Another month, another update. A few random comments.

Good Reads/Listens/Watches

- I really enjoyed this post from Jonathan at MyMoneyBlog (link).

- The story he linked to at the end of the post was incredible (link).

- I really enjoyed the most recent videos from Beau Miles (link).

- The snow kayaking one was pure joy.

Life

- I visited California and climbed a bit in Vegas.

- I was unfortunately a part of the Southwest Airlines debacle over Christmas. Luckily, I was fortunate enough to be able to rebook on a 6am Southwest flight the next morning (I was among the lucky ones….apparently 95% of outbound flights were cancelled that next day). As compensation for the ordeal, I received ~$300 of flight vouchers. Not too shabby.

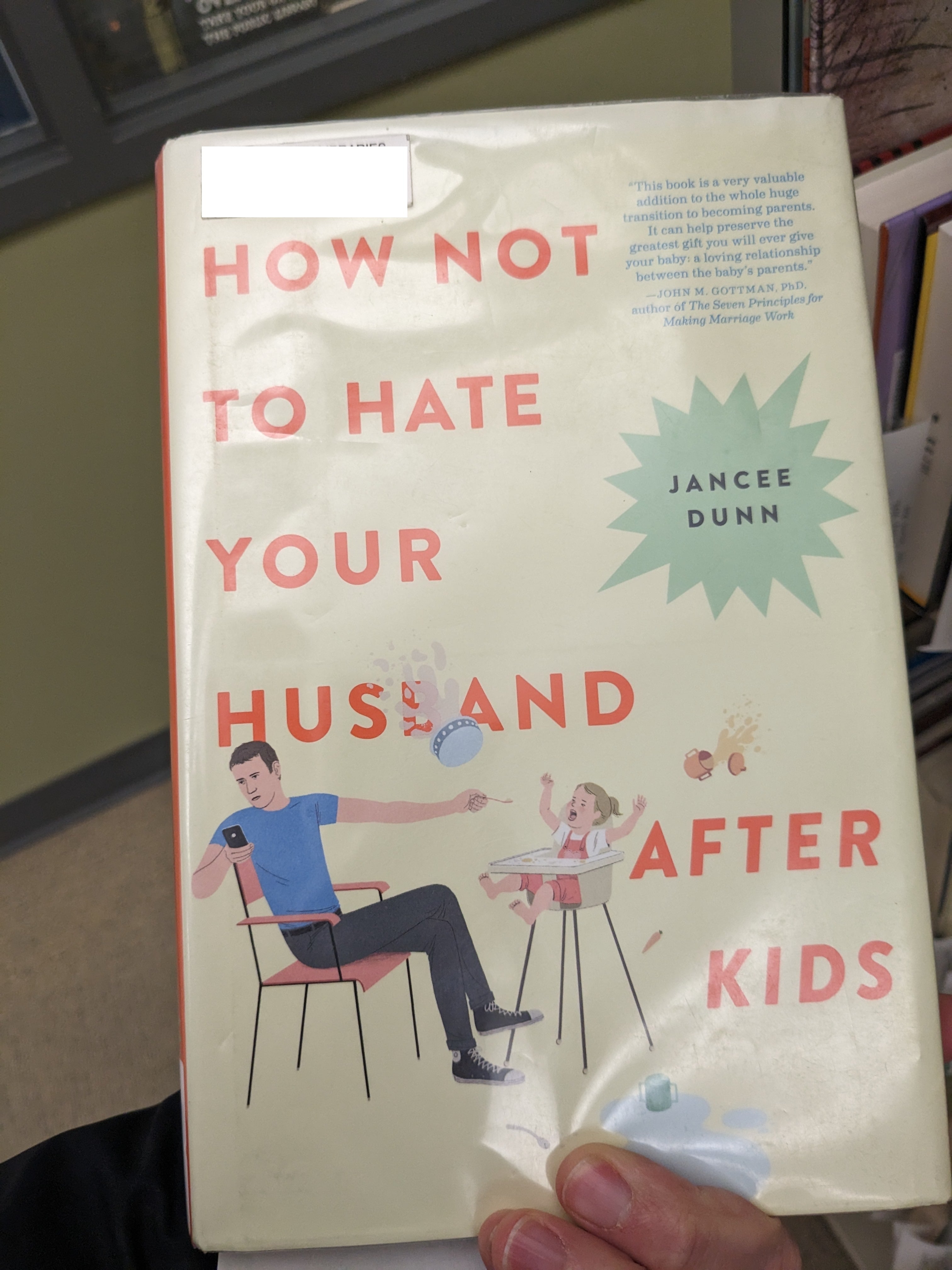

My wife stumbled across this book at the local library. It’ll be the perfect birthday present for her!!! 4.6 stars from 1,500 reviewers!

My brother and I decided to go on a walk from our childhood home without any clear objective. We didn’t bring water or snacks. A couple of hours of later, we were standing on top of Black Mountain in the Santa Cruz mountains. All-in, we hiked/jogged 18.5 miles and got in 3,500 ft of total vert. Luckily we found a water fountain or two along the way.

Fun at the nickelcade.

My father converted me to steel cut oats. I’ll never go back to normal oats. It’s the first time in decades that I haven’t gagged while eating breakfast due to the mushy nature of regular oatmeal.

I saw a rickshaw driving around town. That was a first for me.

Sunrise in the desert.

Pitch 1 of Frogland. We ended up bailing after Pitch 1. We were miserably cold in the early morning shade and the climbing was less protected than we would have liked (at least on pitch 1). Climbing is much harder with frozen fingers and toes.

Back in the sun, happily sport climbing at calico basin.

2022 financial summary

- We spent $81k in 2022 (~200% of the federal poverty level), which is higher than any past year by a decent margin. Inflation was certainly part of the uptick, but we also loosened the purse strings quite a bit this year. Our biggest expenses were ~$5k for a 10-day trip to Maui and ~$2.5k for my 10-day trip to Peru.

- Over 2022, our investments incurred $306k of (mostly unrealized) losses. Ouch.

- Our net worth dropped by $128k.

- I’m content with our current level of spending. We are living abundantly and I remain skeptical that any additional spending would tangibly increase our happiness. We have no grandiose vacation plans this year, so I expect our cost of living to drop by at least $10k-$15k in 2023 to $65k-$70k.

- CC rewards + CC sign-up-bonuses + bank account sign-up bonuses totaled $9k in 2022. The bank bonuses generate 1099’s and are taxable, but all of the credit card stuff was untaxed. I’ll continue to keep my eye out for decent sign-up bonuses in 2023. Otherwise, the BoA ecosystem is continuing to work well for us.

- I’m enjoying the newly added Costco eGift cards as a way of getting 5.25% (+2% executive) cash back there.

- Mrs FP opened up a third cash rewards card in 2022, so that brings our total number of cash rewards cards up to 6 across the two of us.

- For the $100 travel incidental credit on the BoA premium rewards card, I think I’m going to experiment with United’s TravelBank as an alternative to American Airline eGift cards (which I’ve done for the past many years but always sell since I don’t fly American).

- Recent commenters at Doctor Of Credit report success with United’s TravelBank (e.g. link).

This Month’s Finances

- The good:

- Still employed.

- The bad/abnormal:

- $536 initial payment (of $3,355 total) for Invisalign treatments for FC2.

- Christmas shopping drove our “other expenses” category up a bit higher than usual.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/