Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Andre Agassi’s autobiography/memoir, Open (link).

- I heard about the book in the comment section of the WSJ this past month. I checked out the audiobook from the library and devoured it in about 3 days. For those who don’t care about tennis, you could probably skip the middle 60% of the book, but the first third and last 10% should be appealing to non-tennis buffs. As a child of the 80s/90s, I grew up idolizing Agassi. I still remember vividly watching him play an epic match against Blake in the 2005 US open when he was 35, one of his last.

- Rick Ferri interviews Kaye Thomas, the founder of the tax website Fairmark (link).

- Nothing terribly new or earth shattering, but I love a good tax geek-fest as much as anyone.

- Guy Raz interviews the founder of Prenuvo, a company that does preventive full-body MRIs (link).

- A (new) 3.5 minute drone fly-through of Tesla’s Berlin factory (link).

- Mr Clipping Chains dropping knowledge (link).

- Happiness is what we have minus what we want.

Life

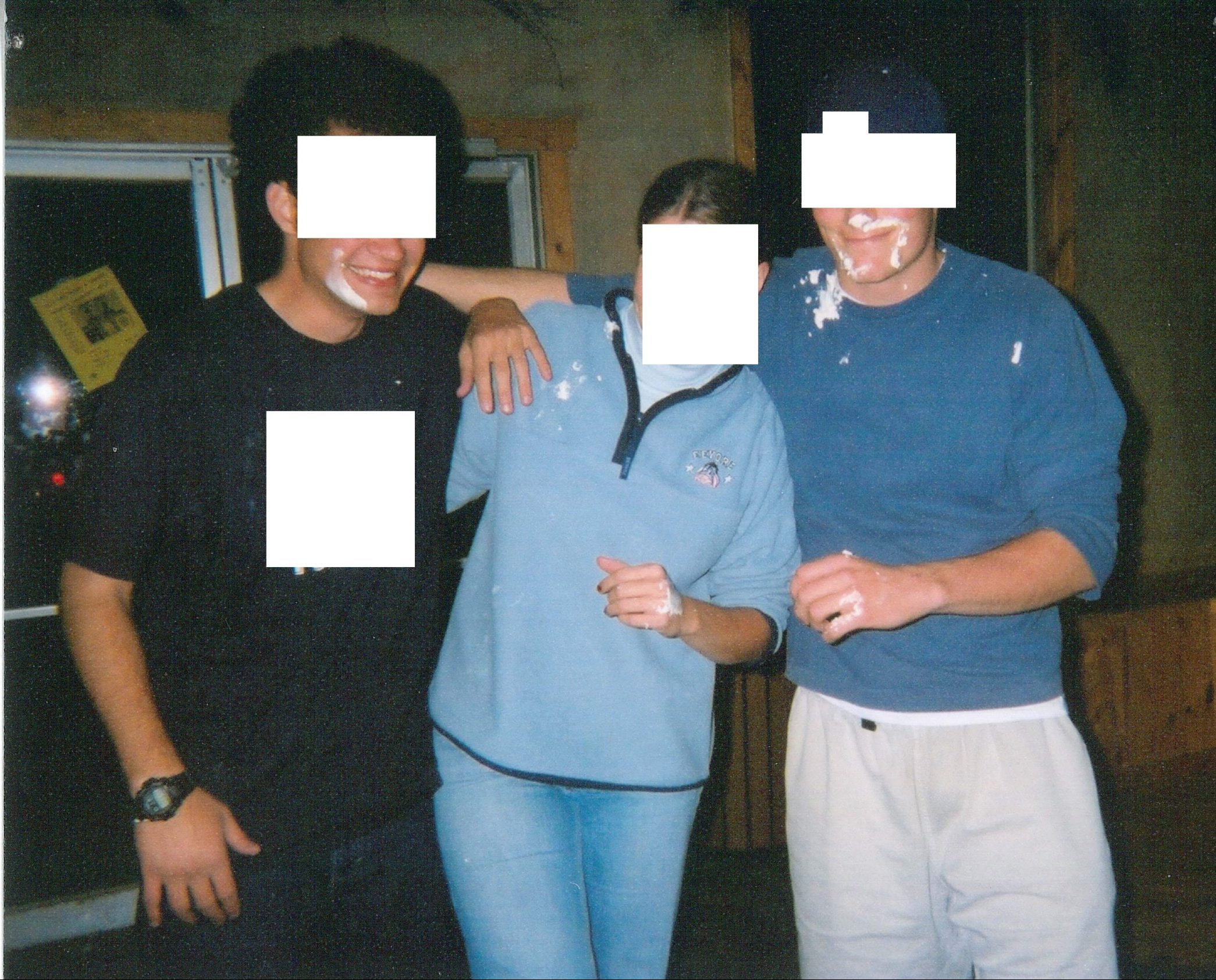

- One of the great joys in life is playing “the whipped cream game.” A friend of mine taught it to me in High School. It’s been a few years since we’ve done it with the kids, but it’s a guaranteed good time. Mrs FP and I did it at the beginning of our friendship. Wear a shirt you don’t mind getting stained (or create a makeshift poncho). This reddit video brought back some good memories (link).

- I participated in another climbing competition on campus and finished in 8th place. The winner was a 15-year-old freak of nature who competes at the national level. I never cease to be amazed (…demoralized if I’m being honest…) at how good these gravity-defying teens are.

- A colleague bought the Apple Vision Pro headset and let me try it before returning it 2 weeks later. It was pretty cool, but not worth the $3,500 price tag. It strikes me as a solution desperately in need of a problem.

- That said, I’ve been wrong before in my predictions. When streaming came online in the early 2000s, I was a DVD subscriber to Netflix and couldn’t see the wisdom of paying the same price to Netflix for its inferior streaming library (at the time, Netflix’s DVD library was much more robust than its streaming library). Suffice it to say, I was a little wrong on that prediction.

- In the future, perhaps we’ll all walk around with computers strapped to our faces 24/7….

- That said, I’ve been wrong before in my predictions. When streaming came online in the early 2000s, I was a DVD subscriber to Netflix and couldn’t see the wisdom of paying the same price to Netflix for its inferior streaming library (at the time, Netflix’s DVD library was much more robust than its streaming library). Suffice it to say, I was a little wrong on that prediction.

