Today, I helped my 17-year-old daughter file her taxes. Since she doesn’t earn much income as a teenager, we opted to use TurboTax for its free federal and state e-filings. While I don’t love TurboTax, I’ll grudgingly use it when it’s truly free—which is the case for my teens.

After submitting her return, we were redirected to a Credit Karma landing page (both TurboTax and Credit Karma are owned by Intuit). To my surprise, Credit Karma allowed my 17-year-old daughter to open an account.

I started adding my five children as authorized users on several of my credit cards over a decade ago. My goal was to help them achieve the perks of high credit scores as they left home—lower borrowing rates, better credit cards, rent approvals, etc. However, as they’ve gotten older, I’ve come to appreciate the practicality of them having reliable payment methods, both physical cards and digital wallets.

Here’s what I learned through Credit Karma today:

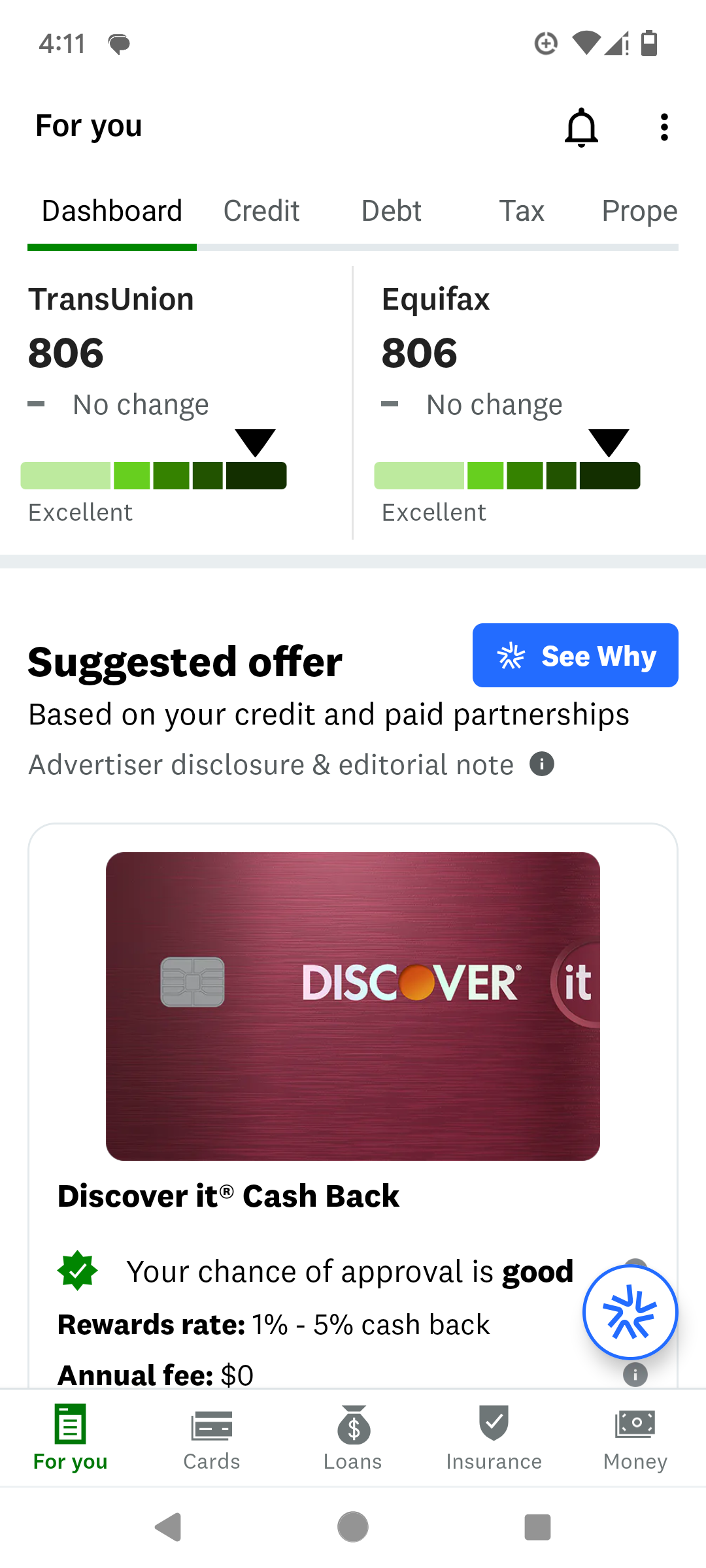

- My daughter has an 806 credit score with both TransUnion and Equifax.

