So you want to be a millionaire?

So you want to be a millionaire?

Introduction

I know quite a few people who are older and broke. Given the extremely favorable market returns over the past many decades, I find myself having little sympathy for such individuals. The purpose of this blog post is to see whether my lack of sympathy is justified or whether I’m a cold-hearted, unsympathetic jerk.

Background & Methodology

For decades, brilliant visionaries like Warren Buffett & John Bogle have touted the benefits of the lowly index fund. As recently as a few years ago, Warren Buffet gave the following instructions on how his trustee should invest his billions after his death (link):

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund (I suggest Vanguard‘s). I believe the trust’s long-term results from this policy will be superior to those attained by most investors—whether pension funds, institutions, or individuals—who employ high-fee managers

I was too lazy to model the exact advice above, but I instead modelled the growth of a 100% allocation to the Total Stock Market Index. To do so, I downloaded data from Ken French’s website here and inflation data from the St Louis Fed here. Ken French’s data only goes through the end of Aug 2020, so you’ll have to forgive me for not extending it to today.

Only slightly deviating from Buffet’s advice (because I’m too lazy to model it properly), I was curious to see what historical monthly contribution amounts would generate $1M today.

The Model

You can download my model here (link). Everything in yellow is an input that you can change. If you wanted to turn off the inflation adjustment for some reason, you’d do so by entering a “0” in the appropriate row.

The first sheet in my file illustrates what it would take to generate $1M today with 0% investing fees. The second sheet imposes a 2% annual investing fee.

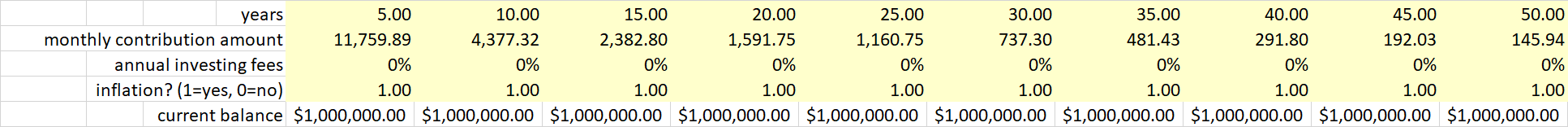

What it Would Have Taken to be a Millionaire Today with 0% fees

Again, I’m assuming 100% invested in a Total Market Index with 0% fees. Here’s the answer.

The above chart may be a bit hard to read on a mobile device, so let me spell it out. To have $1M at the end of Aug 2020, one must have saved the following (adjusted for inflation using Aug 2020 dollars) per month:

- $11,760/mo for 5 years

- $4,377/mo for 10 years

- $2,383/mo for 15 years

- $1,592/mo for 20 years

- $1,161/mo for 25 years

- $737/mo for 30 years

- $418/mo for 35 years

- $292/mo for 40 years

- $192/mo for 45 years

- $146/mo for 50 years

I graduated high school a little over 20 years ago. To hit $1M today, that would have required $1,592/mo (in Aug 2020 dollars) in contributions since 2000.

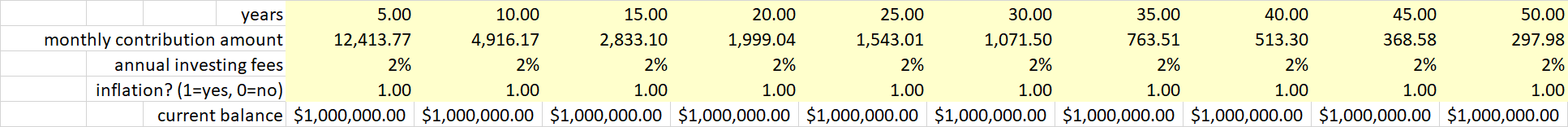

What it Would Have Required to be a Millionaire Today with 2% investing fees

You might argue the above is unrealistic because most people haven’t been self-managing their investments using $0 fee index funds for decades.

You’re right!!!!!

Let’s recalculate the monthly contributions with a 2% headwind (dividend tax drag, capital gain tax drag, expense ratios, AUM fees). Given all of the possible investing frictions, 2% probably understates the true investing costs to investors.

Here’s how the above table looks in the face of that 2% investing fee headwind (again, adjusting for inflation using Aug 2020 dollars):

- $12,414/mo for 5 years <=== 5.6% higher than the 0% fee example!!!

- $4,916/mo for 10 years <=== 12.3% higher than the 0% fee example!!!

- $2,833/mo for 15 years <=== 18.9% higher than the 0% fee example!!!

- $1,999/mo for 20 years <=== 25.6% higher than the 0% fee example!!!

- $1,543/mo for 25 years <=== 32.9% higher than the 0% fee example!!!

- $1,072/mo for 30 years <=== 45.3% higher than the 0% fee example!!!

- $764/mo for 35 years <=== 58.6% higher than the 0% fee example!!!

