Another month, another update. A few random comments.

Good Reads/Listens/Watches

- NYT podcast on the collapse of the National Association of Realtors, along with the 6% commission for selling homes (link).

- WSJ podcast about a psychiatrist losing $400k on gambling apps, despite multiple attempts to ban herself from gambling through the state’s problem-gambling website (link).

- It will be interesting to see how the legalization of sports betting plays out, alongside the proliferation of day traders + crypto traders. It would stand to reason that stories like this will become much more commonplace.

- NYT podcast about Oregon backtracking on the decriminalization of drugs (link).

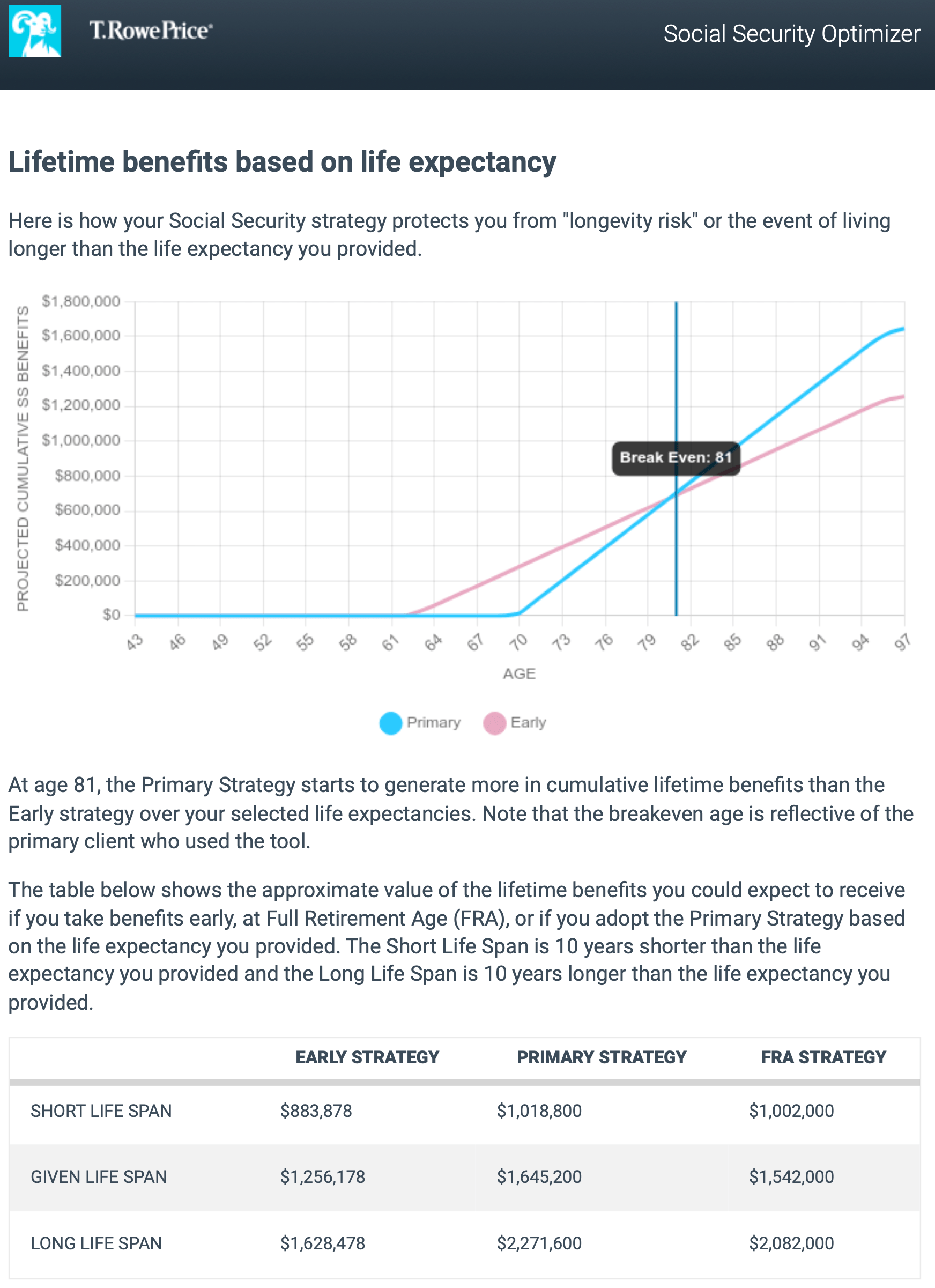

- MyMoneyBlog on T Rowe Price’s Social Security Tool (link).

- The tool told me the optimal strategy is for both Mrs FP and I to wait to age 70 to take benefits.

- Years ago, TFB made a similar post highlighting a different tool (link).

