Nov 2020 update:

Doctor of Credit discussion that the 75% BoA Platinum Honors bonus might be killed: https://www.doctorofcredit.com/survey-bank-of-america-might-eliminate-75-platinum-honors-bonus-2-62-5-25-etc/. If this eventually happens, it’ll effectively put the kibosh on the strategy outlined in this blog post. Fingers crossed it won’t happen, though I’m worried that the program’s time is limited….

The first two quarters of 2020 are behind us. Good riddance!

It’s been about 9 months since I last did an audit of the BoA’s credit card strategy and I was curious to see how it was going so I ran the numbers on the past 6 month of spending.

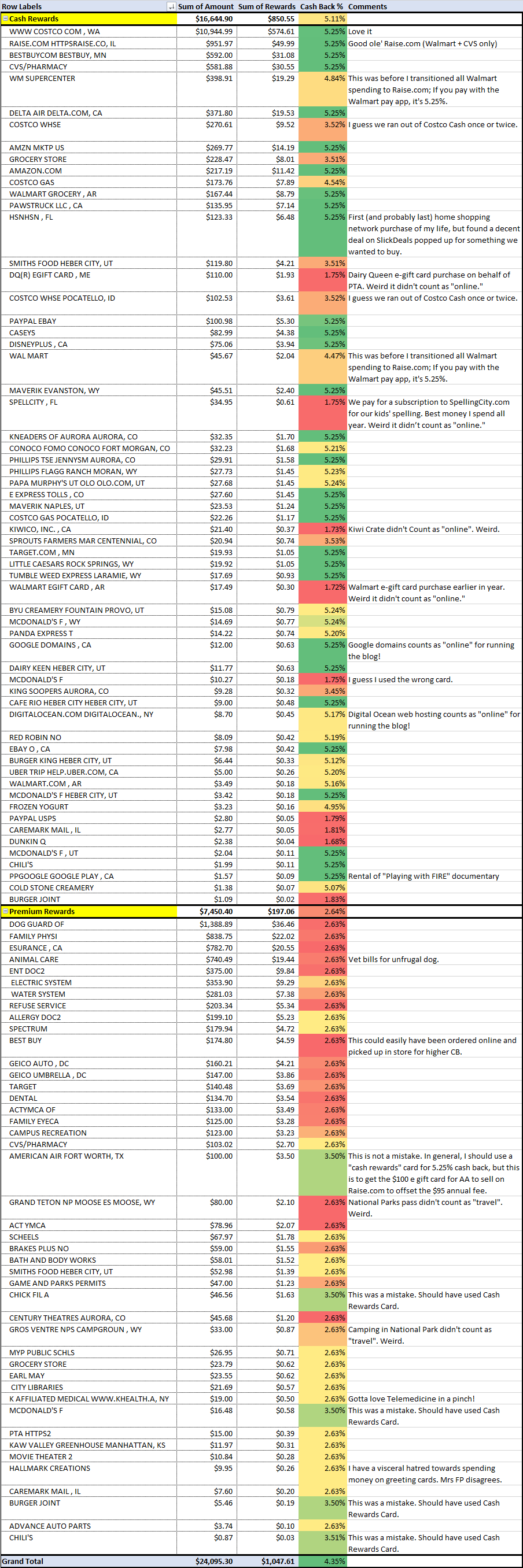

Here are the highlights:

- Cash Rewards

- Across my five (I’m a hoarder) Cash Rewards cards, I’m averaging 5.11% cash back (weighting appropriately by dollars spent). This is primarily “online” purchases as well as in-person purchases (e.g. Costco, Walmart, CVS) funneled through online channels (Costco gift cards or Raise.com for Walmart/CVS). If I didn’t do this funneling, I’d lose 1.75% at Costco and Walmart, earning only 3.5% in the process.

- Premium Rewards

- I’m averaging 2.64% cash back, which is not surprising given that the minimum rewards on that card is 2.625% and all 3.5% restaurant and travel spending should optimally be reallocated to the “Cash Rewards” cards.

- Combining spend across all cards, I achieved an average of 4.35% cash back for the first 6 months of 2020.