- $513/mo for 40 years <=== 75.9% higher than the 0% fee example!!!

- $369/mo for 45 years <=== 91.9% higher than the 0% fee example!!!

- $298/mo for 50 years <=== 104.2% higher than the 0% fee example!!!

Wrapping it Up

If a savvy investor had fully exploited the multi-decade bull market run by investing in tax-efficient broad-based index funds (as Buffett & Bogle have been advocating for decades), then hitting a $1M investing balance today would have been achievable with pretty modest contribution amounts, even after appropriately adjusting for inflation.

Also, expenses matter!!!!!!! Particularly over the multi-decade horizon where “the tyranny of compounded costs” (to quote John Bogle) can rear their ugly head.

Given today’s near-zero interest rates on fixed income, equity valuations continue to be (rationally) high. This is great for those of us with equity holdings who have benefited from the recent price appreciation, but bad for equity investors going forward because our expected return in the future is going to be more modest.

It doesn’t do much good to sulk over the lost opportunity of the past several decades. What matters is that you save. Save early and save often and keep your investing costs (taxes, expense ratios, AUM fees) as close to zero as possible.

What if you don’t have enough money to invest?

I don’t want to hear those excuses. I hear those excuses all of the time, including by people making several hundred thousand per year. It infuriates me.

Spend less than you earn!!!!! End of story.

Brown bag it to work. Cut the cord and use an antenna. Drive a hooptie (or better yet, bike or take public transit). Pay ~$0 for cell phones. Eat at home. Buy in bulk (I’d recommend Costco, of course). Maximize your CC cash back. Minimize your tax burden by fully exploiting tax-advantaged accounts. Etc, etc, etc.

Every single dollar not spent is a dollar that can be directed towards investments (or paying down debt). There is a one-to-one mapping!!!!

Each and every dollar invested today will be worth $1*(1+R)^N in the future. Unfortunately, we don’t know R (the return our investments will return going forward), but for a distant enough N, these small savings can cumulate to large sums thanks to the magic of compounding.

You’d be amazed at how pinching those pennies can cumulate to 7-figure investing balances, particularly over a many-decade horizon, as the above analysis demonstrates. Pinching pennies (alongside the receipt of generous government subsidies like the EITC) is how my wife and I maxed out both of our Roth IRAs during my phd while earning $25k/year with 5 kids.

In Conclusion, Am I a Cold-Hearted, Unsympathetic Jerk?

Maybe….

Solid. Love it. I’m going to use every bit of this in my personal finance class module on investing. Thanks you for the clear, concise write-up!

It’s fun using actual stock returns as opposed to hypothetical stock returns. It makes the question of “How much would have been required to hit $1M today” easily answerable.

Good luck with your class!

Becoming a millionaire could be as simple as maxing out one’s 401(k). Doing so would put the saver between the 25 and 30 year marks. Unfortunately, folks start robbing their future self through car loans and consumer debt and before too long it becomes a habit.

Amen! When you think about the “tax arbitrage” angle, then going the traditional 401k route could be even easier to hit a $1M balance since $1 of contributions only costs the household $!*(1 – federal tax rate – state marginal tax rate) in cash flow.

…what is you’re still in debt, living with in laws, shelling out thousands per month like a madman to pay off loans and you’re still 24 months away from getting out of the red? Still no excuse?

Getting out of (high interest, non-mortgage) debt is the precursor to saving. You’re doing a great job, so keep up the good work!

But I think the post is pretty thought provoking. With the benefit of hindsight, we can do the math and realize it only would have required $1,600/mo (in Aug 2020 dollars) OR $1,000/mo (in Sept 2000 dollars) to hit $1M in the 20Y span from Sept 2000 in Aug 2020 thanks to the raging stock market. If you knew that when graduating HS, would you have made any different life choices?

With the benefit of hindsight, I look at the 12Y I spent in college and think about the tremendous amount of forgone income. Given the ranging stock market, perhaps the much simpler path to wealth would have been learning a trade (plumbing, electrician, etc) immediately after high school and dutifully investing a modest amount from the get go.

How is this actionable for you and me? Well, it’s not particularly actionable in terms of undoing our past life choices (e.g. 12Y of college). However, I hope it’s somewhat informative for illustration purposes on what it will take for someone starting at $0 to hit $1M in 20, 30, 40Y in the future. To do so requires decades of diligent and boring investing in low-cost index funds, minimizing your investing and tax costs. On a daily basis, it moves at a glacially slow pace. Over a multi-decade horizon, however, the magic of compound interest will reward those who dutifully save early and often every single paycheck.

Agreed. We are encouraging trades before “college” and investing early with our family. See you 30 years down the road.

PS: B and I watched Free Solo. Filled the FP hole we’ve had four the last four years. (Also, ever considered an MRI…? LOL)

Free solo is an interesting movie. I much preferred “Meru” and “Dawn Wall” if you’re interested in that genre of film.