Intro

Well, thanks to the $1.9B Coronavirus stimulus bill (#3), there are some pretty major changes to the tax code this year:

- Child tax credit (temporary changes for 2021 only):

- Fully refundable this year

- Phases out at 5% above $150k of income for MFJ, $112.5 for HoH

- $3,600/kid for ages 0-6

- $3,000/kid for ages 7-17

- For those with high enough incomes, it reverts to the same $2k/kid credit with 5% phaseout at $200k for HoH and $400k for MFJ

- EITC

- Tiny change for childless households

- Investment income threshold was increased from $3,650 to $10k!

- With a 2% dividend yield, this implies that one could qualify for the EITC with $500k of taxable investment balances.

Download the Model Here

========> Download Here <=============

Model details

Stuff my spreadsheet handles (or attempts to):

- Single, Head of Household (new this year!), Married

- Standard vs Itemized deductions (including $10k SALT cap)

- Investment Taxes

- Kids (young & old)

- CTC

- ETIC

- Deductible trad IRA’s

- Effective marginal tax rates for $1 extra labor income

- Child and dependent care tax credit

Stuff my spreadsheet does not attempt to calculate:

- AMT (because Trump essentially removed it for most people)

- I used to calculate this, but I decided to ditch it this year to simplify the spreadsheet given that AMT is practically dead.

- Phase-out of Trad IRA deductibility

- If you’re in this boat, simply enter the deductible portion in my sheet

- Further, a non-deductible IRA contribution should obviously converted to Roth (a-la backdoor Roth)

- Stimulus recovery rebates

How to Use Model:

- Plug in input parameters in yellow.

- Then, compute your taxable income on your own. If you made $100k gross but contributed $19.5k to a Trad 401k, paid $12k in healthcare premiums, and contributed $7,200 to an HSA, then your taxable income is $61,300 (=100k-19.5k-12k-7.2k).

- Look up your taxable income in the table/chart to see your tax liability.

- Your 2021 tax refund = 2021 withholdings – 2021 tax liability.

- I don’t compute your tax refund. Rather, I compute your tax liability.

- People conflate the two. Big refunds aren’t necessarily good. They simply mean you withheld too much.

- Want a big refund? Withhold 100% of your paycheck as federal & state tax withholdings. In April of 2021, you’ll get your income – tax liability returned to you in the form of a massive tax refund….the largest of your life.

- Your 2021 tax refund = 2021 withholdings – 2021 tax liability.

Screenshots:

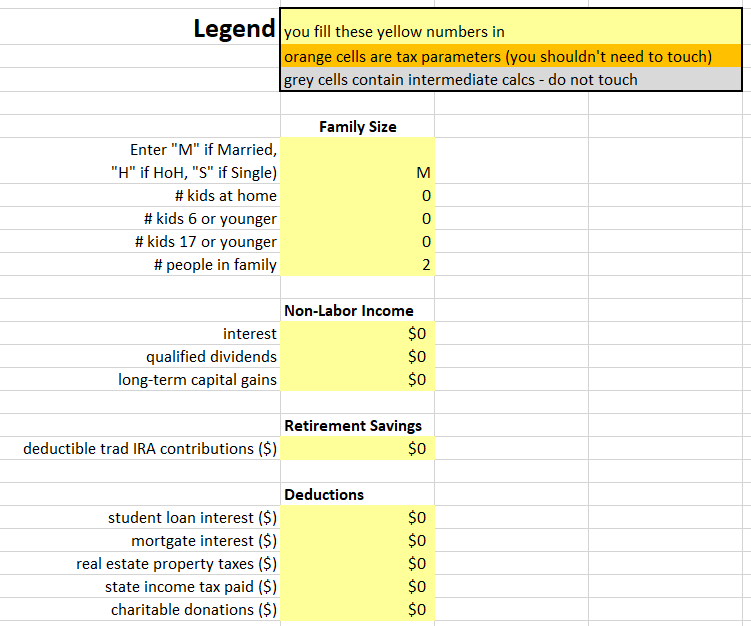

Inputs are pretty simple, as always. Just put stuff in the yellow cells.

Inputs are pretty simple, as always. Just put stuff in the yellow cells.

The output table looks like this. Your welcome to expand the collapsed cells to dig into the underlying calculations.

