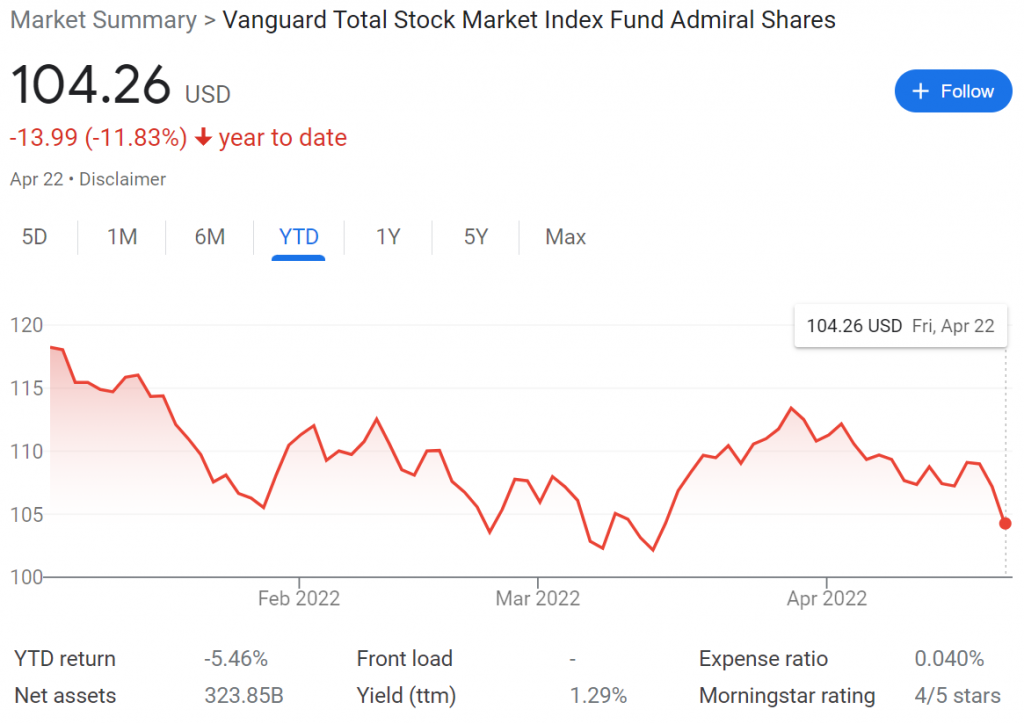

With domestic markets down 12% YTD, now might be a good time to think about tax-loss harvesting (TLH’ing).

For the uninitiated, here is a good overview of TLH’ing: https://www.bogleheads.org/wiki/Tax_loss_harvesting.

That said, I think it is a largely unproductive endeavor, as I’ve blogged about here: https://frugalprofessor.com/tax-loss-harvesting-is-overrated/.

Despite convincing myself in the above blog post that TLH’ing is largely an unproductive endeavor, I decided to try my hand at it this year. Thus far, I’ve performed three distinct TLH transactions.

TLH #1 — Jan 26 — The unconventional TLH (Taxable Brokerage VTSAX => IRA + 529)

Early this year, I sold ~$20k of taxable investments at a small loss to front-load my IRA and 529 contributions for the year. This was an unconventional TLH that I’d never read about before, but frankly was my favorite TLH experience this year. I received all of the benefits of TLH’ing without the baggage (e.g. the higher cap gains taxes downstream or being stuck with less desirable “TLH partner” forever). I would unambiguously recommend this strategy to anyone.

