FreeTaxUSA

I’ve been using FreeTaxUSA for a few years now. Despite having the scammiest-sounding name in the world, their software has been great to me. Their business model is pretty straight forward. 100% free federal, $15 for state. Because I’m notoriously stingy, I use FreeTaxUSA for my federal return and use my state’s free self-serve online tool for my state taxes. It takes me about 5 minutes, which works out to $15/(5/60)=$180/hr of income-tax-free money. Plus, by taking the time to use my state’s online tool, it’s a bit easier to “see how the sausage (of state income tax) is made.”

Frugality rant aside, their 2021 software is now live: https://www.freetaxusa.com/

A few interesting observations for 2021

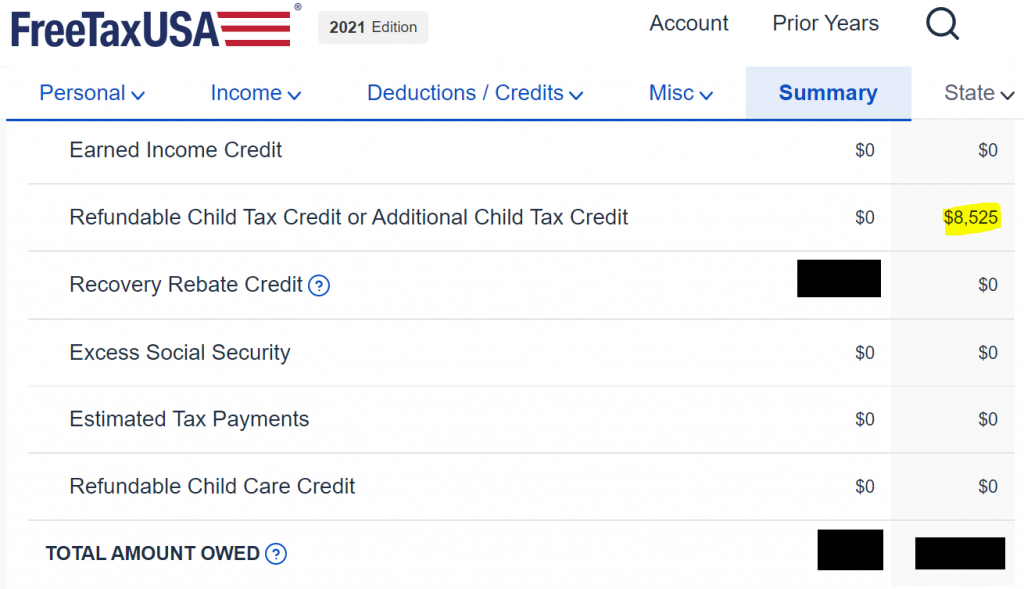

- It looks like FreeTaxUSA has not correctly computed the 5% child tax credit phase-out yet (second screenshot below).

- Kiplinger explains how it ought to work here: https://www.kiplinger.com/taxes/602334/2021-child-tax-credit-calculator.

- 5% phase-out with MAGI above $150k for MFJ, $112.5k for HoH, $75k for single.

- I’m confident they’ll clean that up soon enough.

- Kiplinger explains how it ought to work here: https://www.kiplinger.com/taxes/602334/2021-child-tax-credit-calculator.

- MFJ can deduct $600 of above-the-line (for non-itemizers) charitable contributions this year. Half that if single.

