Overview

2020 is almost over (good riddance!), so perhaps now would be an appropriate time to assess your 2020 tax withholdings for taxes due in April 2021.

I find it slightly annoying that TurboTax & TaxAct don’t update their tax calculators until mid-late November, so perhaps my spreadsheet can fill the void for someone wanting to get an early start on 2020.

To combat this, as usual, I’ve updated my tax calculator spreadsheet. You may download it here (link).

A big thanks

The master himself, MDM from https://forum.mrmoneymustache.com/forum-information-faqs/case-study-spreadsheet-updates/, graciously helped me to debug a major CTC coding error last year. Those fixes have been carried over to this year’s sheet.

How to Use My Spreadsheet

Same as any other year. Refer last year’s post for more details (link).

Some More Thoughts

FreeTaxUsa usually releases their (great and free) software mid-November. What I did last year was input all of my data into their site to compute my actual tax liability (to compare to my spreadsheet). You won’t have your W2’s yet, but if you’re a salaried employee I suspect you could guess to within a couple bucks what your annual income and tax witholdings will be (=YTD income/withholdings + future income/withholdings). For me, the only remaining uncertainty in my taxes will be the size of my Dec VTSAX dividend, which I easily estimated as $250k * 2% dividend yield / 4 quarters = $1,250. YTD dividends and interest are easily extracted from Personal Capital or your brokerage.

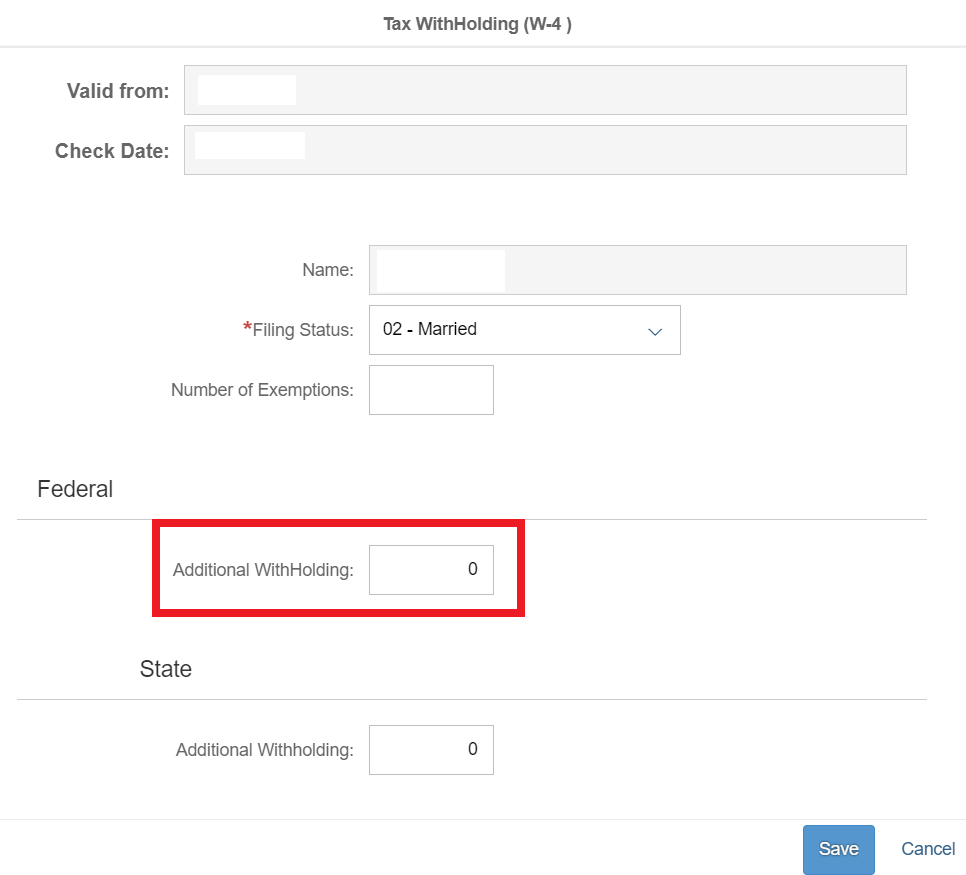

With your essentially final tax liability computed in mid-November, you’re now empowered to adjust your withholdings to your heart’s content over the remainder of the year in your W4 by adjusting the red boxes below. It’s kind of a fun game to try to get a $0 refund, and it’s not terribly hard to accomplish with a tiny bit of effort.