TLH #2 — Feb 24 — The conventional TLH (Taxable Brokerage VTSAX => Taxable Brokerage VLCAX)

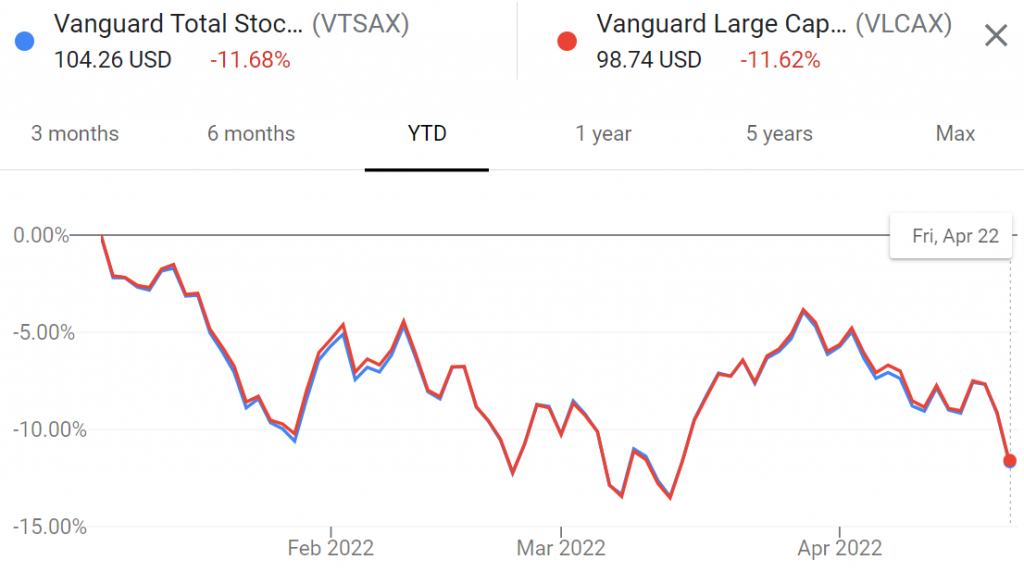

Here, I did the conventional TLH from VTSAX to VLCAX. Why VLCAX? It seemed to track VTSAX slightly better than the S&P index. The YTD performance of VTSAX vs VLCAX is shown below. Unsurprisingly, they are mechanically correlated since they are practically the same fund.

With this second TLH, I reached a combined YTD loss of $3,323, just barely high enough to max out the $3k deduction from ordinary income for 2022, with a little left over for next year.