- One of these years I’ll do the optimization math myself, but it’s far enough away that I don’t care enough yet.

Output of the T Rowe Price tool (requires creation of free account).

Output of the T Rowe Price tool (requires creation of free account).

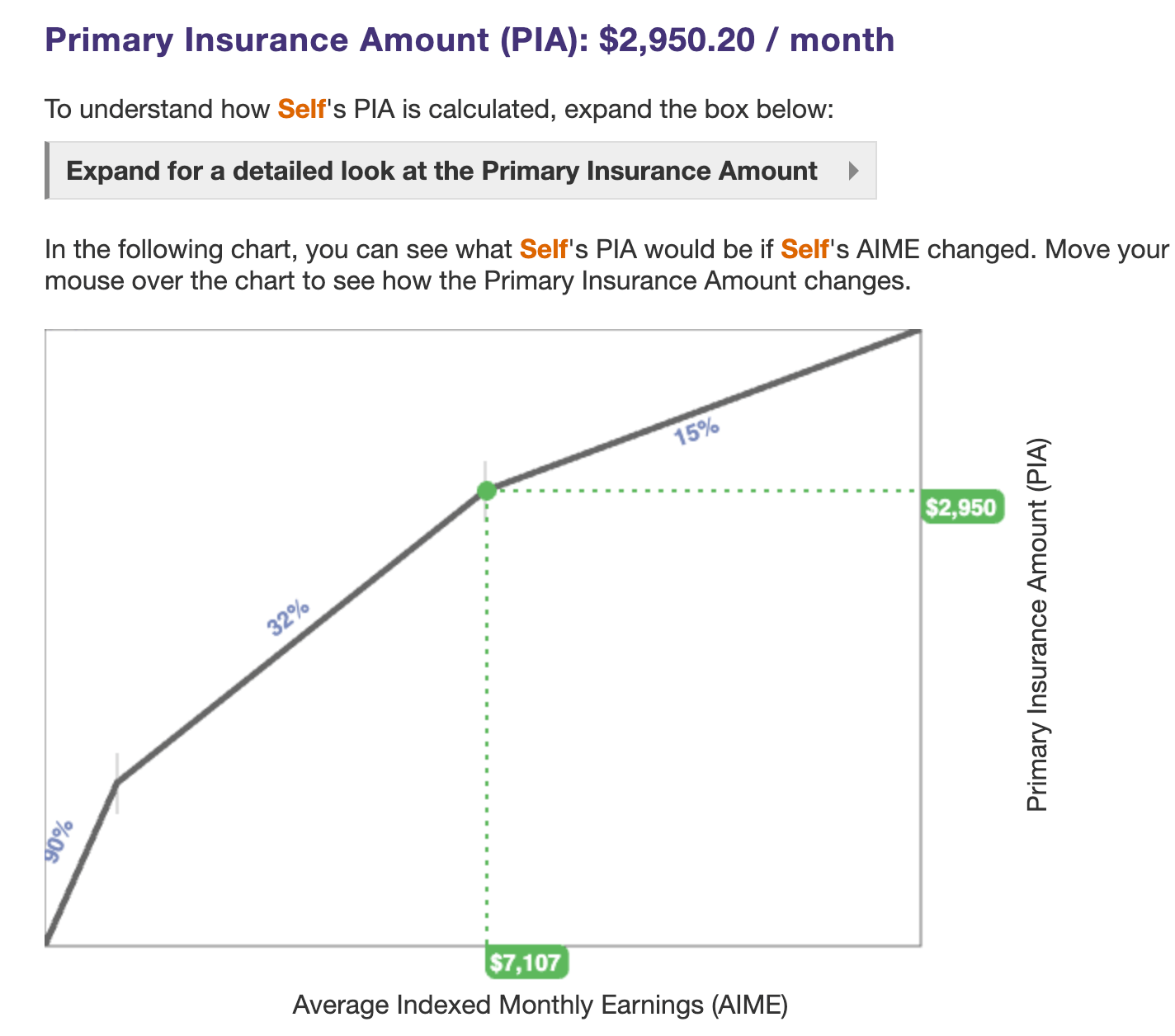

Output of the free SSA tools site, after inputting my expected # of working years (and salary) remaining. Pretty cool to see the kink points. An early-ish retirement would put me at the second kink point.

Life

- For spring break, we drove 4 hours (one-way) to take the kids rock climbing & camping. The trip went great until the trip turned into a puke-fest a little before midnight of the first night. One child puked many times in the tent and another kid puked upon returning home. Mrs FP carried most of the puking burden that first night. We headed home the next morning, so we ended up driving 8 hours over a 24 hour period to get in 2 hours of climbing. We tried…

- I took my own advice and played the “whipped cream game” with my kids. 6 of the 7 of us had a good time, but 1 of the 7 of us sobbed inconsolably because they couldn’t get the whipped cream to launch off of their hand like their siblings. As a result, my assertion of a “guaranteed good time” last month may have been a bit overstated.

