——————————————————–

Brief intro from Frugal Professor

——————————————————–

One of the best parts about having a blog is getting to meet smart people I wouldn’t have already met. A week ago, one of these smart people reached out to me via email to discuss credit card strategies. I enjoyed the discussion so much that I asked him to synthesize the information into a blog post. Fortunately, he obliged.

Blog reader Jeff is the Chief Systems Engineer at his company. Suffice it to say, he likes to optimize systems, which also carries over into his personal life as well. Sounds eerily familiar…

Without further ado, below is Jeff’s experience with the Slide app.

——————————————————–

Jeff’s Slide App Review

——————————————————–

The following article contains affiliate links. You’ll receive the same benefits mentioned, while Jeff gets a small commission.

A number of years ago, I came across the Frugal Professor when he wrote about his credit card strategy. For reference, here’s a link to all the articles Frugal Professor has written on the BoA credit card strategy.

- https://frugalprofessor.com/best-credit-card-rewards-strategy-2019-edition/

- https://frugalprofessor.com/boa-raise-cash-back-big-savings/

- https://frugalprofessor.com/another-boa-efficiency-post/

- https://frugalprofessor.com/an-audit-of-boa-credit-card-reward-efficiency-2019-q3/

- https://frugalprofessor.com/one-month-review-of-updated-boa-cash-rewards-card/

- https://frugalprofessor.com/best-credit-card-rewards-strategy-2018-edition/

If you’re unfamiliar with the strategy he uses, it involves establishing Platinum Honors status by transferring $100k to Merrill Edge to qualify for a 75% bump in BoA credit card rewards. This transforms the BoA Cash Rewards card from earning 3% on Online purchases to earning 5.25% on those same purchases. Although the 3% can be earned on a variety of categories, Frugal Professor points out that the Online Category is the best. Refer to his 2019 edition for details. Where this gets really interesting is when he discusses purchasing gift cards at Raise.com when shopping through a cashback portal like Rakuten. See his BoA + Raise article for details.

Raise introduced a new app called Slide which can potentially extend on Frugal Professor’s credit card strategy. The Slide app allows you to get 4% Cash Back on 300+ stores. 4% isn’t bad, but the Frugal Professor already showed how he gets an additional 4.5% using Raise to buy CVS gift cards, so why would he have asked me to write this article?

