Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Beau Miles tries his hand at replicating the Seinfeld (Kramer) aluminum can redemption arbitrage (link).

- His other videos are astounding (link).

- Mediocre Amateurs continue to inspire me (link).

- Clipping Chains interviews the White Coat Investor (link).

Life

- I got a bad case of poison ivy on my lower leg while playing disc golf. Would not recommend; 0/10 stars. The recovery lasted a good 4 weeks. Lesson learned: wear pants. I’ll do the world a favor and withhold the images.

- We chased the kids around a lot. Cross country, soccer, and ninja.

- I’m considering doing this $2,500 Wells Fargo bonus, which apparently expires in 4 days.

- Has anyone taken the plunge on this in the past? Is it worth the hassle?

- If Mrs FP and I could each do that, it would appear to be a pretty attractive offer.

- I need to figure out how jointly owned accounts would work with this…..

Enjoying a glorious sunset while playing Kan Jam, our favorite lawn game.

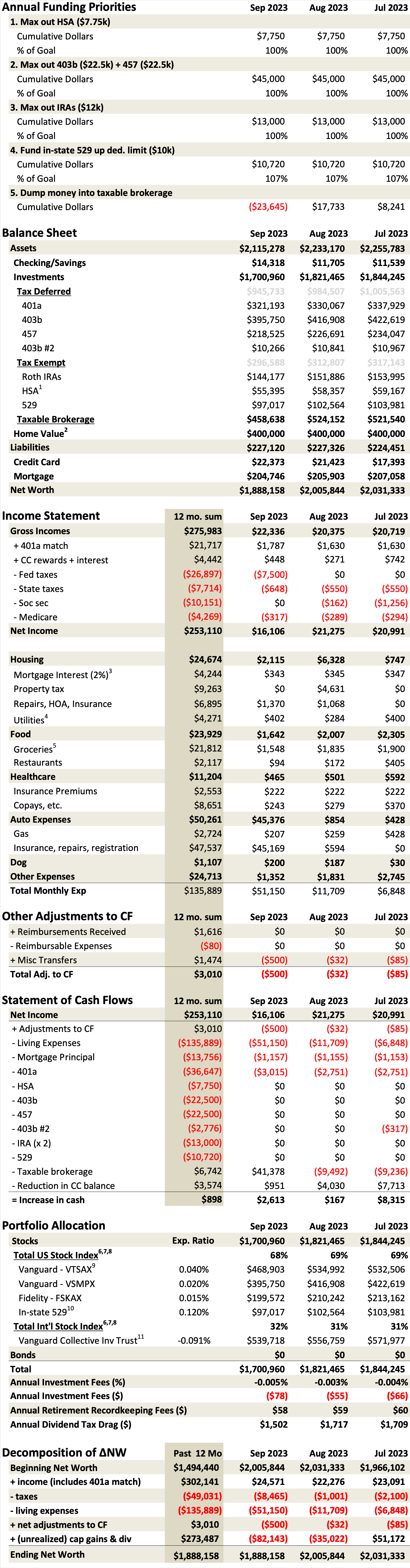

This Month’s Finances

- The good:

- Still employed.

- Costco refunded us $180 from our recent washing machine purchase because it arrived with a dent in the back.

- The bad/abnormal:

- We bought a $40k (net) Tesla Model Y LR (relevant blog post).

- $1,500 for charger + installation.

- Is this an automotive expense? Home maintenance expense? Given that it will stay with the home when we move, and presumably add some value to it, I arbitrarily classified it as “home maintenance.”

- $1,500 for charger + installation.

- $82k in investment losses, which constitutes our 5th-worst investing month in dollar terms, though that is somewhat mechanical and unsurprising given our growing portfolio size.

-

- $400 in repairs for beater Corolla. New brakes, rotors, and transmission flush. Hopefully it will last another 100k miles.

- A mechanically-gifted friend installed the brakes for me. In a former life, I would have done that myself but I’ve gotten soft.

- $400 in repairs for beater Corolla. New brakes, rotors, and transmission flush. Hopefully it will last another 100k miles.

- $170 for allergy meds for unfrugal dog, purchased at Costco.

- We bought a $40k (net) Tesla Model Y LR (relevant blog post).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Root of Good recently did the WF bonus – he sounded happy.

Great data point. Thanks for sharing. I must have read that in his recent update and forgotten it.

I have a technical/nerdy comment to add. I struggle with this too, but I think accounting for your car as an expense is incorrect and makes all your calculations and graphs wonky for 12 months. I track all of my finances in a similar manner as you and was challenged on how to account for a car purchase (I bought a Rivian in July) properly. Ultimately, I considered it an “Asset Purchase” and didn’t include it as an expense – kept it completely on the Balance Sheet and away from the Income Statement. My net worth simply rotated and will adjust monthly based on depreciation (I check KBB monthly to value the vehicle). In the end this doesn’t actually matter and is really an accounting question, but all your charts and calculations will assume you buy a new vehicle every year going forward. And in another view, if you were to sell the car in a month and net $35k in cash, would that be income or negative car expense?

I agree with you in theory, but I’m lazier than you and don’t care to depreciate the car on a monthly basis. As a result, my auto expenditures are indeed inflated this month relative to the underlying economics. Further, to your point, if I were to sell I’d account for it as a negative expense. Maybe not very sophisticated from an accounting standpoint, but it matches the cash flows pretty well and is easy to keep track of.

How are you enjoying the Rivian? R1S? R1T? The R2 line has me somewhat interested. My brother-in-law just got a free company R1T through his work.

I get the laziness and the fact that the accounting won’t matter in the long run (after 12 months).

Regarding the Rivian, it is awesome. I doubt any car company will ever build another car like it at this price point – Big Battery, Four Big Independent Motors, Highly Advanced (McLaren) Suspension and all at negative gross margin. The R2 should be great and more in line with reasonable costs, but I doubt we will see many until 2027. A free R1T sounds sweet, what kind of job gives out that perk?

My brother-in-law is a podiatrist, but he does a lot of traveling to in-home visits so his employer pays for his transportation. He used to have a Model 3 but was recently upgraded to the R1T. I think he likes it quite a bit.

I have watched a lot of Sandy Munro on YouTube and he seems bullish on Rivian. He personally bought a R1T and is apparently really happy with it. He’s a big off-roader, so that’s basically the perfect car for him.

Are you off-roading on yours or do you keep it on pavement?

Funny you ask. I never off-roaded before, but the car is so capable that I have dipped my toe in. So far I have taken it out on Assateague Beach a few times and that has been tons of fun. Now I have visions of putting off-road tires on and taking it out west for real adventure … maybe some day.

Sounds like a blast!

I don’t off-road much, but when I took my family backpacking in WY this past summer I lamented the poor off-roading capabilities of our fully loaded 2012 Sienna. Thank goodness we weren’t stranded with mechanical failures.

I’ve been closely following the Cybertruck development through the years. I’m curious to see how it turns out…

Putting your cash in a money market account for 90 days will give you a better return than the WF bonus and do be less work….unless rates crash. Congrats on the Tesler.

Agreed if I were parking cash there, but what WF has a self-directed brokerage option. So I’d transfer MFs there for 90 days and pocket the $2.5k (no buying/selling, so no cap gains. No opportunity cost of forgone investments). That is the premise of this page: https://www.doctorofcredit.com/best-brokerage-bonuses-earn-up-to-3500/. With enough assets and time, you could easily pocket $15k/year chasing promotions.