- Given that our low-rewards medical spend is front-loaded in the calendar year (before we hit our deductible), it’d be interesting to recompute this for the second half of the year as well as the total year. I’d suspect that this number would be in excess of 4.5% for the second half and around 4.5% for the entire year.

- YTD, we’ve earned just over $1k in tax free money. Extrapolating, it’s $2k/year ($167/month). Not life changing money, but I’ll take it.

- Relative to a simple 2% card strategy, it’s just over twice as much.

- Given the “cash rewards” card, the premium rewards card is pretty impotent.

- YTD spend is about $7.5k on the card (mostly dr appointments, insurance, utilities, etc).

- If I extrapolate to $15k of spending on the card for the year, that provides an extra $93.75 (=$15k*(2.625%-2%)) in CC rewards relative to a simple 2% Fidelity Visa / Citicards Cash Back. Not great, but it’s greater than $0 even after dealing with the AA egift card hassle, so I’ll keep it around for now.

Less important observations:

- I put property taxes on the Premium Rewards card as well, but the swipe fee equals the rewards so I removed it from the analysis because I use CC here simply as a float play.

- Given the 5 “cash rewards” cards across Mrs FP and I, we are WELL (~50%) under the 12.5k/quarter cap (=5 cards*2.5k/card) on the 5.25% bonus. It feels good to not be constrained by that in the event that something big comes up.

- We spend a crapton at Costco.

- Not all of it is food, of course. Car tires, clothing, gas, eyeglasses. It dwarfs all other spending at all other retailers by an order of magnitude.

- The analysis does not consider any additional savings:

- 2% executive bonus at Costco (since this is independent of my CC strategy), which amounted to $350 for us last year.

- 3.5%-4.5% additional cash back at Raise.com for Walmart/CVS gift cards purchased there (since this is independent of my CC strategy). At the end of the day, we don’t spend much at retailers outside of Costco.

- What I show in the pivot table is the aggregation of purchases for the first 6 months. When something doesn’t add up to 5.25% (like Costco Gas around Row 10), this means I used the wrong card a couple of times (e.g. a non-gas “cash rewards” card at Costco gas, earning 3.5% in the process). Same thing for a couple Walmart rows. Shame on me for not optimizing appropriately.

- Mrs FP kind of hates me for subjecting her to this, but it’s a pretty simple system and she’s getting used to it now. “Tiger’s” card is restaurants, etc. When we’re running low on Costco Cash, I’ll put in another $2k order to last us another 6-8 weeks.

Recommended reading to understand the above madness:

Conclusion

BoA’s cash rewards cards are powerful. I’m glad we have 5 of them and have discovered how to utilize the “online” category for in-store purchases at Costco/Walmart/etc.

BoA’s premium rewards card is substantially less powerful (unless your a HUGE spender, in which case the card is the best on the planet).

Is it worth the hassle? It depends on how much you like tax-free free money and whether you have $100k of investments laying around to qualify for “platinum honors” status. I like tax-free free money, especially when it’s recurring and doesn’t take much time. Setting up the system is admittedly a pain in the butt, but once it’s up and running it’s pretty much self sustaining with near zero maintenance costs.

I’ve contemplated supplementing the above by entering the credit card bonus chasing game, but nothing I see on this Dr of Credit post is seems particularly compelling at the moment. Compared to a relatively (ha!) straight forward 5.25% cash back strategy, signing up for credit cards is somewhat of a pain in the butt, especially when you don’t have an existing relationship with a particular bank.

Is there a card with a big signup bonus out there that is worth the hassle? I have a $4k property tax bill coming due in 3 weeks….. I don’t think anything <= $500 is worth the time, but maybe I’m getting too old and lazy.

I just signed up this card – U.S. Bank Business Cash Rewards Card – $500 , which requires $4,500 in spend within 150 days. The sign up bonus is good plus it has 0% APR in purchases for 15 or 18 months (likely 18, cannot remember). Btw, how do you export the transactions from BoA online portal to excel spreadsheets?

Thanks for the recommendation on the US Bank card. The other thing I’m considering is the $900 ME bonus (https://www.merrilledge.com/offers/900offer). Conditional on having the assets, it seems like a much easier to get than a credit card bonus.