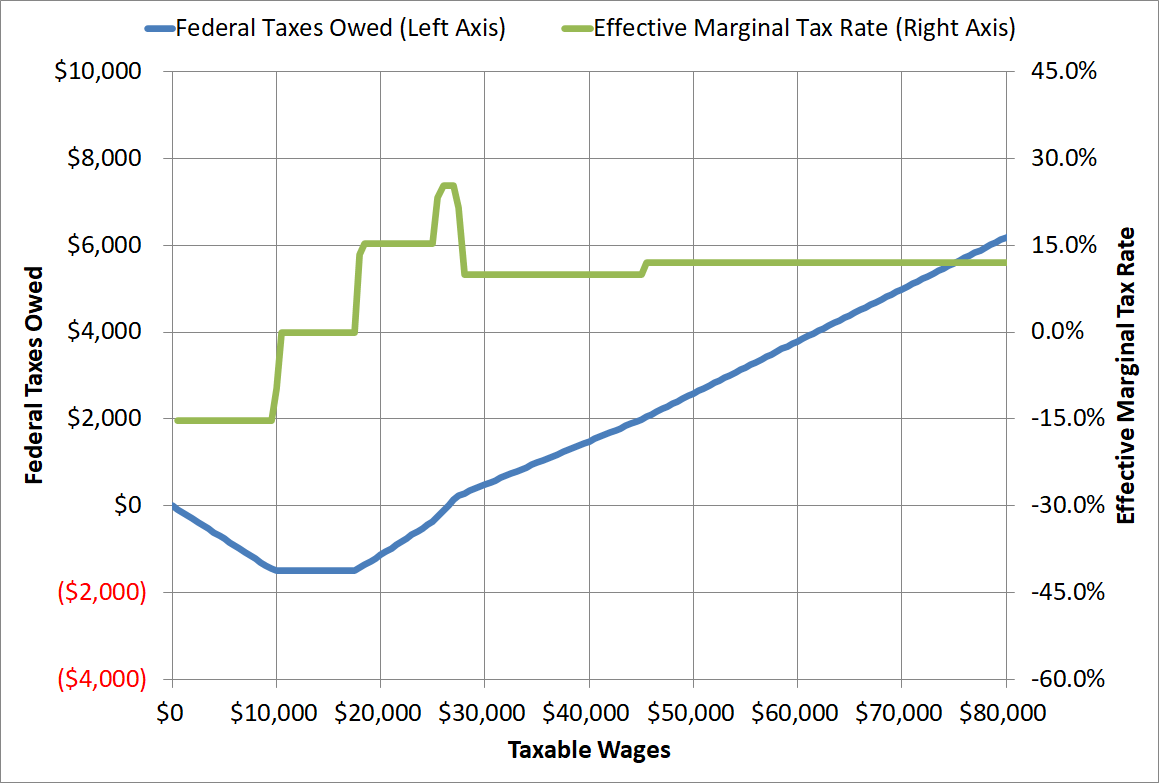

Here’s how taxes look for a MFJ household with zero kids.

Here’s how taxes look for a MJF family with 5 kids. At $15k of taxable income (after 401k’s, HSA’s, etc), they get a refund of $21.728 for a net income of $36,728 (before accounting for food stamps, Medicaid, etc). Not too shabby! The downside of the phase-out of free money is high marginal rates. This household faces marginal federal tax rates of 33.1% as they slide down the EITC ramp and simultaneously enter the 10% federal bracket after exhausting the standard deduction. If I had 5 kids and had a gross income of $60k, I’d shelter as much income as possible to avoid the 33.1% effective rate. Ideally I’d get down to $25.5k of taxable income through utilization of HSA/401k/401a/403b/457. Until you do the math, you’d never realize that moderate income people face higher effective tax rates than the wealthiest people in America. Also noteworthy is the $15k refund for $0 of labor income, thanks to the $3k/kid fully refundable CTC.

Here’s how taxes look for a MJF family with 5 kids. At $15k of taxable income (after 401k’s, HSA’s, etc), they get a refund of $21.728 for a net income of $36,728 (before accounting for food stamps, Medicaid, etc). Not too shabby! The downside of the phase-out of free money is high marginal rates. This household faces marginal federal tax rates of 33.1% as they slide down the EITC ramp and simultaneously enter the 10% federal bracket after exhausting the standard deduction. If I had 5 kids and had a gross income of $60k, I’d shelter as much income as possible to avoid the 33.1% effective rate. Ideally I’d get down to $25.5k of taxable income through utilization of HSA/401k/401a/403b/457. Until you do the math, you’d never realize that moderate income people face higher effective tax rates than the wealthiest people in America. Also noteworthy is the $15k refund for $0 of labor income, thanks to the $3k/kid fully refundable CTC.