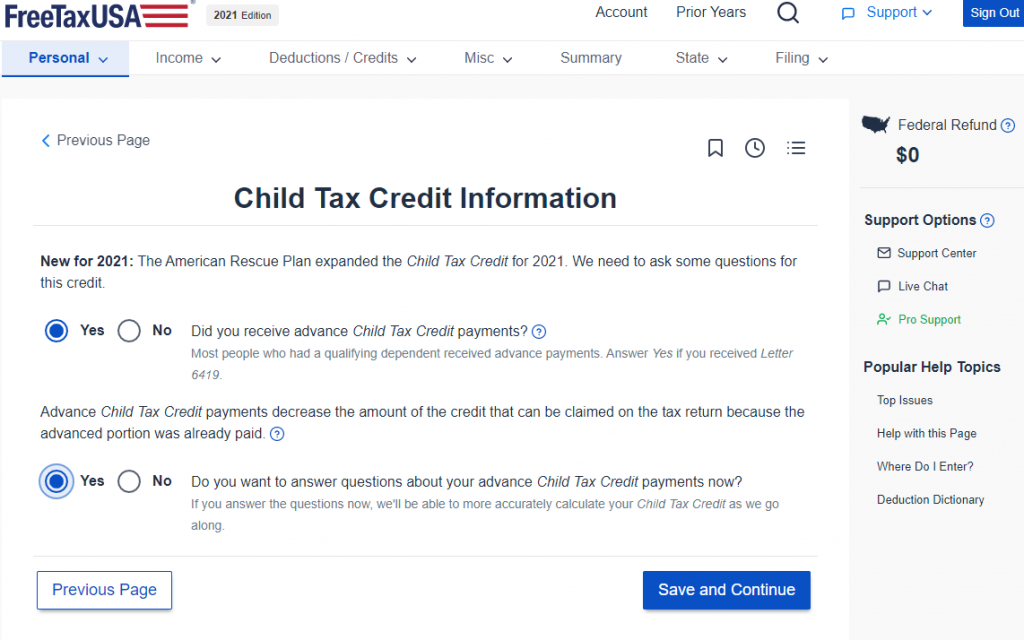

- The questionnaire asks questions about:

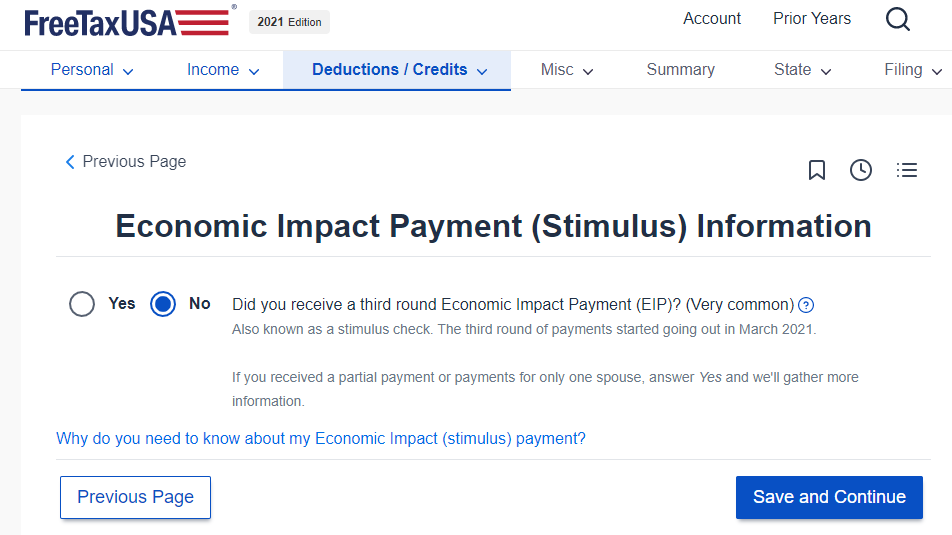

- Whether or not you’ve received your third stimulus yet.

- This was the poorly designed one with >100% marginal tax rates from $150k-$160k of income: https://frugalprofessor.com/stimulus-round-3-proposed-senate-phase-outs/

- If you haven’t received it yet, but are entitled to it, you’ll get it after filing your taxes.

- How much of the CTC you’ve already received.

- This should easily be computed as 6*your monthly payment (since it started in July).

- Whether or not you’ve received your third stimulus yet.

Forecasting Your 2021 Tax Liability

If you are a normal W2 employee, you should be able to estimate today, to a remarkable precision (i.e. within a few dollars), what your 2021 tax liability will be. Filling out a hypothetical W2 should not be hard if you look at your YTD paystub info and extrapolate out to the end of the year (especially when using last year’s W2 as a guide). The only minor source of income uncertainty my family faces is how big our December VTSAX dividend payment will be, but that is easily estimated as VTSAX balance * 1.25%/4 (I don’t think I’d quite noticed until now how low dividend yields had fallen). Households with highly variable and large year-end bonus income are obviously a different story.