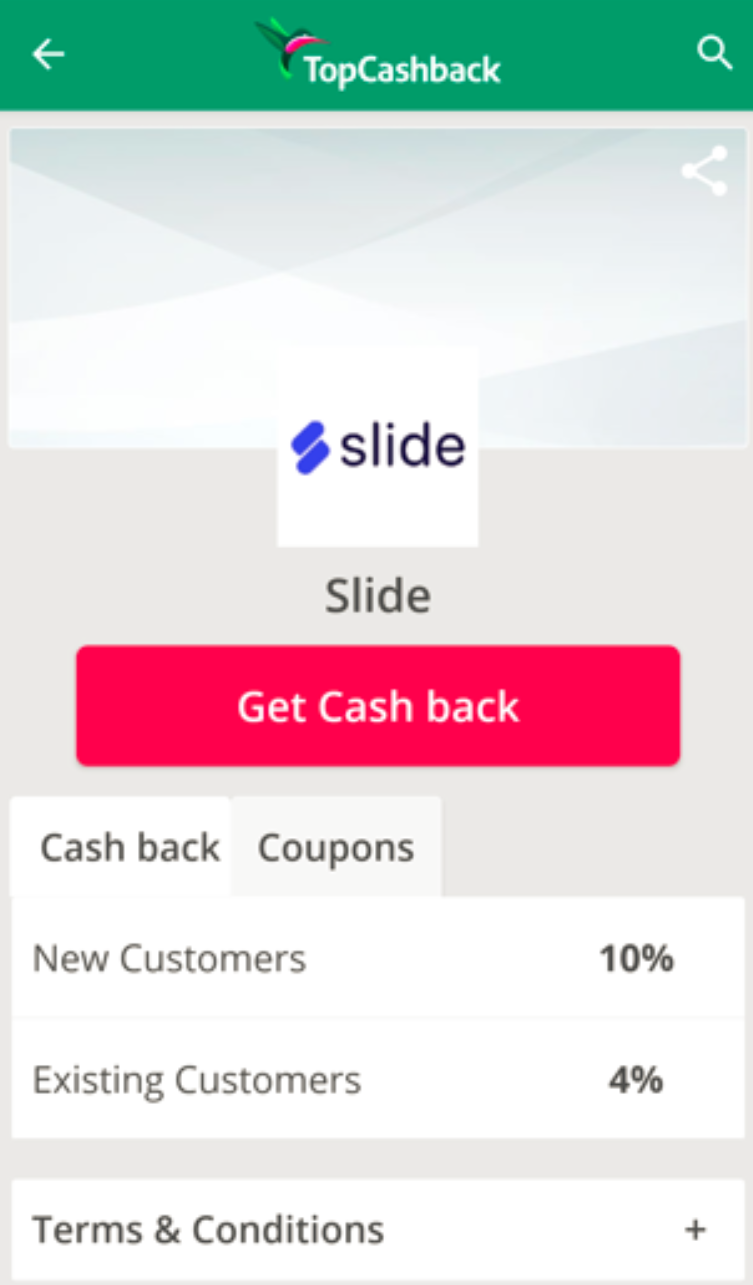

Well, that’s because it gets better. You can get an additional 1% if you add funds to Slide in advance. Loading funds in advance counts as an online purchase, as mentioned in the Doctor of Credit comments of what Frugal Professor called Thread 2 in his 2019 article. Ok, so now Slide is up to 5% which is a little better than using Raise to buy CVS gift cards but an additional 0.5% still isn’t worth an article. Can we make this better? In fact, we can. Instead of using the Slide app directly, we can load it using a cash back portal like TopCashback to earn an additional 4%. I’ve had good luck with TopCashback, but to find what portal is currently offering the best cash back I’d use https://www.cashbackmonitor.com/cashback-store/slide/.

Now we’re up to an additional 9% cash back. Frugal Professor should try to purge his BoA + Raise article from the internet and use Slide for everything right? Unfortunately not. As I said, Slide offers cash back at 300+ stores. You won’t be finding stores like Amazon, Walmart and Costco currently available through Slide. Getting the additional 3.5% Frugal Professor mentioned at Walmart still is great.

A complete list of stores where Slide is available can be found https://getslide.com/blog/brands/. Note that if any stores say (Slide Select) you won’t earn 4%, but you can use your Slide Cash Back towards the purchase of the eGift Card. I’m an avid hiker. Getting an additional 9% at stores like REI and Sierra sounds great to me. Searching CashbackMonitor I see that currently the best cash back portal offers 3% at REI and 4% at Sierra. There’s also an extensive list of restaurants that will be very familiar to just about everyone. Brands in the Travel section also stood out to me. Getting an additional 9% for purchases at Airbnb, Disney and Southwest sounds amazing. Searching CashbackMonitor I see that currently the best cash back at those brands are 1%, 1% and 2% respectively.

I’ve used Slide for about a week and made 4 purchases, so I can share how it’s worked in practice. TopCashback offers a higher percentage (currently 10%) for your first purchase through Slide. Since adding funds to Slide counts as a purchase and adding funds doesn’t qualify for TopCashback rewards, skip that for the first purchase. 10% is 6% more than the 4% you’ll normally get. Losing out on 1% for adding funds in advance is worthwhile. On my phone, I used the TopCashback app to launch the Slide app:

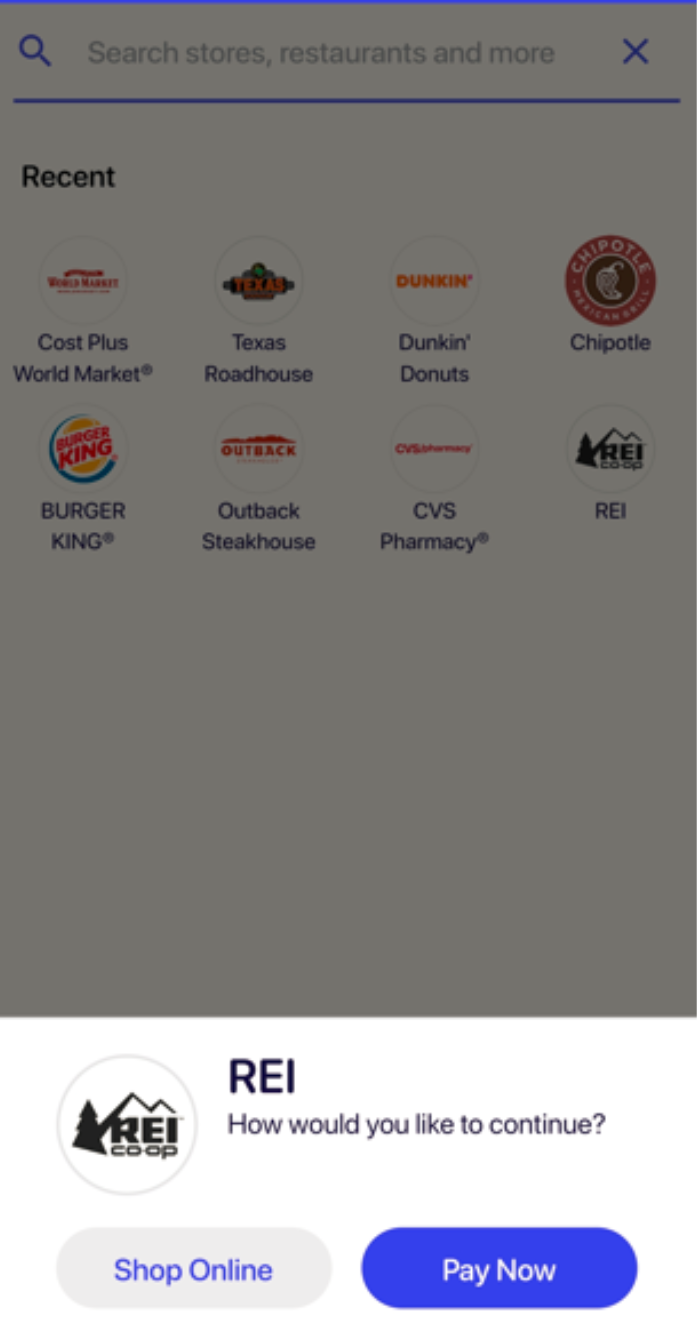

Selecting Get Cash back launched my Slide app, where I searched for REI to make an online purchase:

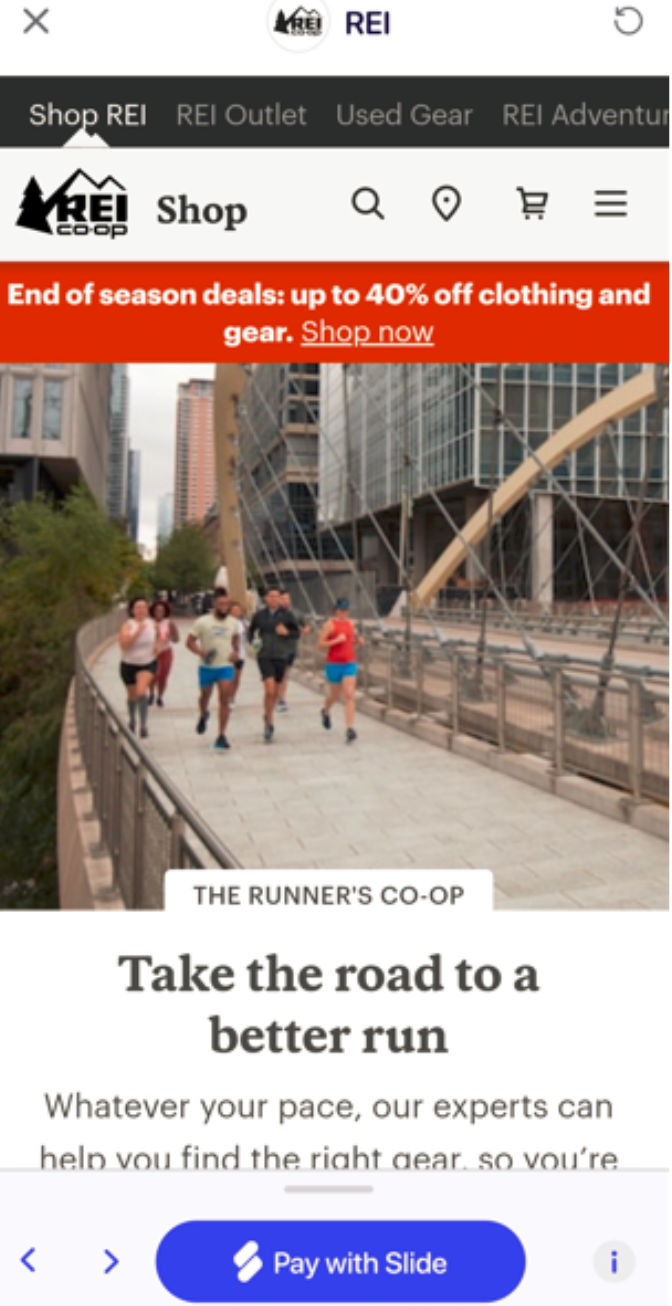

The Pay Now button is for when you’re in a store, which we’ll talk about later, I used the Shop Online button. This launched the REI app, with a Pay with Slide button at the bottom:

I loaded my cart with the items I was buying, then began checkout like normal. I had a coupon code that I applied and continued to the point where they were looking for the payment method. At that point, I selected Pay with Slide. This brought me back to the Slide app, where I entered the amount and purchased the eGift Card. Slide provides buttons to copy the gift card number and PIN to make it easy to enter them back in the REI app and make the purchase.

It didn’t take very long for the Slide rewards Cash Back to be available in the account, if it wasn’t instantly available. TopCashback mentions it can take up to 7 days for the Slide cash back rewards to show up, but within a couple of hours I got an email notification that my transaction had been tracked, and it showed up in my Earnings tab as pending. Sometimes cash back portals won’t track if you use coupon codes, but both Slide and TopCashback tracked, despite me using a coupon code REI had emailed to me.

My REI purchase was online, but Slide can also be used in-store. Wait a minute you say, we’re using the BoA Online Category so that won’t work. In fact, it will. Prior to making the purchase, add funds to Slide in an amount greater than the upcoming purchase which will earn the 1%. I added $25, the minimum they allow, to cover my planned purchase. This counts as an Online purchase that would earn 5.25% from BoA.

After selecting the items I wanted at Cost Plus World Market, but prior to checking out, I used my phone’s TopCashback app to open the Slide app, then selected Cost Plus World Market just like I did with REI. However, since I was in the store, I used the Pay Now button. This brings us to the point where we need the amount for the eGift Card. Since I don’t know the amount, I left it blank and proceeded to the cashier. I had a 15% coupon, which I had him scan and when he gave me the total I typed it in, and purchased the eGift Card. When you go to pay for the eGift Card, Slide allows you to use your cash back from earlier purchases for this. There’s no need to wait for the $15 minimum to cash out. Slide almost immediately showed a barcode the cashier scanned and that was it.

When I mentioned Slide to Frugal Professor, he was a bit concerned about it being cumbersome when making purchases in-store. Me purchasing the eGift Card and showing the cashier the barcode was a few seconds. The cashier probably didn’t even realize what I was doing. I’ve waited in line far longer behind those people who insist on writing checks at the grocery store despite it being 2022. Why do we even still have checks? But I digress.

As before, it didn’t take very long for the Slide rewards Cash Back to be available in the account if it wasn’t instantly available. Once again, within a couple of hours, I got an email notification that my transaction had been tracked by TopCashback, and it showed up in my Earnings tab as pending. Sometimes cash back portals won’t track if you use coupon codes, but both Slide and TopCashback tracked despite me using a coupon code I had for setting up a Cost Plus World Market account.

Conclusion

For any of the 300+ brands Slide offers, https://getslide.com/blog/brands/, you’ll earn:

5.25% BoA + 1% Slide when adding funds to Slide + 4% accessing slide using TopCashback + 4% using Slide to purchase an eGift Card ≈ 14.25% cash back.

If you’d like to sign up for any of the programs I’ve mentioned, I’d appreciate it if you use my affiliate links:

- TopCashback

- Slide – You’ll get $5 off your first 4 purchases (up to $20)

Thanks for reading.

