Another month, another update. A few random comments.

Good Reads/Listens/Watches

- One of the Mediocre Amateur dudes (specifically, this guy) owns a ~$1M helicopter. In this incredible series of videos on their new YouTube channel, they document their recent trip to Canada & Alaska. The footage & storytelling is stunning.

- Part 1, Part 2, Part 3, Part 4, Part 5, Part 6

- One of my favorite parts was when they were flying near Glacier NP when Matt was overcome with remorse for not bringing packrafts with him (here it the relevant clip from Video 1). He called a Missoula outfitter on his cell and asked if they had any packrafts in stock. The retailer confirmed they did, so Matt asked if he could land his helicopter on their property to pick them up. The employee responded that they couldn’t land a helicopter at the business. Undeterred, Matt asked if he could give them his credit card number and have someone deliver the packrafts to the nearby airport.

- It’d be nice to eventually get to the point with money where, when confronted with a problem, I unashamedly ask “What if I give you my credit card number. Would that enable you to solve my problem?”

- I’m not sure I’ll ever get there, but there has been a big spending transformation in my life over the last 10 years. In grad school, I would experience incredible remorse for wasting $9.99+tax on an occasional Costco pizza. Now, I relish the weekly purchase. Our family still can get by with a single pizza if we supplement with a bag of carrots. $10/7=$1.43/person (plus carrots & tax). Not bad.

- It’d be nice to eventually get to the point with money where, when confronted with a problem, I unashamedly ask “What if I give you my credit card number. Would that enable you to solve my problem?”

- I remain amazed at the quality of content available on YouTube.

- Relatedly, Beau Miles walks 56 miles to work (link).

- I love this man.

- Relatedly, Beau Miles walks 56 miles to work (link).

- Last Chance U (link).

- A Netflix documentary that follows the story of a junior college football program each season.

- I binge watched Season 5, which follows Laney College in Oakland, CA.

- The production quality is fantastic. It is as if the Friday Night Lights TV series and Hoop Dreams had a lovechild.

- College Behind Bars (link).

- A Ken Burns documentary about providing college education to prisoners. I’m only one episode in, but I find it to be really interesting.

- Hat tip to the Econtalk episode with Max Kenner, the founder of the program (link).

- A really interesting update from a blogger who FIRE’d and had to adjust (i.e. go back to work) when life threw him curveballs (link).

- Hat tip MyMoneyBlog’s (link).

- I enjoyed Steve Levitt’s interview with Pixar executive Pete Docter (link).

- This has quickly become my favorite podcast.

- Season 3 of All Around Champion just started, which is a family favorite (link or on BYUtv app).

Life

- Mrs FP and I received our first dose of the Pfizer vaccine at the university’s basketball arena.

- Halleluiah.

- It was a pretty cathartic experience to participate in such a well-organized and cohesive effort after such a bitter and polarizing year.

- During our mandatory 15-minute post-injection waiting period, we watched Ohio State lose to Oral Roberts on the jumbotron above center court.

- That busted my bracket; I had OSU winning it.

- I paid $20 to participate in my first climbing competition. It was the most fun I’d had in a long time.

- I initially regretted paying the $20 for the privilege of climbing the same routes that I could do for free the next day. Luckily, I outgrew my remorse. After all, I got a t-shirt.

- I’ve felt similarly every time I’ve participated in a triathlon (3 times?) — why wouldn’t I just swim, bike, and run on public land for free?

- I finished 10th out of 107 competitors.

- Not too bad for a guy that is half dead and competing against people half my age!

- The winner drove 7 hours (one way) to humiliate me. He competed in a different session, so I didn’t see him personally. I’m aware of at least 8 competitors who drove over 7-hours one way to compete.

- His Instagram feed implies that he takes climbing seriously.

- We (basically) had to do 3 roped climbs and two boulders. We got a bonus 20 points for doing a problem our first attempt.

- I’ve since gotten up a 5.12a, 5.12b, 5.12c, and V7 that shut me down during the comp. It was satisfying doing them after the fact, but it came too late (a couple of weeks late).

- Admittedly, many of the best climbers in town don’t compete, like the route setters. There is an 11-year-old girl phenom who lives an hour away who didn’t compete that surely would have creamed me. She tested out the routes ahead of time (called “forerunning”), and got up the hardest route in the competition with ease.