Some Unique 2020 Tax Considerations

The below is not well sourced, but is my current understanding through reading hundreds of articles & blog posts throughout the year. If I’m wrong, please let me know.

- There is a $300 above-the-line charitable contribution allowance for those of us (e.g. most of the population) that doesn’t itemize. This creates a nice opportunity to get a ~30% discount, in my case, on charitable contributions made this year.

- It’s my understanding that this $300 amount is not doubled for MFJ households.

- It’s my understanding that this must be a “cash donation”, which would preclude you from donating appreciated stocks to a charity and receiving this above-the-line deduction. I’m unsure why this arbitrary choice was made.

- For those of us that were in the 5% phase-out region for the Covid stimulus payments distributed in April of 2020, there is a pretty unique opportunity. Even though the initial stimulus payment amount was calculated based on 2019 AGI, it is my understanding that the Covid stimulus payment amount will be updated based on 2020 AGI in the event that 2020 AGI < 2019 AGI. The phase-out for this payment was 5%, so this effectively raises one’s marginal tax rate in 2020 by 5% (for those with 2020 AGI < 2019 AGI who are ALSO in the Covid phase-out region with 2019 AGI), since every $1 of marginal income in 2020 will result in $0.05 less remaining Coronavirus stimulus (to be paid out in April 2021).

- This should rationally spill over into 2020 Trad vs Roth considerations as well as the timing of Roth conversions, etc.

- It seems all but certain that Biden will win the presidency in a matter of days (link1, link2). It seems likely that the Democrats will take the Senate (link) and retain the house as well (link). Therefore, we’re extremely likely to see some drastic changes to the tax code. My incredibly non-insightful prediction is that the tax code is about to become substantially more progressive with Democrats controlling both the presidency and the entire legislative branch. My tax spreadsheet computes effective marginal tax rates currently ranging from -60% to 37% (completely ignoring state income taxes, government transfers, etc.). It’s abundantly clear that democrats don’t view this as sufficiently progressive. Under Democratic rule, the combination of pre-Trump federal marginal tax rates + collection of Social Security > $128k would lead to top marginal tax rates in excess of 60% in the many states (link to TaxFoundation analysis), and close to 70% in CA if it succeeds in increasing their top marginal rate from 13.3% to 16.8% (link).

If you were planning on realizing large capital gains in 2021 (e.g. to buy a home, pay for college, etc) AND you’re in a high marginal tax bracket, it might be advantageous to realize those gains before Jan 1 2021 as a hedge against future tax increases if Biden ends up winning.(thanks to reader Ira for the correction, though I guess the advice still holds if you are “unlucky” enough that your 2021 AGI will exceed $1M).- When $1 of pre-tax marginal income only creates $0.30 of marginal after-tax income, I think the only logical conclusion is to spend those precious after-tax pennies more frugally and lay off the income accelerator. Democrats will argue that these high tax rates won’t sufficiently distort the incentives of billionaires like Bezos and Musk, who will continue to innovate, but surely this must severely distort incentives to work/innovate for many of us mere mortals.

- Lest I appear overly partisan, I’m well aware that Republican politics has been a flaming toxic dumpster fire for the past 4 years. Massive tax cuts, without commensurate spending cuts, has increased the deficit and debt levels to frightening levels. Suffice it to say that I’m decisively in the “neither” camp when it comes to partisan politics.

- Biden has gone on record repeatedly indicating that taxes will not rise for those with incomes < $400k.

In the next breath, however, Biden has contradicted himself by proposing the elimination of the preferential taxation of capital gains and dividends. If someone making < $400k/year has investments in a taxable brokerage account (e.g. me), the act of removing the preferential treatment of dividends/cap gains would necessarily increase my taxes (albeit somewhat trivially).(thanks to reader Ira for the correction). - The venerable Michael Kitces wrote a masterpiece on the Biden tax plan here (link).

- Biden’s promised 28% tax credit on Trad retirement contributions replacing the income tax deduction seems logical in theory — increase incentives for lower income households to save while decreasing the ability for higher income households to lower their taxes (by capping the effective federal tax deduction to 28% from 39.6% if pre-Trump rates are restored). In that sense, it’s a relatively simple move to make the tax code more progressive. However, when you dig into the actual accounting (e.g. the state tax implications given that AGI won’t change with a 28% tax credit), it’s a dumpster fire of complexity as the article appropriately highlights.

