ve noticed that even after a year or two some of the flimsier receipts (like cash register receipts from pharmacy purchases) are already quite faded. What’s your strategy for long-term receipt preservation? I wonder if there would be issues with submitting photos of old paper receipts as proof.

I share your thoughts entirely on the completely bogus risk of over-saving. It’s simply a comical scenario to entertain.

With respect to saving receipts, I don’t have it super dialed in yet. Every year my insurance company provides me with a end-of-year summary of every penny of medical expenditures. I also save detailed EOB’s for large expenditures ($500). This, coupled with the corresponding transactions on credit card statements (Bank of America produces a consolidated credit card statement each year that would be perfect for this reason), I’m hoping will suffice. Like you, I’m somewhat concerned about this approach but the previous paragraph seems to imply it’s a non-issue entirely.

Another point in favor of deferred reimbursement from HSA is its treatment by FAFSA, for college financial aid.

HSA balances do not count as assets for federal student aid purposes, and qualified HSA distributions (such as a deferred reimbursement) do not count as income on next year’s FAFSA form. Contrast this, for example with the treatment of a Roth IRA. There, too, the balance does not count for FAFSA; however, qualified early withdrawals for education *are* treated as income on next year’s form.

So, if you like, you can mentally treat the HSA and your old receipts, as an “offshore” educational savings account as well.

Thanks for sharing!

More generally, I wonder if the same logic could be applied to broader “asset protection’ strategies: https://www.bogleheads.org/wiki/Asset_protection

I’m a fan of HDHP, but what do you recommend inregards to knowing about upcoming high health costs. For example, if I am planning on starting a family, could it be advisable to ditch the HDHP the year I expect the birth to happen?

Austin,

I’m of the opinion that HSA’s should be fully funded independent of expected healthcare costs because they are so tax-advantaged (even better than IRAs, etc). Check out this article for more context: https://frugalprofessor.com/hierarchy-of-savings/. Consequently, you should just fill it to the brim every year. However, if you live in CA/NJ, then this advice would not apply to you.

Good luck with starting your family!

HSAs are not tax-advantaged at the state level in CA, but the federal tax benefits still apply and still very much worthwhile.

Thanks for the correction!

“Future insurance premiums are generally not a “qualified medical expense” for the HSA.” The BIG exception to that is Medicare premiums, which can be paid (well, reimbursed) using HSA funds. This m

Great point!

Thanks for this post. I wonder what you’re thoughts on an HSA are for a self-employed person since health insurance premiums can be deducted. To wit, this past year I could have paid ~$20k for zero deductible plan for my family and deducted it all or paid ~$12,500 for an HSA plan with the option of $7,200 in HSA contributions.

This is quite a good riddle!

Are the $20k premiums exempt from payroll taxes? If so, that’s pretty attractive.

What are your typical medical expenses? If zero, I think the HSA option makes sense and you could simply invest the full $7.2k each year. If you expect to incur $7.2k/year in expenses each year, then it’s pretty much a wash between the two options and I’d probably go for the $20k zero deductible plan.

Can I ask how you have access to such good plans? is it through an ACA exchange or a private insurance? How big is your family?