- I got up my first 5.12d (on top rope) this past week after working it for a week or two. It made me happy.

- I initially regretted paying the $20 for the privilege of climbing the same routes that I could do for free the next day. Luckily, I outgrew my remorse. After all, I got a t-shirt.

- I was guilted into coaching 6-7 year old flag football.

- About a week before the first game, I’d received repeated emails from the league indicating that the team couldn’t function without a coach, so Mrs FP signed me up.

- Luckily, we scored a few touchdowns in our first game. It was really fun.

- I decided to go for it on 4th and 15 from our own 10 yard line, not being entirely familiar with the rules. I incorrectly assumed that a turnover on downs would result in a change in possession at midfield or so. Luckily, FC5 scored a miracle touchdown on the play.

- I loathe yardwork.

- We kill every plant we touch. Our landscaping is slowly turning browner and browner, except for the weeds which are turning greener and greener.

Mrs FP and I about to get shot while Ohio State was missing theirs.

The morning of the climbing competition, my wife sent me this GIF as her way of wishing me good luck. I interpreted the GIF too literally.

The morning of the climbing competition, my wife sent me this GIF as her way of wishing me good luck. I interpreted the GIF too literally.

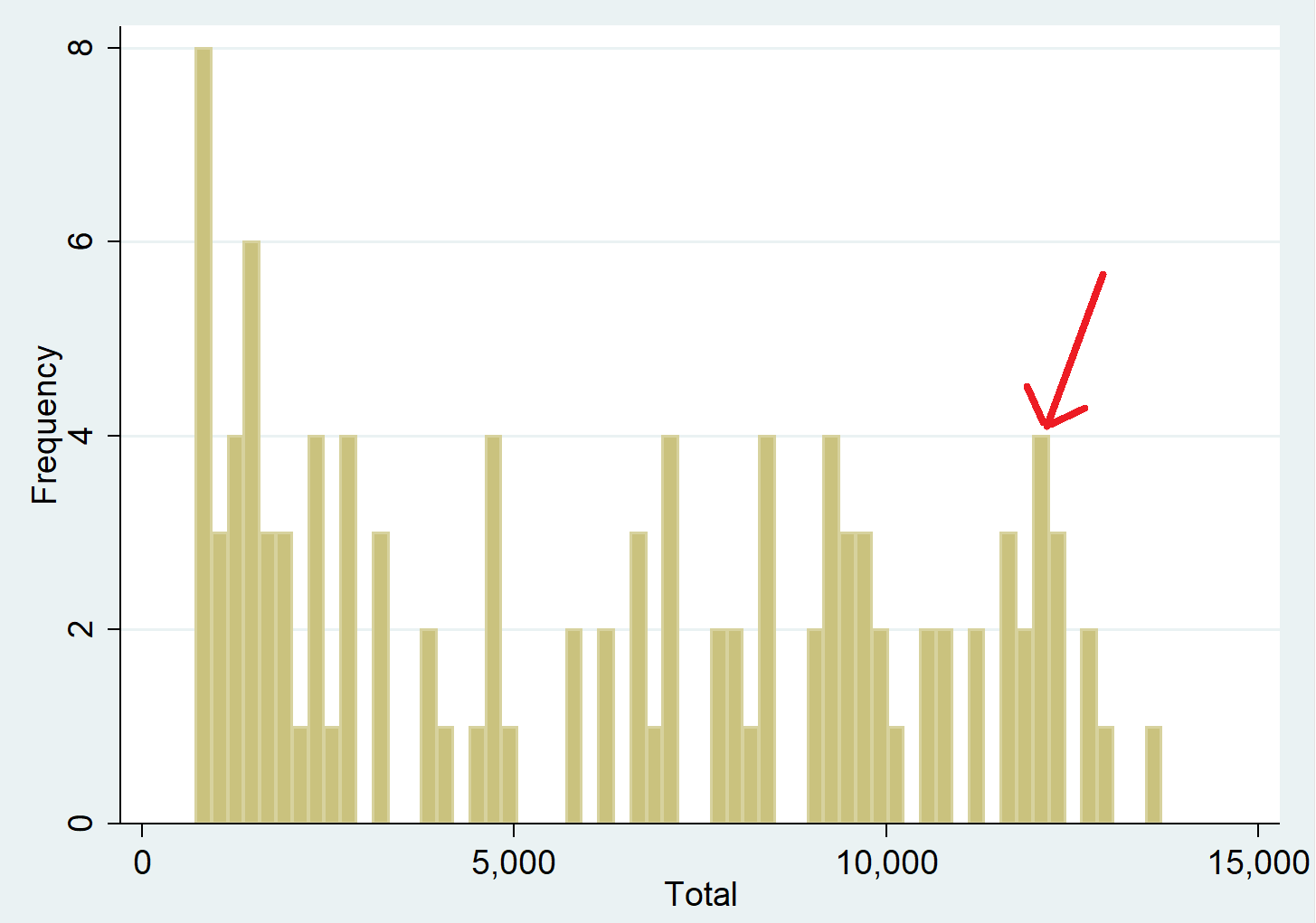

Distribution of climbing scores. Yes, I am a nerd who took a couple of minutes to plot the scores in Stata. I’m in the highlighted group, a sizable distance behind the winner.

The miracle 4th and 15 botched coaching call. Coating FC5’s flags in bacon grease before the game really payed off. We only have one play and simply hand it off to a different person each time. Urban Myer, look out.

FC4, the merperson connoisseur, decided she wants to learn to style hair. FC2 told her about “training” mannequins. I arrived from work to see the above in my internet browser. FC5, who shares a room with FC4, was absolutely horrified of the prospect of one of these heads staring at him while he sleeps. Fortunately, FC4 lost interest in the purchase before pulling the trigger.

Speaking of incredible YouTube channels, mine recently surpassed 100 subscribers thanks to sheep dogs gone viral. They sent me an email with animated confetti so I could celebrate, similar to how Robinhood encourages its users to lose money day trading. Coincidentally, I read yesterday that Robinhood will stop doing that (WSJ article). What a shame…

This Month’s Finances

- The good:

- Still employed.

- Continued to fill the tax-advantaged buckets.