- FC2 got her driver’s permit a few months ago. Due to a combination of 1.) bad weather, and 2.) personality conflicts between FC2 and me, I hadn’t been behind the wheel with her yet. I finally got out with her this month. It is terrifying to have another teen driver in the house, but slightly less so this time around. FC1 accompanied us on our drive and had the absolute time of her life watching me instruct (….lose it with…) FC2. I don’t think I’ve ever seen FC1 happier in my life. One teen driver “taught”, only 4 more to go… Until then, I daydream of the day when my insurance premiums return to normal.

- Mrs FP left town for just under a week to caretake for her mother after a hip replacement surgery. Miraculously, the kids and I survived without her. She makes parenting look easier than it is.

A much buffer and younger me after playing the whipped cream game with Mrs FP and a buddy. Photo taken in fall of 2003, over 20 years ago. How fast time flies.

FC1 doing the butterfly. She wrapped up her first season of swim team this month. She’s in lane 7 at the bottom.

A friend and I visited the golf simulator on campus. It was pretty fun. Years ago, my boys used to love doing this more than anything.

Manchild FC3 with his luscious mane playing middle school basketball (42). He is really starting to fill out. I’m dreading the inevitable day he becomes stronger/taller than me. Until then, I remind him who’s boss every chance I get on the basketball court and elsewhere. Speaking of middle school basketball, in 8th grade I tried out for my middle school team. During tryouts, a fellow (short) point guard and I were going at it — competing like our lives depended on it. In a moment of weakness/desperation, I suggested to him that if we both go easier on each other, we’d both look better to the coaches. Suffice it to say, he did not take me up on my offer. He ended up making the “normal” 8th grade team, whereas I was relegated to the “C” team — designated for the short people (5’2″ and under). He ended up playing throughout high school, playing D1 ball at UCSF, med school at UCSF, fellowship at Stanford, and is now a professor of pediatric cardiology at Stanford (here he is). I’m sure there is a life lesson to unpack there — I think I can attribute everything wrong in my life to that moment of moral weakness at the age of 13.

Jamming a foot on a tough boulder.

Starting a crimpy route…..

My kids made me good luck signs, which put a smile on my face. The top right sign says “Beat those teenage boys.”

FC2 driving. Look out world.

