Another month, another update. A few random comments.

Good Reads/Listens/Watches

- GoCurryCracker’s 2020 tax post (link).

- $0 of federal income tax on $143k of income.

- Entertaining two-hour YouTube documentary of a dude biking (most of) the 2,700 mile Great Divide Mountain Bike Route (link).

- This ride is now on my bucket list (wiki article)!

- He’s done several similar trips through the years:

- Honduras to Boulder, CO (4,000 miles).

- Astoria, OR to NYC (3,000 miles).

- 10-minute video from Buffett directed to recent college grads (link).

- Hat tip MyMoneyBlog (link).

- Bezos’ final letter to shareholders (WSJ link).

- If you want to be successful in business (in life, actually), you have to create more than you consume. Your goal should be to create value for everyone you interact with. Any business that doesn’t create value for those it touches, even if it appears successful on the surface, isn’t long for this world. It’s on the way out.

- Steve Levitt interviews Sal Kahn (link).

- Mankiw on Biden’s goal of “tax fairness” (link).

Life

- Stayed busy with work & kids.

- Coaching FC5 in football continues to be pretty fun.

- I’ve learned that time stands still during middle school track meets. Particularly when it’s in the 30’s and the wind is howling.

- The old man neighborhood biker gang has been reinstated after a several month winter hiatus.

- Continued to enjoy climbing and disc golf.

- I led a 5.12c in the gym, my first 5.12 lead.

- Not sure what to make of the asinine housing market.

- It’s not just a US phenomenon — This Reddit post shows that the home price appreciation in the US is dwarfed by that in Canada, the UK, and France (particularly Canada).

- While I dislike many aspects of home ownership, perhaps the primary aspect of home ownership I enjoy is the hedge it provides against rising house prices.

- I helped a colleague buy a home without a buyer’s agent, saving 3% of the home value in commissions. This is what we did for our only home purchase 5 years back.

Freezing my butt off during a never-ending (4 hour?) track meet.

Freezing my butt off during a never-ending (4 hour?) track meet.

The tramp has been a hit.

Given that my most meaningful accomplishment in life to date is posting a video of almost getting mauled by sheep dogs, I figured I’d add another animal encounter video to the YouTube channel. Last year, my brother (the cameraman of the sheep dog video) and I took a trip to Tetons/Yellowstone. While driving through Star Valley WY, we encountered a herd of cattle crossing the snake river. Suffice it to say, we were caught a bit off guard.

This Month’s Finances

- The good:

- Still employed.

- Maxed out tax-advantaged buckets. On to taxable for the rest of the year….

- With any luck, I will have convinced my employer to allow the mega-backdoor Roth by next year.

- The bad/abnormal:

- $4,320 property tax payment (first of two payments due).

- $741 doctor & dentist payments.

- Our primary care physician billed $292.50 (per child) for a 5-minute wart freezing procedure.

- Two kids had warts, so $585 billed for 10 minutes of the doc’s time.

- I probably should have asked the price before hand. My mistake. I should know better by now.

- Two kids had warts, so $585 billed for 10 minutes of the doc’s time.

- Having a high-deductible health plan has made me a much more informed consumer of healthcare.

- Our primary care physician billed $292.50 (per child) for a 5-minute wart freezing procedure.

- $418 for mulch. $200 HOA payment.

- $290 in premiums for $1M term life insurance policy.

- There are 7 years remaining on the 15-year policy, after which we’ll self-insure.