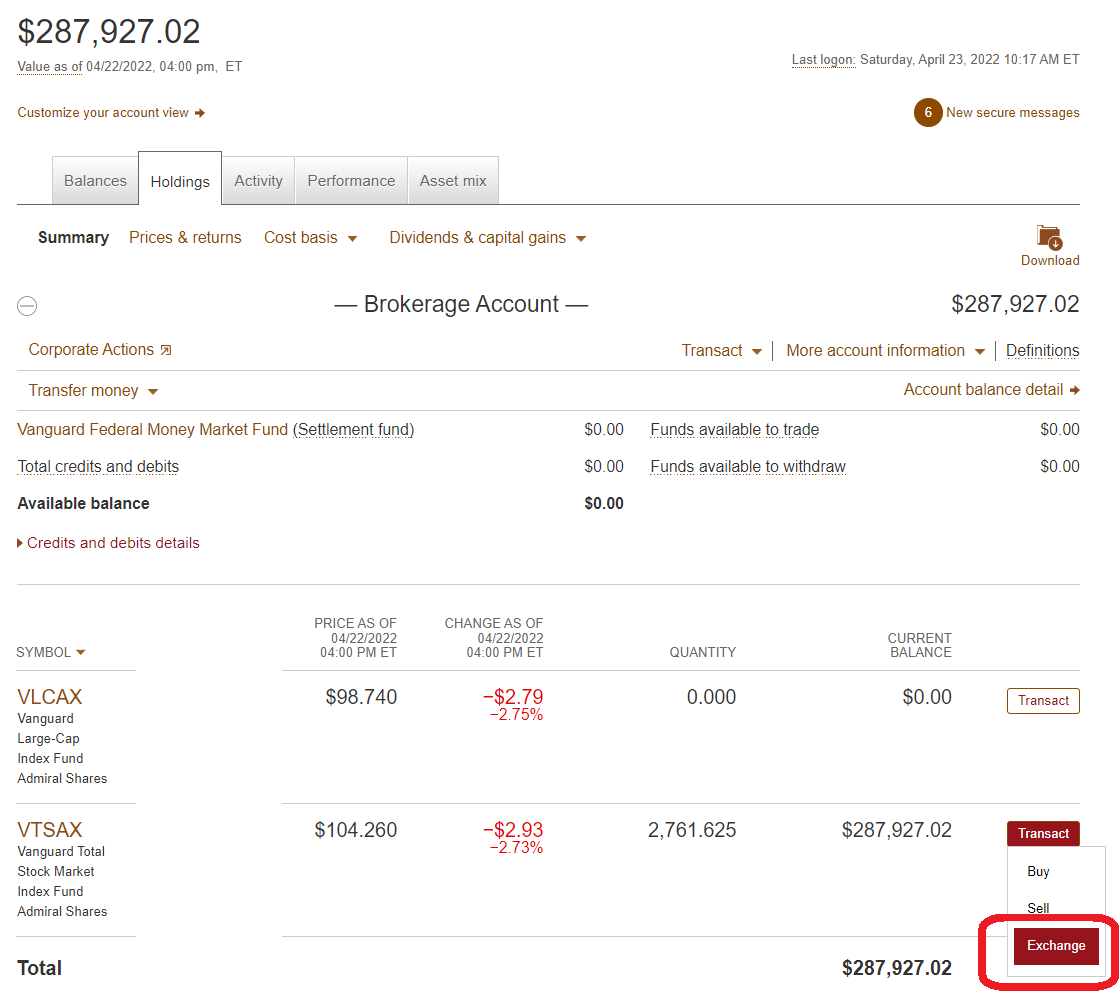

TLH #3 — Apr 22 — The reversal of the conventional TLH (Taxable Brokerage VLCAX => Taxable Brokerage VTSAX)

Since I have a slight (and probably irrational) preference for VTSAX over VLCAX, I waited for an opportunity to get back into VTSAX. That opportunity arose on April 22, where I TLH’d back to VTSAX, generating an additional $640 loss, to get the YTD combined TLH losses to $3,969. Certainly not something to brag about, but it’s not nothing. After taking the $3k deduction this year, I’ll carry forward the unused $969 for the next year (tax year 2023 to be filed in April of 2024).

Conclusion

I still think TLH is the probably the most over-hyped investing gimmick out there. But it was fun to give it a try this year for my first time and the process could not have been simpler. I find it comical that robo-advisors and financial planners pitch this service as a major value-add to justify their ~1% AUM fees since a reasonably competent monkey could do it. My favorite TLH was #1 which I would unambiguously recommend to anyone. The conventional TLH (#2 & #3) went fine, but were certainly not life changing.

Despite the TLH transactions going well, I made a few small blunders this year. Perhaps you can learn from my mistakes:

- With TLH #1, I didn’t appreciate how quickly the mutual funds would be liquidated into my checking account. After hitting sell on a Wednesday, the funds were in my checking account the following day. With the benefit of hindsight, I should have placed my “buy” orders within the 529 and IRA on Thursday, instead of Friday. Oh well.

- With TLH #2, I correctly had dividend reinvestment turned off for VTSAX. However, much to my surprise, I did NOT have dividend reinvestment turned off for the new fund VLCAX. Consequently, when the dividend reinvestment hit my account on March 22, it reset the 31-day clock on when I could sell VLCAX again at a loss to April 22. This was a slight nuisance that I did not anticipate having to deal with.

Despite the triviality of it, it was kind of a fun arbitrage. If the IRS allows this nonsense, why not exploit it? The time commitment is pretty small. Something like 1-2 minutes per TLH event. TLH’ing with mutual funds is pretty slick since all transactions occur at NAV at the end close of business, with every single penny accounted for. The ease with which this can be accomplished through mutual funds is probably enough to convince me to never own ETFs in my brokerage account.