FC2 just wrapped up her first “show choir” season. For the uninitiated, this involves singing and dancing. When applauding for soloists, instead of clapping and disrupting the song, you simply raise your hands and twinkle your fingers towards them. I feel so cool every time I do it — like I’m a member of the secret finger twinkling society. I volunteered at a show choir competition for a few hours as an usher. A fellow show-choir dad (whose daughter is in the varsity show choir) enthusiastically came up to me and congratulated me for how much the freshman group had improved over the year, including the synchronization of Oscar the Grouch’s mouth to the lyrics. I was unsure how to respond to that comment, and remain confused several weeks later. I think I responded with a one-word sentence, “Thanks.”

I want to be a fly in the room of when the Costco executive approved selling a $410 (when not on sale) 3.4 oz moisturizing cream unironically named “Lamer.” What is it made of? Fairy tears?

This Month’s Finances

- The good:

- Still employed.

- The bad/abnormal:

- $508 for plane ticket to Anchorage.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Ha ha! That La Mer stuff has been out for many years and was rumored to be a fountain of youth. Very funny to see it being sold at Costco.

Just wanted to say that I appreciate how you block your family’s identity in your posts. I feel sorry for kids who have an online presence without their control.

I’d never heard of La Mer before. If it’s the fountain of youth, I guess I’ll have to start putting it on my oatmeal each morning.

Posting kid pics/videos seems especially egregious when monetized through influencing or vlogging. In the early days of Blogger, we maintained a family blog but was invite only. But those days (and norms) of privacy are long gone.

The Agassi memoir is great! Shortly after reading it, I saw something on ESPN.com, where sports commentators were thoroughly confused by Agassi’s insult of Pete Sampras as a “bad tipper.” As I had learned from the book, Agassi’s dad had worked for tips, so coming from Agassi, it was quite the insult.

After finishing the book, I stumbled across this YT video of the two of them playing a charity exhibition match. The issue of stingy tipping was brought up by Agassi. Seems like there is still some animosity there. https://www.youtube.com/watch?v=4QSK9t6OrgU

Thanks for the interesting update again. I’m going to get the Agassi book.

As I was reading your post this month, I was curious about your thoughts on asset location of

your international funds vs. the US based funds. I understand the Boglehead preference of putting

Int’l into taxable in order to claim the tax credit, but am still not convinced since the foreign

funds generally have a higher dividend rate. Not sure if this optimization depends on current earnings.

In any event, as someone that is 70/30, I suspect you’ve thought about this and am interested in

hearing your thought process on optimization.

Great question. I wrote a blog post about asset location here: https://frugalprofessor.com/asset-location/

Last time I did the math, it made more sense for me to hold int’l stocks in tax-sheltered accounts due to the higher dividend yields and lower QDI ratio. This site tells me that only 59% of Vanguard’s total int’l dividends are qualified vs 95% for VTSAX. https://advisors.vanguard.com/tax-center/qualified-dividend-income

Another reason for me to shelter international in a 401a/457b is that it allows me to hold the Collective Investment Trust (CIT) version of those funds which provides ~10bp of tax alpha through lower tax withholdings. I expound on that technicality in the footnotes of each monthly update.

In summary, I share your skepticism of the conventional wisdom that Int’l is good to hold in taxable.

That said, int’l stocks are going to be better than bonds in a taxable portfolio.

Thank you for the link. I think that’s a good framework to look at it. I currently have VEA in my taxable, and while its a little more qualified than Total Int’l, its still only 72%. I think I’ll be doing some rebalancing!

FP, now Webull is getting in on the action aside RobinHood.

https://www.webull.com/ko-yield/1708508176523-bb98c7

https://www.webull.com/ko-yield/1708508176523-bb98c7/fde920?__app_cfg__=%7B%22supportTheme%22%3Atrue%2C%22browser%22%3Afalse%7D

Eric S

Interesting. Bogleheads thread here: https://www.bogleheads.org/forum/viewtopic.php?t=425796

Are you biting?