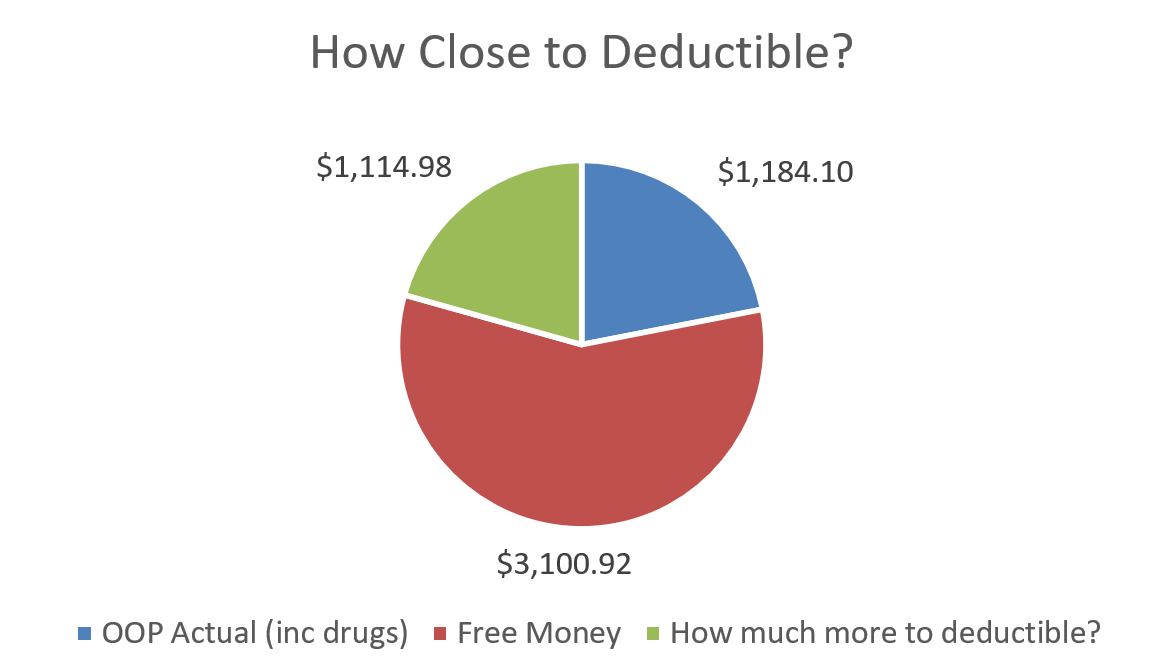

Above is our YTD progress towards our healthcare deductible. $1,184 of real money spent. $3,101 of drug coupons applied (e.g. free money towards our deductible). $1,115 remaining. We’ll hit the deductible in about a month with the redemption of more drug coupons. What a bizarre system….

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Would be interested in hearing your thoughts about the decision to self-insure re life insurance in seven years? How does it fit with net worth expectations, age of children, etc.? I’m facing a similar choice.

Once someone is financially independent, it means that they have sufficient means to cover life expenses going forward without additional labor income. If I kick the bucket post-FI, it means my wife already has sufficient to live without an insurance payout.

As a general policy, I don’t insure anything I can afford to replace. That’s why I carry high deductibles for healthcare, auto, home, etc. I turn myself into an insurance company, investing any premium savings to the big pot. Of course, all is not gravy with this approach as my son’s $10k appendectomy can attest (or $3.5k 80mph deer incident).

However, on average, I think it’s a winning strategy. I carry enough insurance to avoid financial ruin (hence the $1M umbrella policy), but not much more.

Could you please provide a reference for buying a home without an agent? Thank you.

Here’s what we did 5 years ago (and advised my colleague to replicate):

1.) Get preapproval letter from lender (or show up with a pile of cash if not financing). This is to establish credibility of your offer.

2.) Find home on zillow (or alternative resource).

3.) Reach out to the listing agent shown on zillow for the property. Name + google is your friend. It’s weird to me that the listing agent normally doesn’t show the house. It’s usually the buyer’s agent.

4.) Make offer through seller’s agent. They will require you to sign a form indicating that having the same agent represent both sides of the transaction is a conflict of interest. We were charged $250 to use the listing agent as our buyer’s agent.

5.) Price offer 3% less than what you would with a buyer’s agent.

6.) Chose an inspector carefully. This is the only person in the entire process who will ensure you’re not getting screwed. I’d be leery of any recommendation from a realtor (buyer’s or seller’s agent).

You’re done. You just saved 3% by cutting out an unnecessary middle (wo)man.

* https://www.bogleheads.org/forum/viewtopic.php?f=2&t=324342&p=5471066&hilit=agent#p5471066

* https://www.bogleheads.org/forum/viewtopic.php?f=2&t=328482&p=5564712&hilit=agent#p5564712

One selling agent who’s territorial told me that she would still charge the seller the full 5%… Does this depend on the state?

I think it is all case-by-case. In your offer letter, I’d spell out the economics such that it forces the seller to push back on the seller’s agent. The seller’s agent initially told me the same rhetoric, but eventually he caved.

Thank you!

I’m about to try this next week. Do you know for a fact that the seller in your case “saved” the 3%? Thank you!

Good luck!

On the closing documents, all agent commissions are outlined explicitly. I confirmed that the seller indeed kept my 3% for himself. Why? Because the RE agent only charged 3% (not 6%) in total commissions. If memory serves me well, total commissions were ~2.5% in my particular case.