Here’s that same chart as above (MFJ with 5 kids), but now with an expanded X-axis. As shown, the effective MTR of 37% for MFJ households with taxable incomes of $400k finally (meaningfully) exceeds that of households making ~$26k-$57k of taxable income for the first time. This is the downside of phase outs of needs based aid (ETIC). From my perspective, a more sensible tax policy would be accomplished in the following manner: 1.) coordination of phase-out rates and levels across programs (ETIC, CTC, food stamps, ACA subsidies, etc.), 2.) limit combined phase-out of collective benefits (10%?). Such a policy would avoid the wild and nonsensical gyrations of effective marginal tax rate (the green line) shown above. Such a policy would remove the current weird distortions on the low/middle end of the income distribution (e.g. http://gregmankiw.blogspot.com/2009/11/poverty-trap.html)

Here’s that same chart as above (MFJ with 5 kids), but now with an expanded X-axis. As shown, the effective MTR of 37% for MFJ households with taxable incomes of $400k finally (meaningfully) exceeds that of households making ~$26k-$57k of taxable income for the first time. This is the downside of phase outs of needs based aid (ETIC). From my perspective, a more sensible tax policy would be accomplished in the following manner: 1.) coordination of phase-out rates and levels across programs (ETIC, CTC, food stamps, ACA subsidies, etc.), 2.) limit combined phase-out of collective benefits (10%?). Such a policy would avoid the wild and nonsensical gyrations of effective marginal tax rate (the green line) shown above. Such a policy would remove the current weird distortions on the low/middle end of the income distribution (e.g. http://gregmankiw.blogspot.com/2009/11/poverty-trap.html)

Errors?

If you find any bugs, please report them and I’ll update the sheet.

Conclusion

You should know what your effective marginal tax rate is.

It’s the most important number in the tax code, but practically impossible to observe. That’s a bit of a paradox, eh?

Tax tables won’t give you the full picture because they fail to consider phase-in’s and phase-outs of the multitude of tax credits available to you. Tools like TaxCaster will spit out a tax liability, but not the effective marginal tax rate. You need to compute that on your own.

The reason I built this sheet and maintain it every year is to help convey to people how easy to control (and compute) your tax liability. It’s not black magic, like I thought for the first two decades of my life. It’s just simple math.

If you use my sheet and find out that you’re facing a 33.1% effective marginal tax rate at $50k of household income, then contributing an extra $10k to a 401k will save you $3,310 of federal taxes (and even more when you consider state income taxes). This becomes more powerful as you max out HSA/401k/401a/403b/457 plans. I max out everything I can each year, saving me tens of thousands of dollars in taxes each year.

After realizing that $1 of 401k contributions only cost you $0.669 of net cash flow (even less if you consider state income taxes), you soon realize this is financial alchemy. Particularly when you realize that these pre-tax vehicles can be withdrawn tax-free under certain scenarios (e.g. https://frugalprofessor.com/hierarchy-of-dissavings/).

Disclaimer

You’d have to be crazy to take tax advice from an internet stranger. My spreadsheet probably has a bunch of errors, so don’t take it very seriously.

However, if you want to think about 2021 taxes (due April 2022), then you frankly don’t have too many choices at this point. MDM has posted his sheet here if you want to compare. His model has a lot more bells and whistles.

TurboTax will update their calculator (TaxCaster) around October of 2021. FreeTaxUSA will offer their full (and free and excellent) tax software around November of 2021.

Looking forward to checking this out. The Child and Dependent Care credit is also a huge change for people with child care expenses. For example, consider a family with two kids in daycare, $16k+ expenses, and AGI <$125k. The fully refundable credit has increased from $1,200 all the way up to $8,000.

I’ve never bothered to model the Child and Dependent Care credit before, mainly because I’m ignorant of how it works and it has never impacted us. It’s my understanding that we’re not eligible since we don’t do child care (e.g. we can’t use this for summer camps, etc?).