Exporting transactions from BoA isn’t easy. I simply copied and pasted from the webpage; it’s a bummer there’s not an export to CSV option. Given the slight hassle, I think it’s the last time I’ll ever do a formal analysis. But it’s a pretty fun analysis to run.

I’m moderately tempted to try this with putting tuition payments on a credit card. The university passes on only a 2% fee so if I can get higher than 2% back, then I win. I’m currently using the Fidelity Rewards which maxes out at 2%. However, I’ll still have the WAF (wife acceptance factor) to overcome. I have to be careful what frugality I subject her to.

I’m obviously a fan of the BoA system. I take the active roll of replenishing Costco Cash + Walmart gift cards, so it’s pretty seamless for Mrs FP. She carries two cards: the Premium Rewards and a Cash Rewards (tiger version). Here’s the instructions:

If Costco use Costco Cash

Else if Walmart, use Walmart pay.

Else if Restaurant/Grocery, use Tiger card.

Else use Premium Reward card.

I don’t think it’s the worst thing in the world. Mrs FP is slowly accepting it. Cash back adds up and I get irrationally happy knowing that I’m getting more cash back at Costco/Walmart than anyone else I know of.

I’ve been thinking about the pros and cons of the automatic redemption feature. If I have three total BOA credit cards (two Cash Rewards and one Premium Rewards), and I set them all to automatically redeem, does it redeem all available amounts for all 3 accounts on the 31st of every month? Thanks.

My cash rewards are available to me on the 5th of every month because my statement closes on the 4th. Like you, my auto-redemption is effective on the 31st of the month.

I have it set to auto-redeem, but usually remember to transfer manually at the beginning of the month to get it sooner.

Gotcha. I’ll think I’ll leave manual for now. I’m such a nerd anyway that I enjoy looking at my rewards and redeeming them as soon as the applicable statement closes.

I really should do this — Cook County charges a 2.1% swipe fee to use a credit card for property taxes, so I could actually turn a small profit if I paid with the Premium Rewards card.

It’s a good system; My county charges a 2.35% swipe fee so I turn a slight profit as well, but I mainly use it for 60 days of float since I swipe at the beginning of my cycle.

Rakuten is offering 2% cashback on Raise at the moment.

Thanks for the heads up!

Dear Professor,

I’m thinking of applying for the Bank of America’s cash back credit card, and was wondering if online payments of utility bills (water, electricity, waste management) and/ or online payments of real estate taxes would fall within their “online shopping” category.

If not, would you happen to know of another cashback credit card for a good cashback on home utility/ RE tax bills, and/ or even IRS estimated payments?

Thank you very much!

Those sorts of payments (utility bills and taxes) generally won’t fall under the BOA Cash Rewards “online shopping category”. So if that’s your main expense that you are seeking cash back on, your 2 best choices would likely be to either (i) get the BOA Premium Rewards, which will give you 1.5% base plus the preferred rewards bonus (so if you’re platinum honors, the total cash back would be 2.62%) or (ii) get one of the other non-BOA 2% cash back cards out on the market.

P.S. also wanted to ask if monthly payments of Anthem medical insurance premiums would also fall under as “online shopping” category of the Bank of America cashback credit card..

Same with medical payments, they will generally not count as online shopping.

Can you explain more about how you put so many of your monthly bills on your BofA card? For example the water bill, electric bill, cable bill, and insurance.

I have user accounts on each of my utility company websites. I log on, set up autopay with credit card, and never have to worry about paying bills on time. I’m fortunate that most of my utilities allow that. I think there’s one that doesn’t autopay.

Were you actually able to sell an AA gift card on Raise recently?

I haven’t tried it since January. It does take a while to sell once listed because there is a 60 day anti-fraud hold listing on that particular transaction for some reason.

Which Bank of America checking account did you open? I’m thinking of pulling the trigger on this and not using the checking account for anything other than getting the rewards (keep a $0 balance). I see three on the site, all of which waive the fees if you are enrolled in Platinum Honors.

I have the “Adv Relationship Banking” account. I keep $0 there and the only purpose of the account is to fulfill the program requirement that I have a checking account. I avoid fees with my platinum honors status. CC rewards are dumped there and immediately swept to my primary bank (Fidelity) or investments.