I enjoyed Steve Levitt’s interview of Sal Khan, too. I have been enjoying “People I (Mostly) Admire” even more than “Freakonomics.” I like how Levitt approaches the interviews as an academic rather than as a journalist.

Glad you’re liking the podcast as well! Levitt was always my favorite member of the freakonomics duo, though Dubner is obviously great.

Levitt just strikes me as a very thoughtful and genuine guy. I’ve loved the variety of guests that he’s had on his program.

Levitt is a strong critic of academia, which has pushed him away from research pursuits as of late towards more practical endeavors (podcasting, consulting, etc). I can’t say that I disagree with his conclusion.

I didn’t realize until his podcast (specifically the Greg Norman interview) how seriously he pursued golf, trying to make the senior tour.

I’ll do that Great Divide Mountain Bike Route with ya! We should try out the Tahoe Twirl (also documented by Van Duzer) first.

The price of lumber must be having a trickle down effect on the price of mulch! $418!?!? I got a dump truck load of mulch poured out on my driveway for $90 delivered. How much did you get?

Deal on Tahoe Twirl + GDMBR!!!! I’ll email you…

We paid a bit more for over a dozen yards of cedar mulch. We do it every other year or so.

I would be interested to learn more about how you convinced your employer to allow mega-backdoor Roth contributions. Did your work on the 401k investment committee help? I don’t have that much clout with my employer.

I don’t have much clout either, but I’ve served on a couple of committees at the university level pertaining to investing (e.g. HSA & retirement plans). I’ve successfully communicated to my employer that there is much upside and very little downside to allowing the mega backdoor roth. I’m crossing my fingers that it will actually happen, though I should probably not get my hopes up too high. I’ve learned long ago to never underestimate the power of inertia & bureaucracy of getting in the way of progress.

is the link to the downloadable version of the spreadsheet correct? I’m getting a .png file. Thanks for the great model!

Is it even possible to do a megabackdoor with 401a, 403b, or 457b? I thought it’s only possible through 401ks. Our university recently allowed in service Roth rollovers in the 403bs, but since there is no way at present to contribute after tax funds above the 19500 for this year, wouldn’t be able to do a backdoor anyway.

Stanford and UC allow it in their 403b plans:

* https://cardinalatwork.stanford.edu/benefits-rewards/resources/roth-403b-after-tax-retirement-savings-plan

* https://myucretirement.com/Resource/278

TFB talks a bit about this here: https://thefinancebuff.com/401a-plan-contribution-limit.html

Best to remove warts over the counter (HSA eligible even) : )

Nice month – as you sailed passed our net worth in recent months you continue to motivate me to jump jobs once more for a large pay increase. Would likely mean a move to another state. Unless we take a year off and move to Australia.

Be well,

Max!

Next time we have warts, I’ll definitely do over-the-counter if we haven’t hit our deductible yet (and freezing at Dr’s office if we have). However, with 5 kids, it’s hard to stay diligent with reapplications. We’ve tried over-the-counter wart removal in the past with little success. They tend to spread like wildfire.

Not sure what to say about net worth. Markets are frothy, so I’m sure we’re in for a long period of lower future returns….

Best of luck to you as you sort out future moves! Australia sounds like a great opportunity! Several of my phd colleagues ended up there and are enjoying it.

lol re: MoviePass. That was a nice gravy train while it lasted! Pre-pandemic, I enrolled in AMC’s A-List, which I was quite pleased with; $19.99/mo for up to 3 movies per week, any format (IMAX etc.). I’ve kept mine on hold for now while I cautiously approach seeing movies again.

MoviePass was indeed great while it lasted. We purchased our membership from Costco because I was so unconvinced of the sustainability of the business model (so we could ask for a reimbursement if they went belly up). They did, but luckily it was 10 months or so into our year long membership.

Haven’t tried AMC’s A-List, but it sounds pretty nice!

Where is your vehicle equity in your balance sheet and vehicle depreciation in your income statement?

Good question.

I treat our 10Y+ old hoopties as worthless. Mentally, I fully depreciate them upon purchasing them (new or used).

This has the favorable effect of simplifying the income statement (don’t have to think about MACRS, SL depreciation). This has the unfavorable effect of being somewhat detached from reality.

It takes 2 minutes to get an online quote from Carvana or CarMax, so it’s easy to track your cars’ true asset value over time. In this particular environment you may even be surprised at how much those cars are worth.

Not a bad idea!