I should probably incorporate it into the sheet? If so, do you have a cliff-notes version of what to model?

The expansion of the EITC investment income threshold to $10k/year is also a big deal.

I’d also be interested in seeing the dependent care credit modelled for 2021…I believe summer camp costs for kids under 13 do qualify!

Kitces has the details here: https://www.kitces.com/blog/the-american-rescue-plan-act-of-2021-tax-credits-stimulus-checks-and-more-that-advisors-need-to-know/. Cliff notes are that the expense cap is $8k for 1 child, $16k for 2+ children, with the credit amount falling linearly from 50% of the expense (<$125k AGI) to 20% ($185k AGI); the credit amount is flat at 20% for $185k through $400k of AGI; and then the credit falls linearly to 0% for AGIs between $400k and $440k.

^^ What Ira said. Thanks for adding it to your spreadsheet, or at least thinking about it!

Thanks Ira and Ken!

Mrs FP is now a substitute teacher. When I looked into this in the past I thought the credit wouldn’t work because she’s part-time. Over the summer she wouldn’t work and therefore couldn’t use a summer camp as justification for claiming the credit.

I haven’t looked into this for years, so your comments have inspired me to check again.

Regardless, I’ll incorporate the changes into an updated version of the spreadsheet soon (less than a week)….

Is Mrs FP looking for work? Can she work one hour during a day (maybe by doing some gig work)? That would qualify under the letter of the law. https://www.irs.gov/publications/p503

“Part-time work. If you work part-time, you must generally figure your expenses for each day. However, if you have to pay for care weekly, monthly, or in another way that includes both days worked and days not worked, you can figure your credit including the expenses you paid for days you didn’t work. Any day when you work at least 1 hour is a day of work.”

Thanks for the response! I’ll definitely look into this!

@IRA and @Ken, I updated the model to reflect the dependent care tax credit.

Thanks for adding HofH!

No prob!

Child & Dependent Care Credit (and/or FSA for care) is also available to your family if Mrs. FP decides to become a student again and/or if (heaven forbid!) she becomes disabled and mentally or physically incapable of self-care.

Thanks for the input!!!!!

Hello,

Where can I find a link to your calculators?

https://www.dropbox.com/s/mbyhneq50gjolt3/2021%20federal%20tax%20calculator%20PUBLIC.xlsx?dl=1

I updated the text of the post to make it easier to find.

Thank you

Hello: this is slightly confusing to me (a retiree) since it is not clear which “model” includes SS. Plz provide a “link” used to download a tax calculator for retiree with income from: SS, pension, investments. Thanx.

Bewildered Bob

Bewildered Bob,

Taxation of Social Security bewilders me, so I don’t handle it specifically in my sheet. I’m sure MDM does it in his spreadsheet that I linked to above.

That said, the 2021 tax law changes only marginally effect you (assuming you don’t have young kids). It mostly impacts those with young kids due to the big increases in the CTC.

Consequently, you’d be almost just as well off using a calculator like 2020’s TaxCaster (https://turbotax.intuit.com/tax-tools/calculators/taxcaster/), which handle’s Soc Sec / Pension income in the “other income” category. Or you could do scenario analysis in FreeTaxUSA if you want a more sophisticated tool.

Hi FP, your tax calculator is great and something I look forward to each year. Comparing it with the IRS’s withholding estimator, I was curious what the differences were and theirs has not updated the Child Tax Credit for 2021 yet so they’re overestimating the tax liability for parents with kids.

A minor change to your sheet:, B16 should be # kids 5 or younger and B17 should probably be labeled # kids 6-17 otherwise someone might double count their kids 5 or under (like I did at first)

Thanks for the suggested edits! I should have caught that sooner. I’ve changed the sheet accordingly.

It’s insane to me that we don’t have better tax planning tools.

Maybe I’m confused (entirely likely) but for your example of 100k income with 12.5k in healthcare premiums you show subtracting 12.5k from the 100k to get to taxable income. I thought HC premiums are only deductible if more than 7.5% of income… so doesn’t that mean you only can subtract 5K not 12.5k?

Health insurance premiums for a normal W2 employee reduce taxable income dollar for dollar. There is no need to deduct anything. The taxable income reported on your W2 at the end of the year will have already netted out the payroll deductions for health insurance.

What you are thinking of are healthcare expenses (the stuff other than the premiums).