Below, is a simplified TLH guide for dummies

Step 1: Click “exchange” on the fund you want to sell.

Step 2: Select the specific tax lots to sell, ensuring that your most recent purchase of these funds is at least 31 days prior. The easiest way to do this is to sort by the second-to-last column, which is the gain/loss per share (based on most recent closing price). Intraday price fluctuation will influence the actual value here since mutual fund transactions occur at the end of the trading day (and is thus unknown at the time you place the trade). The day I performed TLH #2, one of the tax lots that was showing up as a loss in this screen ended up with a small gain thanks to intraday price movement.

The below screenshot is pretty uninformative because I currently don’t have any meaningful tax lots with large losses since I’ve already TLH’d what I could have. Nonetheless, you’d look for losses in that second to last column, preferably large losses (as a percentage of the fund price).

Step 3: Here you choose the new fund. Pretty self explanatory.

And, with that you are done. With a couple of mouse clicks you have accomplished what financial advisors would lead you to believe is an unbelievably complicated process that only a true “expert” (charging 1% AUM fees) could handle.

Step 4 (optional): Wait 31 days and rinse and repeat above steps if desired. The optimal TLH scenario is that the fund decreases in value, causing the realization of even bigger losses (e.g. my TLH #3 above).

One more screenshot for the curious: YTD tax lots

I wonder if you realize that the link to your blog (in your email) is not hyperlinked? You have to do a copy/paste job to get here. (The Bogleheads link is hyperlinked, but not your blog link.)

Weird. Thanks for letting me know.

On my end, it looks like all hyperlinks are operational on the current version of the post.

What do you estimate your $3k of TLH will be worth in terms of savings on income tax this year? I realize this is a deferral of tax until the future, but its something!

Between state and federal taxes, our combined marginal tax rate is around 30%, so the $3k deduction will save us around $900 (=$3k*30%) in taxes over the short term this year, with a bit carried over for next year. It’s not nothing, but it also will bring a higher tax liability in the future.

If you are replacing income tax with cap gains tax in the future, then I’m guessing overall savings would be 30-20%=10%…..so roughly $300. This would imply that each year one should look to TLH $3k to use the provision.

The real arbitrage is to realize downstream cap gains in the 0% federal bracket (a la go-curry-cracker). If this can be accomplished, then today’s $900 tax savings would be truly free money (especially if I were to relocate to a tax-free state in retirement).

$300-$900 is not nothing, but it is certainly not life changing. But, of course, every bit helps.

Title should be tax LOSS, not LOST? ….although tax money does feel like it’s just LOST many times, LOL. Thanks for the Blog!!!!

Don’t know how I missed that typo. Thanks for the heads up!

Thanks for the post FP. I think looking at TLH in isolation may be unproductive and I applaud you for trying it though.

One thing you might want to consider in combination with TLH is “Tax Gains Harvesting”. When use together, it could be a good way to reduce your overall tax-burden now and in the future.

In your TLH #2, you captured a combined loss of $$3,323 which maxed out your deduction from ordinary income for 2022 with $323 left over. You can then sell an investment where you have a gain of $323 to offset the left over. Once you sell, you can IMMEDIATELY buy back the same investment which effectively reset the cost basis of that investment (some of the rules for TLH does not apply for TGH… e.g. wash sale)

Maybe another example, let’s say you own Fidelity Total Stock Market (FSKAX) with $100,000 in unrealized gain and you have VTSAX with $20,000 unrealized loss. You sell VTSAX to capture the $20k loss… minus the $3k deduction from ordinary income for 2022, you can sell enough of FSKAX to capture $17k gains and IMMEDIATELY re-buy FSKAX. Doing this, you will not have to pay the capital gains for the $17k you realized on FSKAX, reset your cost basis for FSKAX, and maintain market exposure.