——————————————————–

Jeff’s Platinum Honors Footnote

——————————————————–

I also wanted to clarify a common misconception about establishing Platinum Honors status. In Frugal Professor’s 2018 article he states “Once the $100k is at Merrill Edge, you have to wait up to 3 months for the “Platinum Honors” status to kick in since it is computed on a three-month rolling average.” While it is true that that’s one of the ways of establishing Platinum Honors status, there is a better way for those without a BoA personal checking account.

From https://www.bankofamerica.com/preferred-rewards/, “You can satisfy the combined balance requirement for enrollment with either:

- a three-month combined average daily balance in your qualifying deposit and investment accounts or

- a current combined balance, provided that you enroll at the time you open your first eligible personal checking account and satisfy the balance requirement at the end of at least one day within 30 days of opening that account.”

Frugal Professor talks about the first method, but the better way is item 2 for those that don’t have a BoA personal checking account. To use this, transfer the $100k to Merrill Edge before establishing an eligible personal checking account. Once the money has been moved, open an eligible personal checking account and ensure you enroll at the time. By doing this, you avoid the three-month delay in establishing Platinum Honors status.

——————————————————–

Frugal Professor’s Concluding Thoughts

——————————————————–

Thanks again to blog reader Jeff for taking the time to enlighten us about the Slide app!

A quick query of Personal Capital shows that I’ve spent ~$14k at Raise over the past few years. I’ve almost exclusively used it for Walmart and CVS purchases. Since we’ve historically spent thousands of dollars per year on prescriptions at CVS, so the historical >10% savings (5.25% BoA + 1% Rakuten + >3% Raise) has resulted in non-trivial benefits accumulating to us.

As a somewhat relentless optimizer myself, I’m going to have to take a hard look at incorporating Slide into our spending strategy.

——————————————————–

Reader Poll

——————————————————–

Have any of you used the Slide app? If so, what has your experience been? Any tips to share?

I appreciated this post and wanted to share our results. Starting with the bottom line: After cash back and fees, we saved about 10% on our weekly Aldi run.

This requires a bit of math to get to that result, so a bit of finance nerdery below explaining it

——————————————

We’ve been using using FP’s BOA method for most of our shopping since last January to great effect (>$1000 extra cash back, excluding the other incentives). However, since we go to Aldi for our groceries we can’t take full advantage of the online purchase category. Aldi does its pickup orders through Instacart which is one of the Slide options. In theory, this method should work for any grocery store that does instacart pickup and if you already get groceries delivered, all the better.

Aldi Pickup charges a flat fee ($2 for >=$35 orders and $4 for <$35) plus a mark up on the items vs in-store plus a bag fee, which we normally don't pay by bring reusable bags. The product markup varies by item: I've seen up to 20%. That has always left me a bit leery. More on it later.

With instacart you can actually do a bit better even than the Slide method alone. If you sign up for instacart express through Delta SkyMiles you get 3 months free and importantly in the long run a skymile for each $1 spent (https://www.instacart.com/help/section/360007996832/4420039448084). Based on Points Guy, that skymile equates to about 1.4% cash back. Also with Instacart express, you don't pay the pickup fee and get a 5% credit for your order. Assuming you grocery shop weekly (we do) then removing the pickup fee balances out with the $100 price of express, and maybe a bit better since you can pay the membership via Slide.

This past week we did a trial run. The total came to $85.99. Looking at old receipts this would have been about $78.99 in store. So a 8.3% weighted mark up. The cash back on the pickup order, excluding first time bonuses, was 20.66% (vs. just 3.5% normally):

5% Instacart Credit

1.41% Instacart Delta Skymiles

5% Slide Credit

4% TopCashBack

5.25% BOA Online Spending Cash Back

After cash back we paid $68.25 vs $76.23–a savings of ~10%.

I am personally a big fan of grocery pickup since it saves time and with a small human, stress. Unfortunately in the case of Aldi, while it didn't really take extra time, it also didn't save it either. Aldi produce, particularly since the supply chain issues began, has been a mixed bag. So we still have to go into the store to see what fruit looks good this week and that means waiting in the checkout line.

So…. big thanks Jeff and FP!

Thanks for sharing your experience!!!! 10% ain’t too shabby!!!!