- This score places her in the top 10% of the entire population.

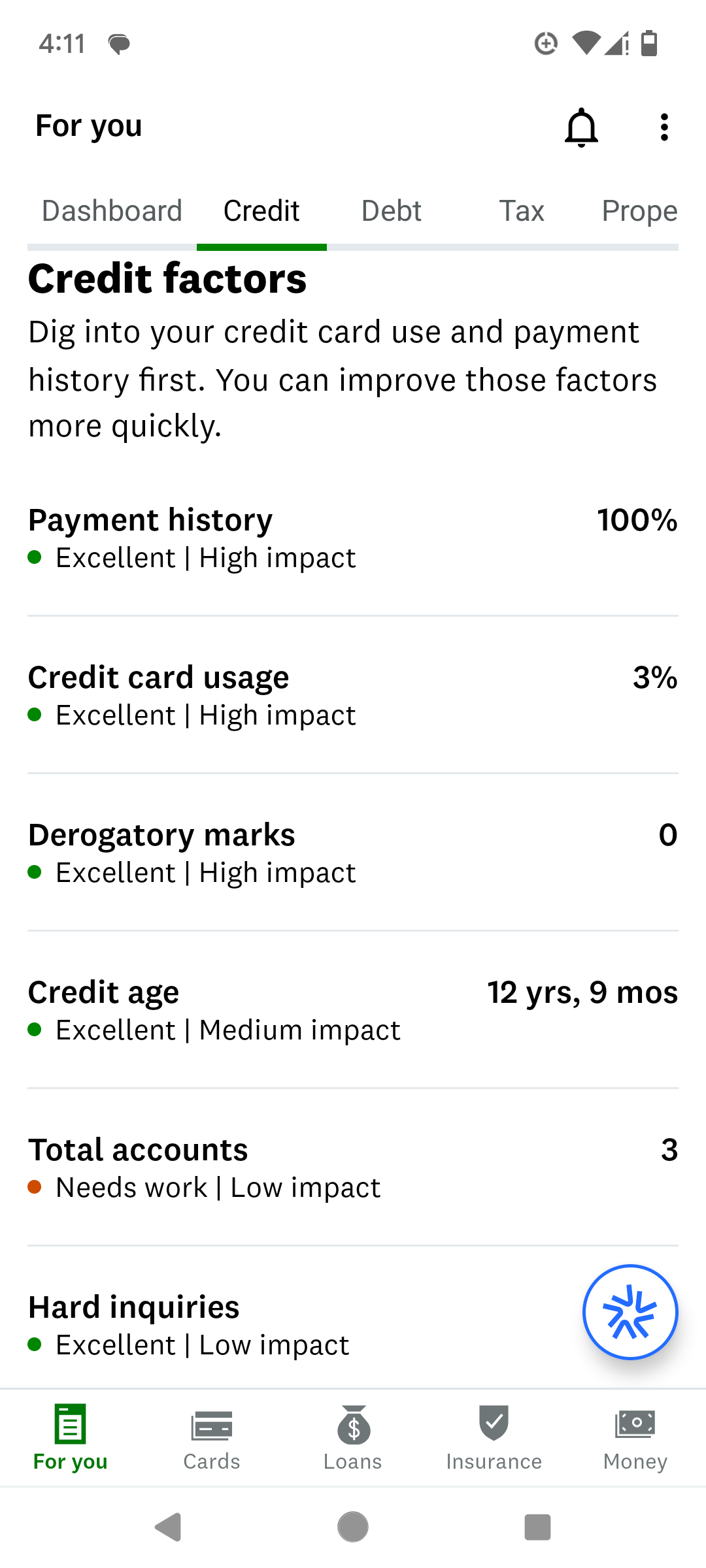

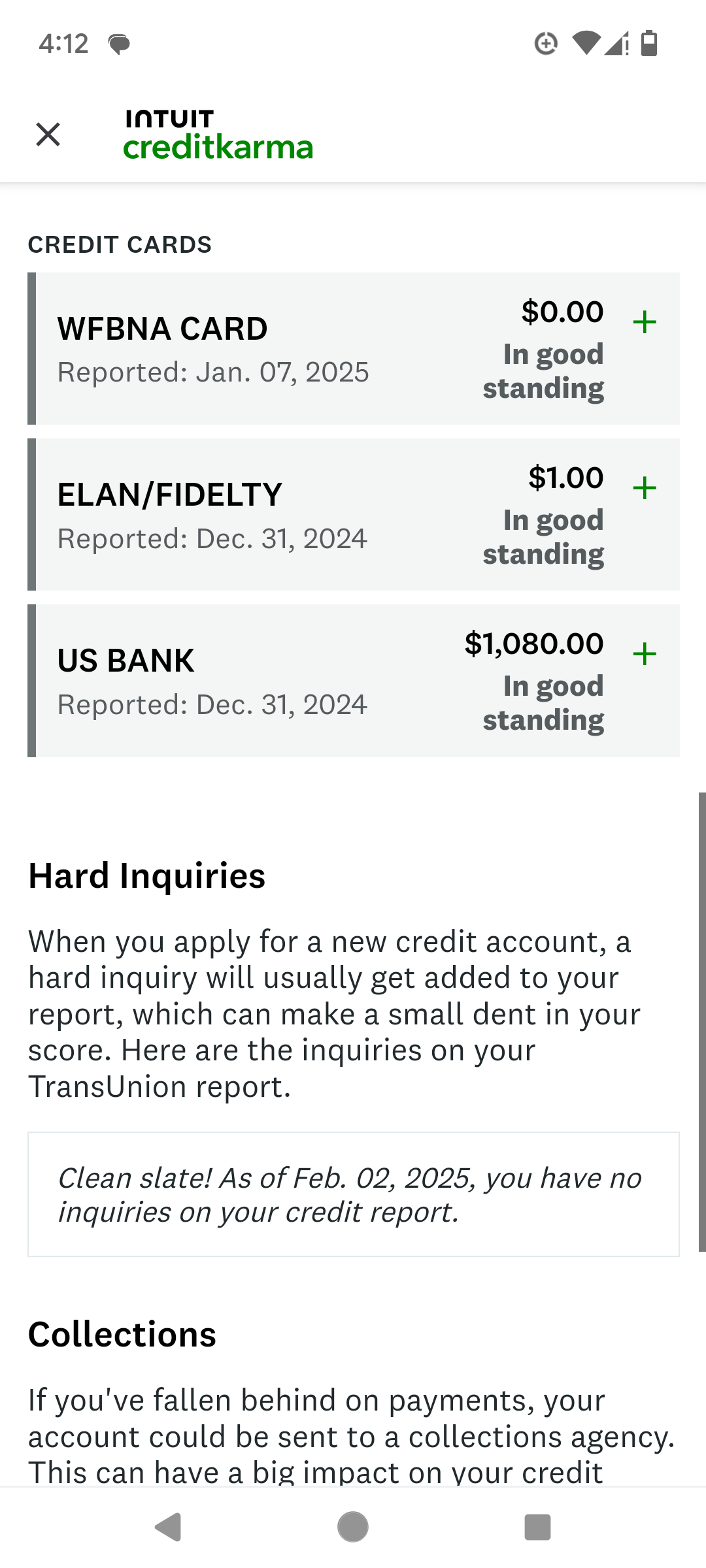

- She has three credit cards listed on her report, all from being an authorized user:

- Which banks reported AU: Wells Fargo (Platinum), Fidelity (2%), and US Bank (4% Smartly).

- Which banks did not report AU: Bank of America (neither 5.25% Cash Rewards or 2.625% Premium Rewards worked).

- Here’s a NerdWallet article I found on the topic, but some of it contradicts my experience above.

- Her average credit age is 13 years.

Yup, her credit age is 13 years despite being only 17. If not for the recent addition of a US Bank Smartly Card, her average credit age would be ~20 years. It’s absurd to think that a teenager’s credit age can exceed their physical age, but that’s how this silly game works.