I hope this helps. Feel free to reach out if you have any questions. Cheers!

Thanks for the thoughtful response. I’m a huge fan of Tax Gain harvesting, and very much look forward to exploiting that strategy post FIRE.

In fact, GCC had a great writeup on the benefits of Tax Gain harvesting today: https://www.gocurrycracker.com/go-curry-cracker-2021-taxes/

Given that I have no intention of realizing cap gains in the near-term, I’m happy to carry forward unused capital losses to offset future ordinary income (up to the max of $3k/year). If I were to implement your strategy, I understand how that mechanically increases my cost-basis for the tax-gain-harvested security. But, on net, it’s a wash right?

Buy fund A for $100k. Fund A goes to $77k, a $23k unrealized loss.

Buy fund B for $100k. Fund B goes to $120k, a $20k unrealized gain.

If I TLH on fund A in isolation, I am able to deduct $3k of ordinary income this year and carry forward the unused $20k, generating 6.66 years of future annual $3k deductions against ordinary income). I’m fine with that outcome.

If I follow your suggestion and tax-gain-harvest fund B as well, then the cost basis of fund B is indeed reset to $120k (and the cost basis of fund A is reset to $77k). In this scenario, there is no carry-forward of losses since the $20k “excess losses” in fund A are “used up” by the $20k realized gain in fund B. However, I do understand that the higher cost basis in fund B will make it easier to TLH fund B in the future, but I don’t see a big advantage of this approach for someone who is still working.

In contrast, I completely understand the benefit for someone who is retired a-la GCC. That situation of 0% LTCG is pure arbitrage.

If I’m not understanding something fully, I’d love to hear your thoughts. Thanks again for the thoughtful feedback.

“…it was kind of a fun arbitrage,,,[so] why not exploit it?”

Good summary!

We did some significant TLH-ing in 2020, so there isn’t much opportunity for us now, but who knows what the rest of the year will bring?

Fingers crossed(?) for further TLH opportunities in 2022….

I agree that TLH isn’t a huge game changer. I think the complications around avoiding a wash sale across all of your taxable and tax-advantaged accounts can be annoying. If you already make charitable contributions, you can sweeten the process by gifting the most appreciated shares and avoid the future tax bill.

I agree that charitable contributions make TLH more appealing.

Have you TLH’d recently?

I did some TLH on 1/21, 2/22, 3/4, 3/14. All total for 2022 has been ~$3,200 in losses harvested. I use ETFs and I don’t have to wait until the end-of-day to know how much I harvested. I use a series of three groups of ETFs that all track similar-but-different indices, mostly modeling my system after Wealthfront’s process and using VTI, VOO+VXF, SCHB and ITOT. I did a similar TLH in March 2020, then gifted appreciated shares during 2021.

Sounds like you have a pretty slick system. ETFs certainly have their advantages (e.g. being able to trade cross-brokers), but I do love the simplicity of MFs.

My brokerage balance was relatively small in March 2020, but I probably should have TLH’d anyway. Oh well.

An important point about your first transaction: If you harvest losses in a taxable account, you can’t buy back the same securities within 30 days even in an IRA or any other type of account. It sounded like maybe you sold and bought VTSAX in the same week, which makes it a wash sale even if the purchase was in an IRA. Hopefully that wasn’t the case. So this method still requires a “TLH partner”, although it is easier to get rid of it after 30 days in an IRA–maybe that is what you meant.

Thanks for the insightful comment. I agree with you.

However, my IRAs are with Fidelity (invested 100% in the foreign index FZILX) and my taxable investments are with Vanguard (100% invested in the domestic index VTSAX). Fortunately, this puts me in the clear on this TLH transaction. Otherwise, I could indeed have run into issues as you describe.

That said, FZROX and VTSAX track slightly different indexes (for example), so it is plausible to do this without running into wash sale rules even with domestic equities.