Do the calcs jive with my 2021 tax spreadsheet (https://frugalprofessor.com/2021-tax-calculator/)? I think so. However, my spreadsheet nets out the full amount of the CTC, because it is agnostic about the receipt of advanced CTC payments. If you are comparing my spreadsheet to tax software, this will be an obvious discrepancy you’d need to adjust for.

Pretty straight forward portion of the questionnaire. Enter what you will have received in 2021 (e.g. monthly payment * 6).

Pretty straight forward portion of the questionnaire. Enter what you will have received in 2021 (e.g. monthly payment * 6).

Here’s a screenshot of FreeTaxUSA’s bogus CTC calculation (unless I’m mistaken, of course). YTD, I will have received $1,079*6+1=$6,475 of advanced tax payments. FreeTaxUSA claims above that I am eligible for $8,525 more. $6,475+$8,525=$15,000, which is the max of $3k/kid * 5 kids. I’m sure FreeTaxUSA will fix this (pretty obvious) bug sooner than later.

Here’s a screenshot of FreeTaxUSA’s bogus CTC calculation (unless I’m mistaken, of course). YTD, I will have received $1,079*6+1=$6,475 of advanced tax payments. FreeTaxUSA claims above that I am eligible for $8,525 more. $6,475+$8,525=$15,000, which is the max of $3k/kid * 5 kids. I’m sure FreeTaxUSA will fix this (pretty obvious) bug sooner than later.

Question about the third stimulus.

$600 above-the-line deduction for MFJ non-itemizers this year. Half that if single. You’d need to make the contribution by the end of the year.

$600 above-the-line deduction for MFJ non-itemizers this year. Half that if single. You’d need to make the contribution by the end of the year.

Conclusion

Should you invest 30 minutes to play around with some (free) tax software before April 2022?

I think so, for a few reasons:

- It’ll help ensure that your 2021 withholdings are correct.

- It seems suboptimal to consistently receive large refunds (because of time-value-of-money arguments).

- But the vast majority of households receive multi-thousand dollar refunds. This is the norm.

- At the other end of with withholding spectrum, it can be suboptimal to under withhold if you owe penalties (though they tend to be relatively modest).

- It seems suboptimal to consistently receive large refunds (because of time-value-of-money arguments).

- It can help you better understand the black-box (disaster) of the US tax code.

- The entirety of my knowledge on the US tax code has come from me playing around with tax software and trying to reverse engineer the results.

- I’m convinced that a deep understanding of the mechanics of the US tax code can make you a much wealthier individual as you learn to optimize the available strategic tax levers.

- Hence the draft “book” I put together many years ago on the topic: https://www.dropbox.com/s/lv96xgpfp95d3tk/20180531%20-%20Incomplete%20Rough%20Draft.pdf?dl=1

- It’s fun!!!!!!!!

- What could possibly be more fun than playing around in tax software for the sake of learning?!?!?!?

- Playing around with tax software is sure to become the next livestream Twitch phenomenon…

- What could possibly be more fun than playing around in tax software for the sake of learning?!?!?!?

Edit: TaxCaster 2021 is available too: https://turbotax.intuit.com/tax-tools/calculators/taxcaster/.

Credit Karma Tax is completely free, for state and federal. It was sold to Cash App this past year so we’ll see how they handle the roll out on a new venue. I’m a CPA and find more than adequate for all but the most complicated returns.

Thanks for the feedback. Credit Karma Tax is certainly an interesting option. It has been on my radar for some time now. I’ve filled out mock returns there in the past. In its infancy, I think there were problems with the reporting of the backdoor Roth. I vaguely remember hearing about some other limitations as well. Presumably much of that has been cleaned up, but old habits die hard. I like FreeTaxUSA quite a bit.

I volunteered for VITA for several years and did my taxes free through them, but a year ago used H&R block and turbotax last year. Do you think H&R block deluxe is not worth it? It is usually $25-$30 + efile the State.

Given how good the free alternative are, I think paying for tax software is a mistake.

I like FreeTaxUSA a bunch. Lee (and a colleague) recommend Credit Karma Tax.

I think more complex returns will point you to FreeTaxUSA.

There is some inertia at play here. Once you use a service once, it tends to make it easier to use it the next year. For example, with FreeTaxUSA, all of the parameters carry over each year (names, birthdays, employers, EIN’s, investment accounts, etc.). It makes filling out each subsequent return trivially easy. Even in the absence of auto-import functionality.