The kids busted out our water rocket launcher and had a really good time playing with it. It had been a while since we’d gotten this out. Be sure to pair with stratofins.

Our friends invited us to play games with them on one of the coldest mornings we’d had in a while. We played football, ultimate frisbee, and soccer. It was a fun time.

Mrs FP took four of the kids to March Madness. I was teaching so I couldn’t attend. We paid about $22/ticket the day before, but the morning of the tickets dropped to $6/ticket…bummer. I think they had a fun time. I’m now a fan of TickPick and will be using them for future purchases. They have no hidden fees; it’s all baked into the advertised price.

Lion King.

The morning after the puke fest. Mrs FP and sick kid were back at camp.

Scrambling up rocks.

The day before the puke fest. Fun times on a baby crag.

Disc golf with friends.

Corn hole.

This Month’s Finances

It’s becoming increasingly apparent that I’ll likely run out of life before I run out of money. Further, it continues to startle me that FC1 will be gone in approximately a year. Consequently, we’re starting to loosen the purse strings a bit. Hence the money spent on memories (Lion King, basketball, etc). It feels right.

- The good:

- Still employed.

- The bad/abnormal:

- Other Expenses were an unmitigated disaster, but I think good memories were (or will be) made:

- $1,650 in summer flights (to Seattle & NYC).

- The 7 of us are going to Seattle (the birth place of FC1 & FC2) + British Columbia for a week. Should be a blast.

- $386 for Whistler VRBO deposit. Was really cheap to book in summer. $215/night for condo downtown that sleeps the seven of us.

- The USD/CAD exchange rate is looking favorable.

- The Great Canadian Costco Hot Dog Arbitrage (GCCHDA) is still alive and well. We plan to partake.

- Four of the seven of us will be doing a triathlon in WA (assuming we can successfully procure bikes)!

- Mrs FP is taking the girls (FC1, FC2, FC4) to NYC to do touristy things (shows, etc).

- $1,500 for Costco couch. Our old one made my aging back ache.

- $705 in passports for children.

- We bought passports primarily for the Costco poutine in Vancouver. This is turning into an expensive serving of Costco poutine.

- I saved a few bucks by printing off the passport pictures myself. Here’s a note to self on how to replicate:

- Take photos.

- Crop them using gov’t website: https://tsg.phototool.state.gov/photo

- Import to PowerPoint with a 4×6 aspect ratio for the slides (I chose 8″x12″).

- Arrange photos in 3×2 grid, with each photo sized appropriately.

- Export slide as highest resolution JPEG/PNG.

- Print off 4″x6″ for $0.15.

- Smiling is apparently allowed in passport photos, so long as teeth aren’t shown. I learned this too late so the photos look like mug shots.

- $300 in climbing gear.

- $136 for Ben Rector Concert tickets for the fam.

- $109 for 5 tickets for march madness for the kids. I was stuck at work, but Mrs FP took 4 of the kids.

- Other Expenses were an unmitigated disaster, but I think good memories were (or will be) made:

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

FP, glad to see you are loosening the purse strings a little and traveling more with the kids. I retired early and have had difficulty transitioning from accumulation to spending, but realize I must enjoy life before too old to physically complete the bucket list.

I may have shared this article before, but will link it again. My wife and I are taking SS early due to the possibility of benefit cuts (a bird in the hand,,,) and reasons described in the article.

http://danielamerman.com/va/BenefitAge.html

Such a weird tradeoff we all face. Save for our future selves vs try to enjoy the now (while we still have health). As we all know, future health (or life) is not guaranteed.

The way I’ve rationalized frugality in the past is that I don’t believe it’s cost me or my family any in forgone happiness. But the older I get, the more experiences I want to share with my kids. I don’t know that a trip to Canada or Europe will make them significantly happier human beings (relative to a simpler vacation), but I do want them to understand that the world is bigger than our town (or state or country). We have the means to give them these experiences, so I suppose we should do so.

Thanks for the SS link. I’ll certainly be giving this topic a lot more thought in a decade or two….

I was able to travel to Italy and France several times on business and for pleasure. One life changing experience was a week in Rome alone with total freedom/no fixed schedule. It would be fantastic if all Americans could experience Europe. I hope you and your kids can do so together. They would love Rome, Florence, Pompeii, and Paris.

Thanks for the recommendation!

Hi FP,

Thanks for the update! I’ve been following you since just before the deer accident in 2017. Crazy how time flies. Thanks for continuing to do these updates. I always enjoy seeing what you’re up to and having a barometer to compare against.

I’ve downloaded those two NYT podcasts and will have a listen.