Are you recording the TLH trades yourself or are you relying on Vanguard to keep track for you?

I’m not relying on VG for anything. I simply download the cost basis history from VG, then do my own computations (including timing, etc.). Pretty simple.

Step 0: set up specific identification of shares at Vanguard in advance

Good point, but I’m pretty sure you can change the settings after-the-fact (before selling): https://investor.vanguard.com/investor-resources-education/taxes/cost-basis-methods-available-at-vanguard

When we calculate cost basis for your Vanguard investments, we’ll automatically use “average cost” for mutual funds and “first in, first out” for individual stocks. But you can change those settings—or use “specific identification” if you’re more of a hands-on investor.

Because you are in accumulation mode, you likely have much less awareness of potential gotcha issues folks in their decumulation years face.

Effective marginal tax rates can be exceptionally high (e.g., IRMAA threshholds to take one of the more dramatic examples. Reichenstein computes an IRMAA case with effective MTR of 85,000 percent but there are plenty of other less dramatic non-IRMAA cases of high effective marginal taxrates.)

https://www.advisorperspectives.com/articles/2021/09/28/pay-attention-to-marginal-tax-rates-and-not-tax-brackets

The nice thing about TLH is you can build up a large storehouse of carryforward losses that will allow tapping into highly appreciated equities held in taxable without triggering insane tax consequences due to knock-on effects.) Or allow you to sell your highly appreciated home to downsize or relocate near your kids/grandkids without triggering a huge AGI increase with all kinds of tax consequences.

Older folks can often have a need to tap our taxable account unpredictably for large lumpy expenses (e.g., a major home renovation for aging in place or perhaps admission to a continuing care facility.) Having built up a stock of TLH loss carryforwards gives me the option to sell my appreciated equities in taxable or my home without triggering huge tax penalties of the type described by Reichenstein.

And before you tell me I would have less of a challenge with appreciated equities if I had not TLHed to begin with, I will note that the use of specific ID allows me to mitigate the problem by donating the most highly appreciated lots to my DAF for charitable giving and only selling the more modestly appreciated lots.

Of course I cannot find fault with your TLH strategy!!!!

What kind of reservoir of capital loss carry-overs are you talking here? 6 figures? I can see how this would be a tremendous asset to help offset large downstream liquidity-driven (e.g. home repair, etc). capital gains. Particularly when you mitigate the problem of low cost-basis securities by offloading charity. Then it’s pure arbitrage, which is what I tried to convey in my prior post.

Do you have any advice for a TLH novice like myself? For example, do you have any recommended TLH partners? How often do you TLH? When available losses exceed $X? If so, what is the $X that makes it a worthwhile endeavor to you? Is your procedure sophisticated enough to incorporate the effects of short-term holding periods on non-qualified dividends?

Thanks!!!

No fixed $X criterion. Many people in my age cohort built up a significant reservoir of TLH carryforward from the 2008 meltdown.

At this point, I am pretty opportunistic, so I don’t bother trolling for small fish at every dip. My general practice has been to look for substantial TLH opportunities in late November or early December, well before ex dividend dates so I don’t have to worry about non-qualified dividends.

My only substantial TLH since the meltdown has been in international equities. Vanguard and Schwab international funds are not perfect substitutes but good enough as far as I am concerned. Their indices are definitely not substantially identical.

I have been killing multiple birds with one stone by TLHing international in my taxable account and purchasing the replacement international shares in the TLH partner funds in my tax-advantaged accounts. Since international is notoriously a source of dividend drag, this winds up being very tax efficient for me. (I am tired of messing with Form 1116 and in my particular situation, the FTC was really not sufficient to offset the dividend drag.)

Thanks for the response! I really appreciate it!!!!

You’ve inspired me to be more strategic in this regard going forward, particularly as our taxable brokerage balance grows. The combination of TLH + charitable contributions of low-cost-basis securities is pure arbitrage.