I’ve appreciated reading your site and returned to find your blog now that I’m stuck in bed with Covid. I found Bogleheads when thinking about early retirement as a method of escape from my PT job (it’s a lot of stress for the pay, and in our remote area there aren’t many other options), and found your site there. My older son is getting a ME/EE degree and I plan to show him your site at some future point when he has more time to think about it, since he would agree with your plan and the FI movement, and he’s already frugal after growing up with us. I was a SAHM mom for 18 years and my husband a self-employed carpenter, so we’ve had many years of low income and now operate at about 1/6 of your income, expenses, and net worth ( I can only say our net worth may be $600K because we own our house outright). I am the finance person in our marriage and years ago I did switch our meager retirement accounts to Vanguard for their lower fees. After reading your suggestions, I went on to Vanguard to switch out of their TDF accounts to 3 accounts like yours, and wasn’t offered the choices I needed (the only other options for transfer were accounts with higher fee ratios). Guess I’ll have to call Vanguard. I was also derailed last month in my other plans to begin tracking our expenses by my younger son, a freshman in college, landing in the hospital for a mental breakdown. We offered all the support that I can see you’re offering your kids, with lots of fun in bike races and other sports that we could do close to home, but both have had issues with depression in the last few years. It’s not easy being parents. We were lucky that both sons have very low college costs, but now we’re concerned that our younger son will not be able to maintain his scholarship, or will have future mental health issues that will be costly for us right when we’re trying to retire. It’s important to hold on to your outside adult friendships, which is why I winced when I saw your plane ticket for the trip with friends listed under “bad/abnormal”. I guess that’s where I would have to put the costs of my trip across the country to see my son, and also the upcoming hospital bills we’re expecting. Maybe you should have two lines, “Life Luxuries” (the plane ticket to AK) and “Hiccups” (an unexpected house repair, for example). Also, my husband can totally identify with being beaten by teenagers, in the mountain bike, running, and ski racing he has done over the years.

P,

On the Vanguard front, you won’t have access to the same funds as me because mine are only accessible through my 401k. But you’d have access to the basic building blocks on your own: VTSAX, VTIAX, VBTLX. Since I started the blog, Vanguard’s TDF fees have come down a bit and are now at 0.08%. Most people would do very well to stick with TDFs, particularly in tax-advantaged accounts (IRA, 401k, etc). For taxable, you can make the argument that it’s better to stick with the DIY approach for tax purposes to avoid capital gains debacle that happened to Vanguard TDF investors a few years back.

Sorry to hear about the struggling son. I hope he gets better soon. As parents, there is so much out of our control.

The trip to Alaska is a bucket list item with my close group of undergrad friends. Not a necessity by any stretch. Basically, anything in my “other expenses” category is discretionary: piano lessons for kids, sports for kids, gym memberships, streaming services, entertainment, vacations, etc. I could certainly be more refined, but I like the simplicity of the broad categories.

Still just considering. If it is too good to be true……

I’ve tried to search your blog for the answer, but is there a reason for the “% to FI” chart showing the Rolling 36 months expenses to be in the numerator and SWR*Non-529 Investment balances to be in the denominator. Shouldn’t it be the other way around? You’ve been an inspiration and I’m trying to replicate your format at a spreadsheet novice!

In that chart, I’m trying to capture what my current living expenses (computed on an annualized rolling 36-month window) as a percentage of a theoretical safe withdrawal dollar amount that my portfolio would be generating for the rest of my life.

The numerator is pretty self explanatory.

The denominator is simply my investment assets (excluding 529 since those are earmarked for college savings and therefore unavailable for retirement), and multiplying it by theoretical SWRs that are talked about on the internet. 4% being less conservative than 3.5% which is less conservative than 3%. Then I simply compute what fraction of my retirement I’ve successfully funded.

What the chart fails to account for is how my spending will change post-kids and post-retirement. I think one could argue that with 5 kids at home (and soon to leave), our long-term retirement expenses will be significantly less than what we’re spending currently. While my chart fails to capture that, I think it’s a helpful chart nonetheless. It tells me how sustainable our current spending levels are relative to our assets on a long-term basis.

Hope that helps.

% to FI = (SWR*Non-529 Investment Balances)/(Rolling 36 mo. exp)

Instead of

% to FI = (Rolling 36 mo. exp )/(SWR*Non-529 Investment Balances)

Since the balance you are withdrawing from retirement is compared to your total expenses

Thanks for the Info!

You’re right; I’m wrong. I had inverted my explanation (in both the blog comment above and the chart header), but the underlying chart was produced correctly.

I’ll fix the header next month.

Thanks!