Thank you. Is freetaxusa all cloud based or you can install it on your PC and backup the data?

It’s all cloud based….

I have not found inertia to be a major problem when switching between other brands of software. In 2014, I easily switched from TurboTax to Block. Everything imported smoothly, with just as much ease as in years when I did not switch brands.

That said, for my situation, Block Deluxe is more cost effective than FreeTaxUSA would be. I believe it is also more convenient.

Cost: I prepare returns for several family members as well as myself. I purchase one copy of the Block Deluxe Plus State downloaded product for around $20 on Black Friday sale each year. This single license allows me up to five free Fed & State efiles and an unlimited number of paper files.

Unlike your state, my state (NY) does not offer a free self-serve online option. On the other hand, NY does not allow tax software to charge extra for state efiles.

So preparing a Fed plus NY return for even just one family member in addition to my own is cheaper with Block than it would be with FreeTaxUSA.

Convenience: Block Deluxe allows me to import data from consolidated 1099s at Fidelity, Schwab, Vanguard, and other financial institutions. Everything populates beautifully into the appropriate places. Especially in years with a lot of TLH or TGH transactions, this can save a lot of time and tedium in data transcription. (Of course, proofreading is still important.) I suspect FreeTaxUSA does not offer this functionality.

Thanks for sharing!

In your situation, it make all of the sense in the world to pay $20 for the ability to prepare infinite returns. It’s nice of you to do that for family.

The only thing I’ve reported on my taxable brokerage account is dividends (since I haven’t sold any stocks in a loooong time). This simplifies the reporting quite a bit. If I TLH’d, that would certainly change things.

After this report on Bogleheads, FreeTaxUSA looks like a very poor fit for those of us who donate appreciated securities to charities and run into the 30% AGI limitations, since it appears that FreeTaxUSA does not even attempt to handle it.

https://www.bogleheads.org/forum/viewtopic.php?f=2&t=363324&newpost=6351525

Thanks for sharing!

I see conflicting indications as to whether HR Block Deluxe supports Schedule D. There own site says it does not. Other advertising says Deluxe supports “investments”. Therefore for 2021, it appears a user would have to purchase HR Block Premium in order to file schedule D. Does anyone know for sure?

The download version of Block Deluxe definitely supports Schedule D. However, the online (“cloud”) version of Block Deluxe does not support it, from what I understand. If you are going the online cloud route for Block, you apparently need Premium. But if you (like me) prefer the download version, Deluxe is fine.

Well, that clears it up, No wonder I was seeing conflicting information on Deluxe., Nothing like a little obfuscation when it comes to taxes. Thank you very much for the kind reply, Have a great holiday.

I need to invest some time to do this before the end of the year. I remember leaving a bunch of tax-free tax-gain harvesting moves based on my income last year. I’ll have to play around with the software to make sure I don’t have that happen again.

I’ve found fewer more financially productive uses of my time than playing around with tax software to better understand the financial implications of scenarios like the one you describe. Best of luck!

Thanks for the post. I will likely play it around with it. I’ve been using TurboTax for years and the fee always annoys me, even if I get a deal at Costco. But the inability on FreeTaxUsa to import the 1099 from Merrill Edge is a big turnoff. I’ve found that manual importing of that more complicated document into tax software can be a little difficult, because the boxes on my 1099 seem to be labeled differently than what TurboTax asks for. It’s easier to just use the import function and trust the software.

If you have a lot of gains/trades to report, then I can see why FreeTaxUSA would not be a great solution because it lacks the import feature.

In my case, I never trade, so it is easy to report the dividend information myself.

I’m not sure what kind of auto-import functionality Credit Karma Tax might have.

Is the OLA credit included in your program?

What is the OLA credit?

From your first bullet point:

“5% phase-out with MAGA”

So if I get one of the red hats, this may affect my return?

I enjoy your website and got value from your “book”. Thanks for sharing your knowledge.

Ha! I’ll fix the typo.

Glad you enjoyed the “book.” One of these decades I’ll get around to finishing it and publishing it…. If you have any feedback for me, perhaps you could email me (email address in header).