Another example of how relatively generous the “online shopping” category is: Uber trips code as online.

Agreed. It’s really generous!

@FrugalProfessor

If you are targeted for 100k+ on the American Express Platinum, that’s easily worth at least $1000. It does have a large annual fee, but if you can make use of the credits, it’s still winner, especially for 12-13 months.

Thanks for the heads up!

Love your stuff, FP. I fell in love with BOA CR cards before stumbling on your blog, and your experience with the BOA PR solidified my opinion that it’s not as lucrative. These are great cards if you have funds with Merrill and can access the higher earn rates.

I do think you are missing out on the sign up bonus game. Over the last couple of years, I earned a net 20% back in point value plus cash back on my property taxes after swipe fees. If I have any large expenditure (e.g., tires, season tickets), I try to use the expense to hit a sign up bonus. I do have to track everything on a spreadsheet, but that’s no big deal.

In terms of smaller non-category spend, I recommend the Hyatt card if you travel and have at least $15K non-category spend per year (because that gets you an extra free night worth 15,000 Hyatt points, making the return 2 points per dollar worth 1.7 cents per point = 3.4%). In addition, Citi Double Cash can be very lucrative when paired with Citi Rewards+ and Citi Premier. Rewards+ means you earn 2.22 Thank You points per dollar, and Premier allows you to transfer those points to partners where the points are worth up to 1.7 cents each making it 3.74% back).

PecanPlan,

Great to hear from you and I appreciate the constructive criticism of leaving dollars on the table. I’ve mentally bookmarked this comment for further digestion. I agree entirely that there are free dollar bills to be picked up – it’s just a function of wrapping my head around what the dollars per hours of hassle is.

Once I wrap up my refi (any day now), I’ll have the mental bandwidth to start optimizing in other areas…..

Hi FP,

Your BOA setup has been inspiring. Your color coded spreadsheet in the post above looks nice. I am good with Excel and can roll my own. My question is about data. How do you load the rewards data? The only place I see rewards data is on the “Rewards Tab” and I don’t see a way to download it. I could copy the data manually and parse in Excel w/VBA, but that seems excessive. Are you downloading the CC transaction data + Rewards data from some place on the BOA website that I haven’t found yet? How are you getting the data for analysis?

Thanks

– L

BoA isn’t great with exporting data. I’m pretty quick with Chrome + Excel so I just took a few minutes to copy and paste. No VBA for such a simple task. I wish there was a way of download the data, but there isn’t.

Once imported, it’s just a simple pivot table of course.

That helps and confirms that I wasn’t missing anything for downloading data. I was using Safari and pasting into Excel was a bit ugly and would have taken a bit to pull apart the pieces. Chrome pastes in much better as the columns from the website go into separate columns in Excel. Too bad the defined bonus category doesn’t come along. It isn’t bad as you can infer based on the reward % and what you have the 3% category configured on which card. It will at least help doing some reporting.

I noticed I can get the bonus category to copy/paste if I expand each item by clicking the arrow. That isn’t going to happen once we get fully cut over to the BOA cards.

– L

Curious to know if you are you still using this system in 2023. Have you made any changes or found out anything new about the system? It’s become harder to sell the AA gift cards since the card-reselling sites currently don’t take AA cards–does that affect your thoughts about the Premium Rewards card? I’m using multiple Customized Cash Rewards cards and it’s working great for me; the Premium Rewards card is where I’m wondering if I should make a change this year.

The only change I’ve made recently is introducing a 6th cash rewards card this year to the system (3 for me, 3 for spouse).

I’ve had similar thoughts to you about the PR card. I like the PR card quite a bit, but the “unlimited cash” card looks pretty compelling to me as a replacement to PR if you don’t fly American.

Since I don’t fly American, I’m considering trying out the United Travel Bank this year (since I fly Untied). Check out DoC for the discussion (e.g. https://www.doctorofcredit.com/triggers-bank-america-premium-rewards-100-travel-credit/#comment-1530734)

In summary, I like the PR card quite a bit and am hoping that the United Travel Bank will work for me. If so, I’ll keep it. If not, I’ll probably dump it next year.