- The bad/abnormal:

- A few more bucks than normal on gas for the FC clan to visit my in-laws while I stayed home working.

- A few irregular purchases (trampoline + airline ticket).

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Curious if you had any side effects from the vaccine? Any regrets of receiving it?

Minor pain in the shoulder for a day, but no worse than a flu shot. I hear that the second dose is the one with much more severe side effects.

My friend got dizzy, fainted, concussed himself, and had to go to the ER to get checked out. I’m budgeting a day to be laid out horizontal.

Now that I think about it, I do feel a sudden and irrational desire to purchase Microsoft products (upgrading my perfectly functioning 2010 version of MS office with a perpetual license). Perhaps the Bill Gates microchip conspiracy theory isn’t a conspiracy after all…..?

Nice work crushing the climbing scene. Have you lined out your trad rack for a trip to the Winds yet? You should. Still cold up here in the Greatland. Looking forward to some spring glacier skiing. Long live winter!

Not sure about crushing the climbing scene, but I sure have enjoyed it.

I SHOULD bring the trad rack to the winds, but for now I’m keeping it simple with simple trips (red river gorge, SLC, etc). Maybe one day I’ll convince my buddy to do the winds.

Mt Hooker would be incredible to tick off some day: https://www.youtube.com/watch?v=sjABtlveDqc

Happy spring skiing up North!!!! One of these days I need to take a trip up there!

None at all from the first Moderna vaccine. Slight pain in the arm and minor fever on 2nd day after the second vaccine.

All in all uneventful! No regrets!

Great news!

I notice that frequently your fed taxes are 0. Do you claim “exempt status” and make estimated payments? Is there a blog post that talk about this. Thank you.

I front-load my retirement accounts, so my take-home pay is small for the first many paychecks of the year. I simply settle up at the end of the year with larger than normal withholdings in December.

I’m finding that piano lessons, tennis lessons, summer camps, etc. cost a lot of money. I only have one kid. How do you solve this?

We hire a friend from church to give short lessons to the kids. They are cheap. Our kids are getting pretty good. Not Mozart, but good enough to play a few songs.

With summer camps, we choose them selectively. Usually the cheapo ones through the city or YMCA. Once you go fancy, it certainly adds up.

Suffice it to say that our kids aren’t sports or music superstars. They are following in their parents’ well-trodden footsteps of mediocrity.