- Given the relatively modest 401k contribution limits of $19.5k/year for most individuals (myself being an exception with the triple dipping of the 401a/403b/457 at a public university), the power 401k is already sufficiently moderated for higher income people without further imposing this 28% cap with the associated baggage of added operational complexity.

- The much more sensible solution, in my opinion, would be to expand programs like the Saver’s Credit if the desire is to incentivize lower income people to save.

- Biden’s promised 28% tax credit on Trad retirement contributions replacing the income tax deduction seems logical in theory — increase incentives for lower income households to save while decreasing the ability for higher income households to lower their taxes (by capping the effective federal tax deduction to 28% from 39.6% if pre-Trump rates are restored). In that sense, it’s a relatively simple move to make the tax code more progressive. However, when you dig into the actual accounting (e.g. the state tax implications given that AGI won’t change with a 28% tax credit), it’s a dumpster fire of complexity as the article appropriately highlights.

Disclaimer (pasted from last year)

You’d have to be crazy to take tax advice from an internet stranger. You should definitely hire a CPA. Calculating your taxes is scary and complicated. No reasonable person can 1.) calculate taxable income = gross income – 401k contributions – health insurance premiums – HSA/FSA contributions, then 2.) subtract out standard vs itemized deduction, then 3.) compute their tax liabilities based on publicly available tax tables. That is crazy talk! If you underwithhold based on the values of my bogus spreadsheet and face penalties for doing so, it’s not my fault. I have no idea what I’m talking about. My spreadsheet just spits out random numbers, so you’d have to be crazy to make real-life decisions based on it. This is all way too complicated for you to compute on your own in less than five minutes.

Thanks for the interesting summary of the Biden tax plan. FYI, Biden’s proposal to tax capital gains at ordinary income rates only applies to realized income over $1M. The Kitces article has the details: “if an individual had $900,000 of ordinary income and $250,000 of long-term capital gains, only the $1,150,000 – $1,000,000 = $150,000 of gains that represent income in excess of the $1 million mark would be subject to ordinary income tax rates.”

You might consider correcting the bullet in your summary stating that the capital gains tax change applies to you–it wouldn’t (unless you plan on reporting an income over $1M in the future!).

Thanks for the correction! I’ve updated the article appropriately. I’d missed/forgotten that detail from the Kitces article since reading it a few weeks back.

Thanks for fixing it! I really appreciate your efforts to be transparent on the site and work to get details like this correct.

I appreciate having brilliant readers like yourself to call out my (many) blunders and to help me to learn!

Looking back at the Kitces article, it was a glaring mistake on my part. I didn’t reread the article before writing the post today, but it’s evident that that obvious detail didn’t stick with me 2-3 weeks later….

What did stick, however, is the dumpster fire of an accounting nightmare with the 28% retirement tax credit. One detail I forgot to mention in this post, but was brought to my attention through a recent reader comment on my EITC post, is that hacking the EITC will be now be dead: https://frugalprofessor.com/etic-guest-post-on-gocurrycracker/#comment-1531.

Broadly, the 28% tax credit on retirement plans and associated removal of Trad contributions from AGI (and thus state tax returns for many states) effectively eliminates cross-state tax arbitrage going forward since contributions to a Trad 401k will no longer be rewarded by a commensurate tax deduction at the state level. The double-state-income-taxation implication on Trad 401k withdrawals is horrific.

Thanks for the tax calculator spreadsheet. A head of household option would be awesome.

I’m happy it’s useful to someone.

I agree 100% that I should create a head-of-household option. I’ll do so the next time I revise the spreadsheet. If Biden wins, I’m certainly going back to the drawing board anyway….

Thanks for the spreadsheet. I have a similar spreadsheet I use that is tailored to my own circumstances.

I had assumed the above-the-line charitable donation was $600 for MFJ based on earlier articles this year. It’s good to know that it’s not. Also good to know about the “turn the deduction into a credit” for pre-tax accounts. It will be interesting to see where that puts me on Roth contributions to my 401(k).

If it turns out that I’m wrong about the $300 MFJ assertion, please let me know. I guess I’ll run the $600 scenario through FreeTaxUSA in a few weeks to confirm.

I agree it’ll be interesting to see how the Biden policy will affect the Roth vs Trad decision going forward. For those of us living in high tax states (e.g. yours truly), it’ll incentivize people to opt for Roth accounts as the Kitces article explains.

You’re not wrong. See p. 29 in https://www.irs.gov/pub/irs-dft/i1040gi–dft.pdf.

Thanks!!!!

First sentence should read “… for taxes due in April 2021” instead of 2020, no?

Thanks for catching that!