I don’t think I’ve seen you mention selling credit card tradelines. Is that something you’ve looked into? I’ve done it for the past few years and typically make ~$2-3k annually between my wife and I with very little time committment.

The deer incident…. what a blast from the past.

I’ve vaguely heard about selling tradelines from bloggers, but never looked seriously into it. Do you have any resources to point me to?

Do I understand the mechanics correctly? 1.) add random stranger as authorized user to existing credit card, 2.) don’t give random stranger access to the card, 3.) facilitate the inflating of random stranger’s credit score through the association of my credit card with a long credit history, 4.) get paid by random stranger, and 5) eventually kick random stranger off of card?

I currently have kids as authorized users to my cards. Perhaps I need to start charging them!!!

I always look forward to your monthly updates, fun to read! The Fidelity one-stop-shop setup you’ve mentioned on your blog inspired me to follow suit. Having a CMA for free international ATM and a brokerage account to overdraft from, earning 5%+ with SPAXX, is incredibly convenient.

Fidelity’s recent confirmation that SPAXX is coming to their CMA accounts this June (https://www.reddit.com/r/fidelityinvestments/comments/1bui60e/spaxx_as_cma_core_position_coming/) is excellent news. As someone living in a state without state tax (since only SPAXX is coming and not FDLXX), I might transition to using only a CMA account setup. While a few Reddit users have reported occasional issues with failed transactions of the overdraft strategy, I haven’t encountered any problems yet, I am pretty new anyway. However, having SPAXX integrated into the CMA should make things even more seamless.

This is the first I’d heard of SPAXX being allowed in the CMA! I guess I could easily consolidate to CMA only, but I’ve found the brokerage + CMA to work seamlessly once set up properly (which admittedly is a bit of a pain). Great news — I’ll likely encourage my kids to set up a CMA once they leave the house as their primary checking/savings account.

My kids are about ten years older than yours, and I’ll just say that they actually are not gone for purposes of family travel until they have a job that requires scheduling time off. Some of our best trips as a family were when the kids were in college.

Good to hear.

I guess I’m projecting my own experience onto my kids. In the culture I was raised in, I left the country to live in South America for two years from the ages of 19-21. Even though internet & email & phone calls were readily available in the early 2000s, I was only allowed to call home three times over a two-year stretch. We were allotted 60 minutes per call. No visits from family. No travel back home. Only letters. No access to “outside” books. No access to the internet. No access to media (movies, TV, and almost all music). Extremely draconian. Upon returning, we were encouraged to marry ASAP in our early 20s and have (many) kids as soon as possible.

My lived experience says that in the above culture, family dynamics change rather quickly and permanently after HS graduation. I suppose I’ll find out soon enough what path my kids choose and whether I’ll be able to see them for a two year stretch of time (though the teens are now allowed to Skype/FaceTime/Zoom home on a weekly basis).

I would be supportive of my children breaking free from that culture and experiencing a more “normal” teenage experience. One in which I can interact with them in person over two year windows.

Yeah this one from the Wealthy Accountant (used to be MMM’s accountant): https://www.wealthyaccountant.com/2017/10/11/tradelines-the-credit-card-piggybacking-side-hustle/

Yeah that’s basically it. When you add an authorized user to your card they will send it to your address not the new persons. So you just hold on to it or cut it up.

Let us know if you end up trying it!

I’ll have to learn more about it. Not sure if I’m adventurous enough to pull it off.

This may seem like a strange request (I’m nearly 50 years old and have never purchased a couch before). I’m starting to look for a new couch — is Costco a good choice for this purchase? Any tips on the purchase and what to look for to get the best deal? How does the cost/quality compare to other furniture stores? Have you ever purchased a bed at Costco? I need a new bed as well, but cringe at the shopping process…

In our ~20 years of marriage, we’ve purchased 4 couches at Costco. One was last month, so I can’t speak to its quality or longevity. But 2 of the 3 were great. 1 of the 3 was a dud.

I buy most everything on sale $X.97 or clearance $X.00 these days. 3 of the last 4 couches purchased at Costco were $X.00 purchases as they were clearing out inventory. The selection is a lot better online, but it’s more expensive (because it includes delivery and almost always is not on clearance). I have a hard time spending a few grand on a couch purchased online that I’ve never sat in, so I’ve always bought in person (with the limitation of an extremely limited inventory in warehouse).

On the mattress front, if you can find a time to visit Costco when it is not busy, I’ve placed the mattress on the concrete and laid on it. A weekday evening at our Costco is nearly empty, so we’ve done it then. That said, I’m addicted to our Purple mattress we purchased a few years back (online at Sams, ironically) and will have a hard time going back to anything else. They sell direct to consumers but a lot of companies have them in showrooms for you to try in person.

Good luck.