Here is a great link for an easy, well laid out lawn care guide telling you exactly what to do/buy and where to get it cheapest. (created by someone much more intelligent than I on the subject) I started doing this 2 years ago and it has worked great. It is for the Midwest. In addition, it is broken into 3 Tiers :

1) I just want something green

2) The lawn of TV ads or

3) The Wrigley Field.

https://thelawnforum.com/viewtopic.php?f=9&t=1595

Thanks so much for sharing!!!!!! We need all of the help we can get!

Your monthly updates have cemented my desire to avoid getting a pet. Thanks to you and Unfrugal Dog for the advice.

Goldfish make good pets. Short life spans. A couple bucks of fish food and you’re good to go for life. Easy disposal down the toilet when their time comes.

Dogs are a different story. As I left for work this morning, I found that unfrugal dog had gotten FC5’s football cleat out of my coaches bag and broken a shoelace. Luckily the shoe is salvageable, but there have been other times where we’ve had to throw shoes away.

Suffice it to say, the cost of dog ownership is sufficiently lower than what I formally track on the blog since these incidentals (replacement shoelaces) are buried in the disaster of our financial spending.

I wonder if the blog has deterred others from having kids due to the same reason. If not for them, I’d be living in a van down by the river.

Unfrugal Dog deepens my desire to not have a dog. Or any pet really. For Christmas, my oldest(18yr) bought a beta fish for our youngest(8yr) as a gift and that’s about the limit. I constantly have to remind her to feed her fish, and we must be starving it, because it practically jumps out of the bowl each time someone walks by. But it’s made it nearly three months, so it’s probably doing okay. As a funny side-note, it’s the fourth fish (we call it “July” as in “July the fourth”) we’ve gone through since Christmas. The first three all died within a week and within the two-week guarantee from the pet store.

Unfrugal dog also deepens my desire to not own a pet. It’s a shame that our kids love the thing so much!

When Mrs FP taught elementary school early in our marriage, she had a beta fish for a class pet. It lived a year. I think our kids owned one a decade ago and it lived 2 years. That would have been a cheaper pet.

“…as well as the inability to buy partial shares”

Fidelity allows this now, but I still prefer mutual funds.

Thanks. I’d heard that news but forgot to update the footer of my posts. I’ll fix that now.

Thank you about your friend’s experiences note on the Covid vaccine side-effects. So they are real, I thought just rumors.

Not sure how common those side effects are, but it definitely could have gone better for my friend.

sometimes I’m overcome by the humblebrags

Lucky for you, I have a 100% satisfaction policy on this blog! Not satisfied with what you’ve read? You’ll receive a credit for what you paid on your credit card in 2-3 days.

Ignore the haters. The updates are amazing and we want to hear about your wins as well as the bumps in the road.

Great play call Coach! What a speedster. Speaking of football, Last Chance U was great, particularly this last season at Laney College (I live in the Bay Area–tons of awesome scenics).

I grew up in CA and also loved the Oakland scenes. I thought the show was fascinating. Glad you liked it too.

I am curious about your asset allocation glide path through your accumulation years. Currently it looks like you are 100% stock. Is it because of the low yield for bond? I am about at the same stage at yours, and am thinking to add bond to cover about 10 years of expenses before adding more stock. I’d be interested in hearing your thoughts on this.

Real after-tax bond yields are negative. I don’t like to invest in assets with negative after-tax real yields.

I’m about half dead. Perhaps I have another 50 years of life left. I’m betting on stocks vs bonds over that horizon. Particularly with bond yields as is.

BigERN has written a dissertation on this type of stuff. He concludes that 100% stocks while working is reasonable, then drop to 50% stocks at retirement to avoid sequence of returns risk. Then, gradually increase equity exposure over time. https://earlyretirementnow.com/safe-withdrawal-rate-series/

Congrats on getting the 1st dose of the vaccine! I did too! Also congrats on getting that sweet t-shirt from your climbing competition! I’m happy as well to hear you broke 100 YouTube subscribers! Pretty cool. As far as your bracket, no one could have predicted that Oral Roberts upset. Finally, you cracked me up buying MoviePass just to prove a point haha. Great March recap!

Your comment was sent to spam. Sorry for the delayed response.

Yup, I pretty much live for free t-shirts. I had an accounting professor — also a connoisseur of free t-shirts — during my MBA who was a hilarious individual. He claimed the person who invented “free pants” (e.g. promotionally branded pants) would be a multi-billionaire.