Perhaps it’s noteworthy to mention that my ~25-year-old Wells Fargo card and my ~20-year-old Fidelity card have spent the last 15 years or more unused, collecting dust in the proverbial sock drawer. This highlights a very real, tangible benefit of keeping $0 annual fee cards open.

Why to Add as Authorized Users

Adding children as authorized users to credit cards has several advantages:

- Building a Strong Credit History: By the time they reach adulthood, they already have an established credit record, which can help with renting apartments, getting favorable loan rates, and even landing jobs.

- Financial Education: Having access to a payment method under supervision helps them learn responsible financial habits.

- Practical Convenience: It simplifies family logistics when kids can make purchases independently.

Addressing the Obvious Risks

Some might argue that gifting an 18-year-old a stellar credit score is like handing them a Ferrari on their 16th birthday—a potentially reckless move. But I trust my children to make wise financial decisions — they’ve grown up understanding that credit cards are tools, not free money. We’ve always emphasized treating credit cards like debit cards and know not to be scared of credit.

However, if they do make financial mistakes as adults I’d rather it be on their own credit accounts, not ones I’ve co-signed. My first credit card in college was co-signed by my mother—a move I’m grateful for, but one I’d prefer not to repeat with my own kids.

FAQs About Adding Children as Authorized Users

- What age can I add my child as an authorized user?

- It varies by issuer. Some allow it as young as 13, while others have no minimum age requirement.

- Will adding my child hurt my credit?

- No, their spending is your responsibility. As long as you manage your account responsibly, there’s no negative impact.

- Can your poor credit behavior harm your child’s credit?

- Yes. Don’t add your children as AUs if your credit history is poor.

- Does it matter when I add my child — is sooner better than later?

- In most cases, the age of the account is retroactively applied to the authorized user’s credit report, so adding them earlier doesn’t necessarily offer a big advantage. What matters is ensuring the account remains in good standing.

Conclusion

For various reasons, I think adding children as Authorized Users to credit cards — particularly those with long and positive credit histories — is a good idea.

Some Screenshots for the Curious

FYI, FreeTaxUSA has free state filing too, but you have to access it through the IRS link: https://www.freetaxusa.com/freefile2024

Interesting. I had no idea!

Appreciate the post FP. As a new dad this is a good reminder to check off my to-do list.

One thing to keep an eye on are the credit score models banks and aggregators like Credit Karma are using. The model providing the score (typically FICO 8 or some version of VantageScore) is usually in the fine print at the bottom. Over the next several years card issuers will likely be migrating to newer FICO 10 scoring models which treat authorized user tradelines as less valuable or in some cases even higher risk since they’re frequently used by fraudsters who build synthetic credit profiles at the credit bureaus. That being said, don’t be too surprised if in the future one of the younger kids shows up with a credit score quite a bit lower.

Good to know about FICO 10. Thanks for sharing.

My initial reaction when I read this post was, “why is his 17-year-old filing a tax return?” I was under the impression that they didn’t withhold taxes from teenagers. So I checked my son’s W2, and sure enough there were ~$150 taxes withheld. Good thing I checked!

My daughter made a similar amount as my son, but didn’t have any federal withholding (and $7 of state taxes for some reason).

Am I missing anything else about filing for teenagers, or is the only reason to file if they had taxes withheld (assuming their income didn’t exceed the standard deduction)?

I try to set up their W4s as “exempt”, but inevitably the employers screw it up and I have to file to get back the withheld taxes (since they have $0 liability).

Further, even absent the above, I like to establish the paper trail with the IRS of earned income to justify the 100% gross income Roth IRA contributions from age 13.

After adding her as an authorized user, did you setup an account on the credit bureaus for monitoring? How about a credit freeze, did you set that up for her?

I first added my children as AUs when they were very young.

With my oldest turning 18 soon, I’ll get her set up properly for credit freezes, etc.

For her to get an 806 score, I did nothing more than add her as an AU to a few of my credit cards. Again, some of this was motivated by transactional convenience, and some was intentionally done to boost her score.

Since writing this post, I double checked that all of my children are AUs on my oldest cards. For Wells Fargo (my oldest), some were not so I added them.